Athos Capital Ltd bought a new position in Liberty Broadband Co. (NASDAQ:LBRDK - Free Report) in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund bought 60,000 shares of the company's stock, valued at approximately $4,637,000. Liberty Broadband makes up 1.5% of Athos Capital Ltd's portfolio, making the stock its 10th largest holding.

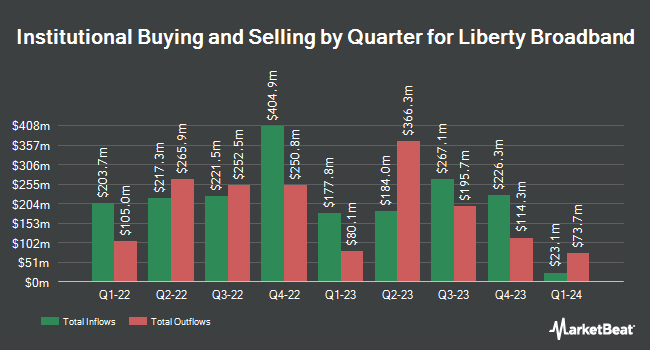

A number of other institutional investors have also added to or reduced their stakes in the company. Maverick Capital Ltd. purchased a new stake in Liberty Broadband in the third quarter worth approximately $1,800,000. Edgestream Partners L.P. bought a new stake in shares of Liberty Broadband in the 3rd quarter worth approximately $459,000. Captrust Financial Advisors boosted its stake in shares of Liberty Broadband by 15.3% in the 3rd quarter. Captrust Financial Advisors now owns 4,417 shares of the company's stock valued at $341,000 after purchasing an additional 586 shares in the last quarter. Capstone Investment Advisors LLC bought a new position in shares of Liberty Broadband during the 3rd quarter valued at $224,000. Finally, Walleye Capital LLC purchased a new position in Liberty Broadband in the 3rd quarter worth $2,253,000. Institutional investors own 80.22% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities analysts recently issued reports on LBRDK shares. Rosenblatt Securities raised their price target on Liberty Broadband from $80.00 to $91.00 and gave the stock a "buy" rating in a research report on Wednesday, August 14th. StockNews.com assumed coverage on shares of Liberty Broadband in a report on Friday. They issued a "sell" rating on the stock.

Read Our Latest Stock Analysis on LBRDK

Liberty Broadband Stock Down 0.6 %

Shares of LBRDK stock traded down $0.53 during mid-day trading on Monday, reaching $84.61. 1,488,564 shares of the company's stock traded hands, compared to its average volume of 1,198,943. The company's 50-day moving average price is $83.52 and its 200-day moving average price is $66.68. The company has a market cap of $12.09 billion, a P/E ratio of 15.68 and a beta of 1.02. The company has a quick ratio of 2.07, a current ratio of 2.07 and a debt-to-equity ratio of 0.40. Liberty Broadband Co. has a 12 month low of $46.46 and a 12 month high of $101.50.

Liberty Broadband (NASDAQ:LBRDK - Get Free Report) last released its earnings results on Thursday, November 7th. The company reported $0.99 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.68 by ($1.69). Liberty Broadband had a net margin of 78.07% and a return on equity of 8.45%. The business had revenue of $262.00 million for the quarter, compared to analysts' expectations of $237.41 million. During the same quarter in the previous year, the business posted $1.10 earnings per share. On average, equities analysts expect that Liberty Broadband Co. will post 6.72 earnings per share for the current fiscal year.

Insider Buying and Selling at Liberty Broadband

In other Liberty Broadband news, CAO Brian J. Wendling sold 2,208 shares of the business's stock in a transaction dated Thursday, September 26th. The stock was sold at an average price of $75.84, for a total value of $167,454.72. Following the completion of the transaction, the chief accounting officer now owns 11,054 shares of the company's stock, valued at approximately $838,335.36. The trade was a 16.65 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Renee L. Wilm sold 4,423 shares of the company's stock in a transaction dated Wednesday, September 25th. The shares were sold at an average price of $76.56, for a total transaction of $338,624.88. Following the transaction, the insider now owns 3,670 shares in the company, valued at $280,975.20. This represents a 54.65 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 6,673 shares of company stock worth $509,688. 10.80% of the stock is owned by corporate insiders.

About Liberty Broadband

(

Free Report)

Liberty Broadband Corporation engages in the communications businesses. The company's GCI Holdings segment provides data, wireless, video, voice, and managed services to residential customers, businesses, governmental entities, educational, and medical institutions in Alaska under the GCI brand.

Further Reading

Before you consider Liberty Broadband, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Liberty Broadband wasn't on the list.

While Liberty Broadband currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.