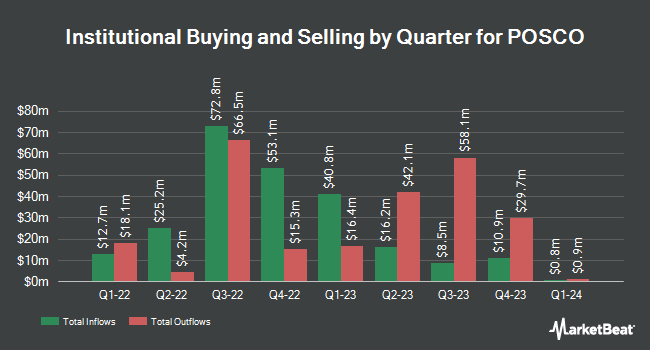

Athos Capital Ltd reduced its holdings in shares of POSCO Holdings Inc. (NYSE:PKX - Free Report) by 63.1% in the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 60,000 shares of the basic materials company's stock after selling 102,500 shares during the quarter. POSCO accounts for about 1.2% of Athos Capital Ltd's holdings, making the stock its 9th biggest holding. Athos Capital Ltd's holdings in POSCO were worth $2,602,000 as of its most recent SEC filing.

Other large investors have also bought and sold shares of the company. Bank Julius Baer & Co. Ltd Zurich acquired a new stake in POSCO in the fourth quarter valued at $41,000. R Squared Ltd bought a new stake in POSCO during the 4th quarter valued at $46,000. Wilmington Savings Fund Society FSB lifted its position in POSCO by 5,312.5% in the 4th quarter. Wilmington Savings Fund Society FSB now owns 2,165 shares of the basic materials company's stock valued at $94,000 after acquiring an additional 2,125 shares in the last quarter. Avior Wealth Management LLC boosted its position in shares of POSCO by 49.2% during the fourth quarter. Avior Wealth Management LLC now owns 2,228 shares of the basic materials company's stock valued at $97,000 after buying an additional 735 shares during the last quarter. Finally, PDS Planning Inc grew its holdings in POSCO by 22.4% during the fourth quarter. PDS Planning Inc now owns 4,973 shares of the basic materials company's stock worth $216,000 after buying an additional 911 shares in the last quarter.

POSCO Stock Performance

Shares of NYSE PKX traded up $0.84 during mid-day trading on Wednesday, reaching $42.27. 434,914 shares of the company's stock were exchanged, compared to its average volume of 237,323. The firm has a 50-day moving average price of $47.05 and a two-hundred day moving average price of $51.58. The company has a debt-to-equity ratio of 0.24, a current ratio of 1.93 and a quick ratio of 1.35. The firm has a market capitalization of $12.83 billion, a price-to-earnings ratio of 19.43, a price-to-earnings-growth ratio of 2.14 and a beta of 1.33. POSCO Holdings Inc. has a 52 week low of $39.40 and a 52 week high of $75.79.

Wall Street Analysts Forecast Growth

Separately, StockNews.com lowered shares of POSCO from a "buy" rating to a "hold" rating in a research note on Thursday, January 2nd.

View Our Latest Stock Analysis on PKX

POSCO Company Profile

(

Free Report)

POSCO Holdings Inc, together with its subsidiaries, operates as an integrated steel producer in Korea and internationally. It operates through six segments: Steel, Trading, Construction, Logistics and Others, Green Materials and Energy, and Others. The company engages in the production, import, sale, and export of steel products, such as hot and cold rolled steel, stainless steel, plates, wire rods, and silicon steel sheets, as well as pig iron, billets, blooms, and slabs; trading of steel and raw materials, textiles, agricultural commodities, and other goods; natural resources development and power generation activities; and planning, designing, and construction of industrial plants, civil engineering projects, and commercial and residential buildings.

See Also

Before you consider POSCO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and POSCO wasn't on the list.

While POSCO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.