Entropy Technologies LP lifted its stake in shares of Atkore Inc. (NYSE:ATKR - Free Report) by 166.4% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 10,881 shares of the company's stock after acquiring an additional 6,796 shares during the quarter. Entropy Technologies LP's holdings in Atkore were worth $922,000 at the end of the most recent reporting period.

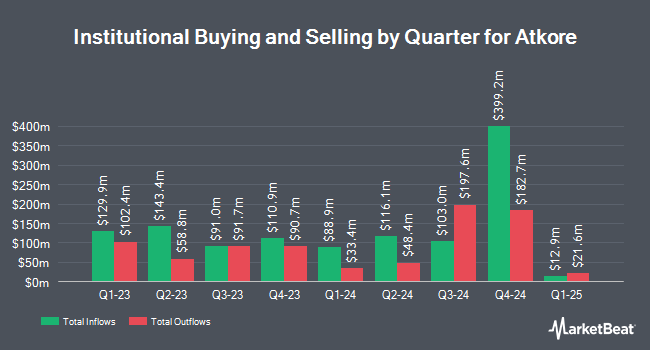

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Quarry LP bought a new position in shares of Atkore during the second quarter worth $57,000. Mather Group LLC. boosted its holdings in shares of Atkore by 895.7% during the 2nd quarter. Mather Group LLC. now owns 468 shares of the company's stock valued at $63,000 after purchasing an additional 421 shares during the last quarter. Signaturefd LLC grew its position in shares of Atkore by 445.6% during the third quarter. Signaturefd LLC now owns 491 shares of the company's stock valued at $42,000 after purchasing an additional 401 shares in the last quarter. Headlands Technologies LLC increased its holdings in shares of Atkore by 829.9% in the second quarter. Headlands Technologies LLC now owns 902 shares of the company's stock worth $122,000 after purchasing an additional 805 shares during the last quarter. Finally, Covestor Ltd increased its holdings in shares of Atkore by 63.7% in the third quarter. Covestor Ltd now owns 1,002 shares of the company's stock worth $85,000 after purchasing an additional 390 shares during the last quarter.

Insider Activity

In other news, insider Mark F. Lamps sold 500 shares of the firm's stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $96.55, for a total transaction of $48,275.00. Following the transaction, the insider now directly owns 27,626 shares of the company's stock, valued at approximately $2,667,290.30. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders own 2.56% of the company's stock.

Analysts Set New Price Targets

ATKR has been the topic of several research reports. B. Riley reduced their price target on shares of Atkore from $183.00 to $135.00 and set a "buy" rating on the stock in a research report on Wednesday, August 7th. Royal Bank of Canada cut shares of Atkore from an "outperform" rating to a "sector perform" rating and decreased their target price for the company from $175.00 to $100.00 in a research report on Wednesday, August 7th. Loop Capital dropped their price target on Atkore from $160.00 to $130.00 and set a "buy" rating for the company in a research report on Friday, September 20th. Finally, KeyCorp cut their target price on Atkore from $125.00 to $105.00 and set an "overweight" rating on the stock in a research report on Friday, September 13th. Three investment analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $131.60.

View Our Latest Research Report on ATKR

Atkore Trading Down 1.8 %

Shares of NYSE ATKR traded down $1.64 during midday trading on Thursday, hitting $90.84. The company's stock had a trading volume of 153,110 shares, compared to its average volume of 617,131. The business's 50 day moving average is $87.32 and its two-hundred day moving average is $117.26. Atkore Inc. has a 12-month low of $80.11 and a 12-month high of $194.98. The company has a current ratio of 3.26, a quick ratio of 2.03 and a debt-to-equity ratio of 0.49. The firm has a market cap of $3.26 billion, a P/E ratio of 6.49 and a beta of 2.13.

About Atkore

(

Free Report)

Atkore Inc engages in the manufacture and sale of electrical, mechanical, safety, and infrastructure products and solutions in the United States and internationally. The company offers conduits, cables, and installation accessories. It also designs and manufactures protection and reliability solutions for critical infrastructure, such as metal framing, mechanical pipe, perimeter security, and cable management.

Recommended Stories

Before you consider Atkore, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atkore wasn't on the list.

While Atkore currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.