Breach Inlet Capital Management LLC grew its stake in Atlanta Braves Holdings, Inc. (NASDAQ:BATRK - Free Report) by 10.3% during the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 519,378 shares of the financial services provider's stock after purchasing an additional 48,414 shares during the quarter. Atlanta Braves makes up about 14.1% of Breach Inlet Capital Management LLC's holdings, making the stock its largest position. Breach Inlet Capital Management LLC owned approximately 1.02% of Atlanta Braves worth $19,871,000 as of its most recent filing with the Securities & Exchange Commission.

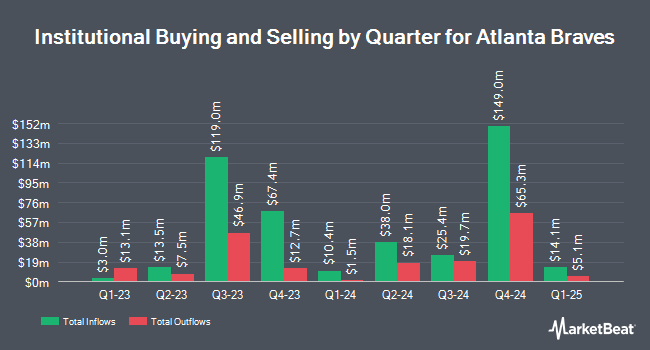

Other hedge funds have also recently bought and sold shares of the company. R Squared Ltd purchased a new stake in shares of Atlanta Braves during the 4th quarter worth approximately $41,000. PNC Financial Services Group Inc. increased its position in shares of Atlanta Braves by 25.7% during the fourth quarter. PNC Financial Services Group Inc. now owns 2,265 shares of the financial services provider's stock valued at $87,000 after buying an additional 463 shares during the period. US Bancorp DE lifted its stake in Atlanta Braves by 17.7% in the 4th quarter. US Bancorp DE now owns 2,862 shares of the financial services provider's stock worth $110,000 after purchasing an additional 430 shares in the last quarter. OFI Invest Asset Management purchased a new position in Atlanta Braves during the fourth quarter worth about $157,000. Finally, ABC Arbitrage SA purchased a new position in Atlanta Braves during the fourth quarter worth about $204,000. 64.88% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other news, major shareholder John C. Malone purchased 15,192 shares of the business's stock in a transaction on Wednesday, January 22nd. The stock was acquired at an average cost of $40.62 per share, for a total transaction of $617,099.04. Following the purchase, the insider now directly owns 146,020 shares in the company, valued at $5,931,332.40. This trade represents a 11.61 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Over the last ninety days, insiders bought 47,692 shares of company stock valued at $1,980,287. Insiders own 11.43% of the company's stock.

Wall Street Analyst Weigh In

Separately, StockNews.com upgraded shares of Atlanta Braves to a "sell" rating in a research report on Friday, February 28th.

Check Out Our Latest Research Report on BATRK

Atlanta Braves Stock Down 0.6 %

Shares of NASDAQ:BATRK traded down $0.24 during midday trading on Thursday, hitting $37.84. 162,356 shares of the stock traded hands, compared to its average volume of 267,823. The stock has a market capitalization of $1.94 billion, a PE ratio of -51.70 and a beta of 0.56. Atlanta Braves Holdings, Inc. has a one year low of $35.46 and a one year high of $44.43. The business's 50 day moving average is $39.42 and its two-hundred day moving average is $39.34.

Atlanta Braves (NASDAQ:BATRK - Get Free Report) last issued its quarterly earnings data on Wednesday, February 26th. The financial services provider reported ($0.31) EPS for the quarter, topping the consensus estimate of ($0.69) by $0.38. The company had revenue of $52.12 million during the quarter, compared to analysts' expectations of $48.20 million. As a group, sell-side analysts forecast that Atlanta Braves Holdings, Inc. will post -0.89 earnings per share for the current year.

About Atlanta Braves

(

Free Report)

Atlanta Braves Holdings, Inc owns and operates the Atlanta Braves Major league baseball club. It also operates mixed-use development project, including retail, office, hotel, and entertainment projects. The company was incorporated in 2022 and is based in Englewood, Colorado.

Featured Articles

Before you consider Atlanta Braves, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlanta Braves wasn't on the list.

While Atlanta Braves currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.