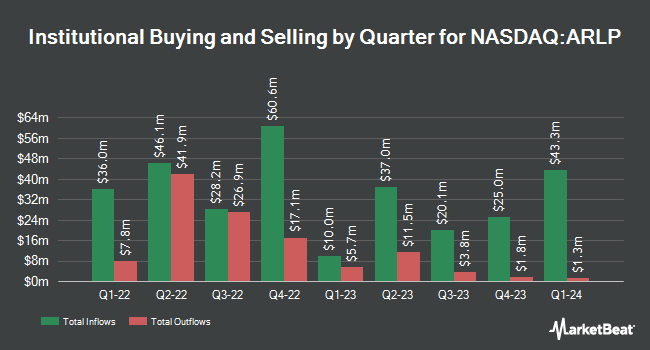

Atlanta Consulting Group Advisors LLC acquired a new position in Alliance Resource Partners, L.P. (NASDAQ:ARLP - Free Report) during the third quarter, according to the company in its most recent filing with the SEC. The fund acquired 1,165,740 shares of the energy company's stock, valued at approximately $29,144,000. Alliance Resource Partners makes up 7.2% of Atlanta Consulting Group Advisors LLC's holdings, making the stock its 3rd biggest holding. Atlanta Consulting Group Advisors LLC owned 0.91% of Alliance Resource Partners at the end of the most recent quarter.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Pathway Financial Advisers LLC grew its position in shares of Alliance Resource Partners by 2,400.0% during the third quarter. Pathway Financial Advisers LLC now owns 67,675 shares of the energy company's stock worth $1,692,000 after buying an additional 64,968 shares in the last quarter. Creative Planning grew its holdings in Alliance Resource Partners by 89.8% during the 2nd quarter. Creative Planning now owns 72,099 shares of the energy company's stock worth $1,764,000 after acquiring an additional 34,106 shares in the last quarter. International Assets Investment Management LLC bought a new stake in shares of Alliance Resource Partners in the 3rd quarter worth about $7,500,000. Crescent Grove Advisors LLC raised its stake in shares of Alliance Resource Partners by 15.5% in the 3rd quarter. Crescent Grove Advisors LLC now owns 208,793 shares of the energy company's stock valued at $5,220,000 after purchasing an additional 28,016 shares in the last quarter. Finally, Progeny 3 Inc. grew its stake in Alliance Resource Partners by 2.8% in the second quarter. Progeny 3 Inc. now owns 2,807,401 shares of the energy company's stock worth $68,669,000 after purchasing an additional 75,340 shares in the last quarter. 18.11% of the stock is owned by hedge funds and other institutional investors.

Alliance Resource Partners Stock Performance

Shares of Alliance Resource Partners stock traded down $0.27 during trading hours on Friday, reaching $26.79. The company's stock had a trading volume of 423,544 shares, compared to its average volume of 382,166. Alliance Resource Partners, L.P. has a one year low of $18.32 and a one year high of $27.80. The company's 50 day simple moving average is $25.11 and its 200 day simple moving average is $24.33. The company has a debt-to-equity ratio of 0.24, a quick ratio of 1.69 and a current ratio of 2.36. The stock has a market cap of $3.43 billion, a P/E ratio of 7.61 and a beta of 1.14.

Alliance Resource Partners (NASDAQ:ARLP - Get Free Report) last issued its earnings results on Monday, October 28th. The energy company reported $0.66 EPS for the quarter, missing analysts' consensus estimates of $0.82 by ($0.16). The company had revenue of $613.57 million during the quarter, compared to analyst estimates of $646.17 million. Alliance Resource Partners had a net margin of 18.52% and a return on equity of 23.74%. During the same quarter in the previous year, the firm earned $1.18 earnings per share. As a group, analysts expect that Alliance Resource Partners, L.P. will post 3.2 EPS for the current fiscal year.

Alliance Resource Partners Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, November 14th. Shareholders of record on Thursday, November 7th were given a $0.70 dividend. This represents a $2.80 annualized dividend and a yield of 10.45%. The ex-dividend date of this dividend was Thursday, November 7th. Alliance Resource Partners's dividend payout ratio is presently 79.55%.

Wall Street Analyst Weigh In

ARLP has been the topic of several research reports. Benchmark upped their price objective on Alliance Resource Partners from $26.00 to $27.00 and gave the company a "buy" rating in a research note on Tuesday, October 29th. StockNews.com lowered Alliance Resource Partners from a "strong-buy" rating to a "buy" rating in a research report on Friday.

Get Our Latest Analysis on ARLP

Alliance Resource Partners Profile

(

Free Report)

Alliance Resource Partners, L.P., a diversified natural resource company, produces and markets coal primarily to utilities and industrial users in the United States. The company operates through four segments: Illinois Basin Coal Operations, Appalachia Coal Operations, Oil & Gas Royalties, and Coal Royalties.

Recommended Stories

Before you consider Alliance Resource Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alliance Resource Partners wasn't on the list.

While Alliance Resource Partners currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.