StockNews.com initiated coverage on shares of Atlantica Sustainable Infrastructure (NASDAQ:AY - Free Report) in a research report sent to investors on Monday. The brokerage issued a sell rating on the utilities provider's stock.

Atlantica Sustainable Infrastructure Stock Performance

NASDAQ:AY remained flat at $21.99 during trading hours on Monday. The company's stock had a trading volume of 2,181,000 shares, compared to its average volume of 1,209,512. Atlantica Sustainable Infrastructure has a 52 week low of $16.82 and a 52 week high of $23.47. The firm has a market cap of $2.55 billion, a P/E ratio of 75.83, a P/E/G ratio of 2.14 and a beta of 1.00. The business's 50-day simple moving average is $22.03 and its two-hundred day simple moving average is $22.02. The company has a current ratio of 1.25, a quick ratio of 1.20 and a debt-to-equity ratio of 3.36.

Atlantica Sustainable Infrastructure Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, December 12th. Shareholders of record on Friday, November 29th were paid a dividend of $0.2225 per share. This represents a $0.89 dividend on an annualized basis and a dividend yield of 4.05%. The ex-dividend date of this dividend was Friday, November 29th. Atlantica Sustainable Infrastructure's dividend payout ratio is presently 306.91%.

Institutional Trading of Atlantica Sustainable Infrastructure

A number of institutional investors have recently added to or reduced their stakes in AY. Alpine Associates Management Inc. acquired a new position in Atlantica Sustainable Infrastructure during the 2nd quarter valued at about $23,699,000. Westchester Capital Management LLC grew its holdings in Atlantica Sustainable Infrastructure by 305.3% in the 3rd quarter. Westchester Capital Management LLC now owns 1,143,722 shares of the utilities provider's stock valued at $25,139,000 after buying an additional 861,541 shares during the last quarter. Picton Mahoney Asset Management acquired a new stake in shares of Atlantica Sustainable Infrastructure during the 2nd quarter worth approximately $13,719,000. Glazer Capital LLC acquired a new position in Atlantica Sustainable Infrastructure in the second quarter worth about $13,629,000. Finally, Water Island Capital LLC bought a new stake in Atlantica Sustainable Infrastructure in the second quarter valued at $13,438,000. 40.53% of the stock is owned by hedge funds and other institutional investors.

About Atlantica Sustainable Infrastructure

(

Get Free Report)

Atlantica Sustainable Infrastructure plc owns, manages, and invests in renewable energy, storage, natural gas and heat, electric transmission lines, and water assets in North America, South America, Europe, the Middle East, and Africa. The company was formerly known as Atlantica Yield plc and changed its name to Atlantica Sustainable Infrastructure plc in May 2020.

Read More

Before you consider Atlantica Sustainable Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlantica Sustainable Infrastructure wasn't on the list.

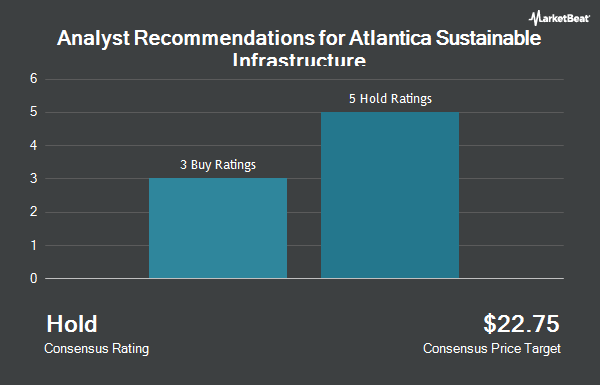

While Atlantica Sustainable Infrastructure currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.