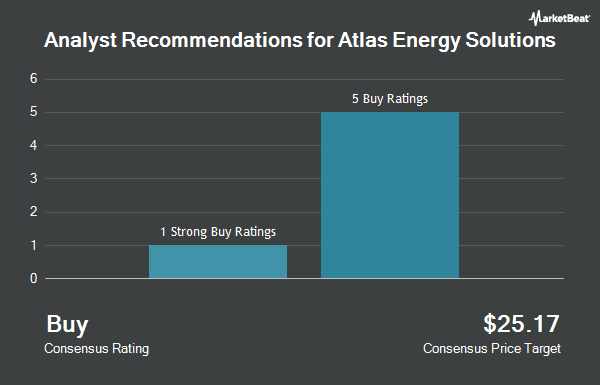

Atlas Energy Solutions Inc. (NYSE:AESI - Get Free Report) has received an average recommendation of "Moderate Buy" from the twelve ratings firms that are presently covering the company, Marketbeat.com reports. Four research analysts have rated the stock with a hold rating, six have given a buy rating and two have given a strong buy rating to the company. The average 12 month price objective among brokerages that have issued a report on the stock in the last year is $24.44.

A number of analysts have weighed in on the stock. Citigroup cut shares of Atlas Energy Solutions from a "buy" rating to a "neutral" rating and cut their price objective for the stock from $23.00 to $22.00 in a report on Thursday, November 14th. Pickering Energy Partners lowered shares of Atlas Energy Solutions from an "outperform" rating to a "neutral" rating in a research note on Wednesday, October 30th. The Goldman Sachs Group downgraded shares of Atlas Energy Solutions from a "buy" rating to a "neutral" rating and decreased their price objective for the company from $23.00 to $21.00 in a research note on Thursday, November 7th. Stephens reissued an "overweight" rating and issued a $28.00 target price on shares of Atlas Energy Solutions in a report on Tuesday, August 6th. Finally, Barclays cut Atlas Energy Solutions from an "overweight" rating to an "equal weight" rating and decreased their target price for the company from $23.00 to $19.00 in a research report on Tuesday, November 12th.

Get Our Latest Research Report on AESI

Insider Buying and Selling

In other Atlas Energy Solutions news, major shareholder Gregory M. Shepard bought 1,797 shares of the company's stock in a transaction on Friday, October 18th. The shares were bought at an average price of $19.65 per share, for a total transaction of $35,311.05. Following the transaction, the insider now owns 7,507,194 shares of the company's stock, valued at approximately $147,516,362.10. This trade represents a 0.02 % increase in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, major shareholder Brian Anthony Leveille sold 10,000 shares of the stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $20.50, for a total value of $205,000.00. Following the transaction, the insider now directly owns 542,010 shares of the company's stock, valued at approximately $11,111,205. This trade represents a 1.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders purchased 60,869 shares of company stock valued at $1,187,983 and sold 115,713 shares valued at $2,517,431. Corporate insiders own 24.34% of the company's stock.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently bought and sold shares of the business. First Horizon Advisors Inc. boosted its position in shares of Atlas Energy Solutions by 313.7% during the 2nd quarter. First Horizon Advisors Inc. now owns 1,725 shares of the company's stock worth $34,000 after purchasing an additional 1,308 shares in the last quarter. Quest Partners LLC purchased a new stake in Atlas Energy Solutions during the third quarter worth about $48,000. Amalgamated Bank boosted its holdings in Atlas Energy Solutions by 328.1% during the second quarter. Amalgamated Bank now owns 2,350 shares of the company's stock worth $47,000 after buying an additional 1,801 shares in the last quarter. FMR LLC grew its position in Atlas Energy Solutions by 101.0% during the third quarter. FMR LLC now owns 2,696 shares of the company's stock worth $59,000 after buying an additional 1,355 shares during the period. Finally, CWM LLC increased its holdings in Atlas Energy Solutions by 47.1% in the third quarter. CWM LLC now owns 2,766 shares of the company's stock valued at $60,000 after buying an additional 886 shares in the last quarter. Institutional investors and hedge funds own 34.59% of the company's stock.

Atlas Energy Solutions Stock Up 0.6 %

Shares of Atlas Energy Solutions stock traded up $0.15 during trading on Friday, hitting $23.57. 701,170 shares of the stock were exchanged, compared to its average volume of 959,594. The company has a debt-to-equity ratio of 0.42, a current ratio of 1.23 and a quick ratio of 1.08. The firm's 50-day moving average price is $21.23 and its 200 day moving average price is $21.07. The stock has a market cap of $2.60 billion, a price-to-earnings ratio of 29.65, a price-to-earnings-growth ratio of 11.84 and a beta of 0.69. Atlas Energy Solutions has a 12-month low of $15.55 and a 12-month high of $24.93.

Atlas Energy Solutions (NYSE:AESI - Get Free Report) last released its quarterly earnings data on Monday, October 28th. The company reported $0.04 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.29 by ($0.25). Atlas Energy Solutions had a return on equity of 11.01% and a net margin of 8.78%. The business had revenue of $304.40 million for the quarter, compared to analyst estimates of $307.93 million. During the same period in the prior year, the company posted $0.51 earnings per share. The company's revenue was up 93.1% compared to the same quarter last year. As a group, analysts forecast that Atlas Energy Solutions will post 0.88 earnings per share for the current fiscal year.

Atlas Energy Solutions Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, November 14th. Stockholders of record on Thursday, November 7th were paid a dividend of $0.24 per share. This represents a $0.96 annualized dividend and a dividend yield of 4.07%. The ex-dividend date of this dividend was Thursday, November 7th. This is a boost from Atlas Energy Solutions's previous quarterly dividend of $0.23. Atlas Energy Solutions's dividend payout ratio is 121.52%.

About Atlas Energy Solutions

(

Get Free ReportAtlas Energy Solutions Inc engages in the production, processing, and sale of mesh and sand that are used as a proppant during the well completion process in the Permian Basin of Texas and New Mexico. The company provides transportation and logistics, storage solutions, and contract labor services. It sells its products and services to oil and natural gas exploration and production companies, and oilfield services companies.

See Also

Before you consider Atlas Energy Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlas Energy Solutions wasn't on the list.

While Atlas Energy Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.