Atom Investors LP lessened its position in The Greenbrier Companies, Inc. (NYSE:GBX - Free Report) by 85.7% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 20,741 shares of the transportation company's stock after selling 124,374 shares during the period. Atom Investors LP owned 0.07% of Greenbrier Companies worth $1,056,000 at the end of the most recent reporting period.

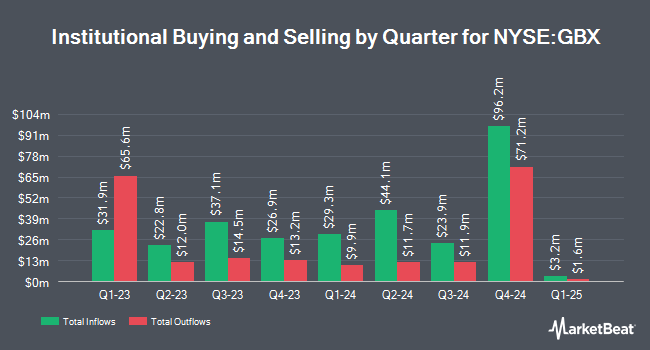

A number of other large investors have also added to or reduced their stakes in GBX. Canada Pension Plan Investment Board purchased a new stake in shares of Greenbrier Companies in the 2nd quarter worth about $25,000. GAMMA Investing LLC lifted its position in Greenbrier Companies by 60.9% during the 3rd quarter. GAMMA Investing LLC now owns 547 shares of the transportation company's stock valued at $28,000 after acquiring an additional 207 shares during the period. Gladius Capital Management LP purchased a new position in Greenbrier Companies in the third quarter worth about $32,000. NBC Securities Inc. purchased a new position in Greenbrier Companies in the third quarter worth about $55,000. Finally, Meeder Asset Management Inc. purchased a new position in Greenbrier Companies in the second quarter worth about $67,000. Institutional investors own 95.59% of the company's stock.

Greenbrier Companies Price Performance

Shares of GBX stock remained flat at $68.22 during mid-day trading on Wednesday. 199,967 shares of the stock traded hands, compared to its average volume of 321,002. The Greenbrier Companies, Inc. has a 1 year low of $38.12 and a 1 year high of $69.12. The company has a 50-day simple moving average of $59.10 and a 200 day simple moving average of $52.40. The company has a debt-to-equity ratio of 0.91, a current ratio of 1.58 and a quick ratio of 0.87. The stock has a market capitalization of $2.14 billion, a P/E ratio of 13.73, a P/E/G ratio of 1.99 and a beta of 1.53.

Greenbrier Companies (NYSE:GBX - Get Free Report) last released its earnings results on Wednesday, October 23rd. The transportation company reported $1.92 EPS for the quarter, topping the consensus estimate of $1.32 by $0.60. The firm had revenue of $1.05 billion for the quarter, compared to the consensus estimate of $1.05 billion. Greenbrier Companies had a net margin of 4.52% and a return on equity of 10.86%. The company's quarterly revenue was up 1.4% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.92 earnings per share. On average, equities research analysts expect that The Greenbrier Companies, Inc. will post 5.2 earnings per share for the current year.

Greenbrier Companies Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Wednesday, November 27th. Investors of record on Wednesday, November 6th were paid a dividend of $0.30 per share. This represents a $1.20 dividend on an annualized basis and a yield of 1.76%. The ex-dividend date of this dividend was Wednesday, November 6th. Greenbrier Companies's payout ratio is 24.14%.

Wall Street Analysts Forecast Growth

A number of brokerages have recently commented on GBX. Susquehanna lifted their price target on shares of Greenbrier Companies from $63.00 to $65.00 and gave the stock a "positive" rating in a research note on Monday, October 21st. Bank of America lifted their price target on shares of Greenbrier Companies from $42.00 to $50.00 and gave the stock an "underperform" rating in a research note on Thursday, October 24th. Finally, StockNews.com lowered shares of Greenbrier Companies from a "hold" rating to a "sell" rating in a research report on Friday, August 23rd. Two equities research analysts have rated the stock with a sell rating and three have given a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $60.00.

Check Out Our Latest Stock Analysis on GBX

Insider Buying and Selling at Greenbrier Companies

In related news, COO William J. Krueger sold 2,000 shares of the stock in a transaction that occurred on Friday, November 1st. The shares were sold at an average price of $58.78, for a total value of $117,560.00. Following the transaction, the chief operating officer now owns 48,714 shares in the company, valued at approximately $2,863,408.92. This represents a 3.94 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, SVP Ricardo Galvan sold 1,388 shares of the firm's stock in a transaction that occurred on Monday, October 28th. The stock was sold at an average price of $62.00, for a total transaction of $86,056.00. Following the sale, the senior vice president now directly owns 32,388 shares in the company, valued at $2,008,056. The trade was a 4.11 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 12,703 shares of company stock worth $790,338 over the last quarter. Insiders own 1.78% of the company's stock.

About Greenbrier Companies

(

Free Report)

The Greenbrier Companies, Inc designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America. It operates through three segments: Manufacturing; Maintenance Services; and Leasing & Management Services. The Manufacturing segment offers covered hopper cars, gondolas, open top hoppers, boxcars, center partition cars, tank cars, sustainable conversions, double-stack railcars, auto-max ii, multi-max, and multi-max plus products, intermodal cars, automobile transport, coil steel and metals, flat cars, sliding wall cars, pressurized tank cars, and non-pressurized tank cars.

Further Reading

Before you consider Greenbrier Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Greenbrier Companies wasn't on the list.

While Greenbrier Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.