Atom Investors LP purchased a new position in Haemonetics Co. (NYSE:HAE - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm purchased 19,545 shares of the medical instruments supplier's stock, valued at approximately $1,571,000.

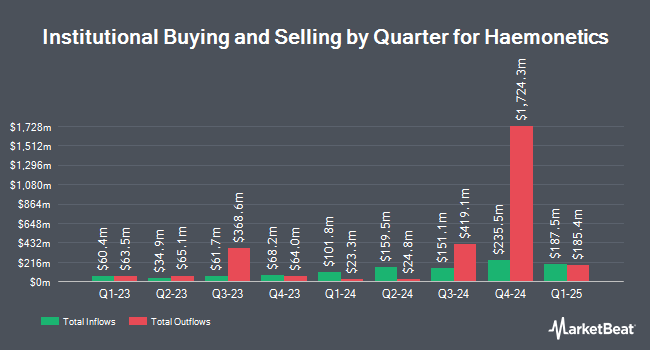

Several other large investors also recently added to or reduced their stakes in the stock. Global Alpha Capital Management Ltd. bought a new position in shares of Haemonetics during the 3rd quarter valued at approximately $806,000. Harbor Capital Advisors Inc. raised its position in Haemonetics by 311.4% in the 2nd quarter. Harbor Capital Advisors Inc. now owns 25,775 shares of the medical instruments supplier's stock worth $2,132,000 after purchasing an additional 19,510 shares during the period. Janus Henderson Group PLC boosted its position in shares of Haemonetics by 26.8% during the first quarter. Janus Henderson Group PLC now owns 29,730 shares of the medical instruments supplier's stock valued at $2,536,000 after buying an additional 6,287 shares during the period. CWM LLC grew its stake in shares of Haemonetics by 40.5% during the second quarter. CWM LLC now owns 36,526 shares of the medical instruments supplier's stock valued at $3,022,000 after buying an additional 10,537 shares during the last quarter. Finally, Loomis Sayles & Co. L P lifted its stake in shares of Haemonetics by 8.1% during the 3rd quarter. Loomis Sayles & Co. L P now owns 163,856 shares of the medical instruments supplier's stock worth $13,171,000 after acquiring an additional 12,310 shares during the last quarter. 99.67% of the stock is owned by institutional investors.

Haemonetics Stock Down 2.3 %

Shares of Haemonetics stock traded down $1.99 during trading on Tuesday, reaching $85.49. The company's stock had a trading volume of 69,836 shares, compared to its average volume of 552,604. Haemonetics Co. has a 1-year low of $70.25 and a 1-year high of $97.97. The company has a 50-day simple moving average of $80.21 and a two-hundred day simple moving average of $82.00. The company has a quick ratio of 2.09, a current ratio of 3.49 and a debt-to-equity ratio of 1.39. The company has a market cap of $4.29 billion, a price-to-earnings ratio of 36.30, a P/E/G ratio of 1.36 and a beta of 0.38.

Haemonetics (NYSE:HAE - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The medical instruments supplier reported $1.12 earnings per share for the quarter, topping analysts' consensus estimates of $1.09 by $0.03. The business had revenue of $345.50 million for the quarter, compared to analyst estimates of $342.57 million. Haemonetics had a return on equity of 22.67% and a net margin of 9.10%. The company's revenue was up 8.6% on a year-over-year basis. During the same quarter in the previous year, the firm earned $0.99 earnings per share. As a group, equities analysts forecast that Haemonetics Co. will post 4.59 earnings per share for the current year.

Wall Street Analyst Weigh In

HAE has been the subject of several research analyst reports. Raymond James upgraded Haemonetics from an "outperform" rating to a "strong-buy" rating and set a $120.00 target price for the company in a research report on Friday, November 8th. Needham & Company LLC reiterated a "buy" rating and issued a $112.00 target price on shares of Haemonetics in a report on Friday, November 15th. Bank of America assumed coverage on Haemonetics in a report on Wednesday, September 11th. They issued a "neutral" rating and a $85.00 price objective for the company. Citigroup cut their target price on shares of Haemonetics from $94.00 to $85.00 and set a "neutral" rating on the stock in a research report on Thursday, August 22nd. Finally, BTIG Research began coverage on shares of Haemonetics in a research note on Tuesday, September 10th. They issued a "buy" rating and a $112.00 price objective for the company. Three research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $107.88.

Read Our Latest Stock Report on HAE

About Haemonetics

(

Free Report)

Haemonetics Corporation, a healthcare company, provides suite of medical products and solutions in the United States and internationally. The company offers automated plasma collection systems, donor management software, and supporting software solutions including NexSys PCS and PCS2 plasmapheresis equipment and related disposables and solutions, as well as integrated information technology platforms for plasma customers to manage their donors, operations, and supply chain; and NexLynk DMS donor management system and Donor360 app.

Featured Articles

Before you consider Haemonetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Haemonetics wasn't on the list.

While Haemonetics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.