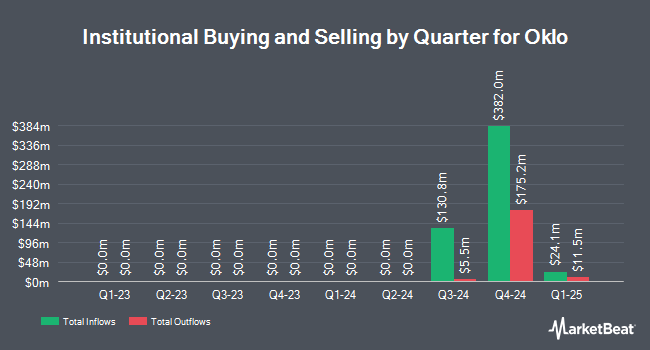

Atom Investors LP acquired a new stake in Oklo Inc. (NYSE:OKLO - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 81,251 shares of the company's stock, valued at approximately $657,000. Atom Investors LP owned 0.07% of Oklo as of its most recent SEC filing.

Several other institutional investors have also modified their holdings of OKLO. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC acquired a new stake in shares of Oklo in the third quarter valued at $104,000. Zurcher Kantonalbank Zurich Cantonalbank acquired a new stake in shares of Oklo during the third quarter worth $135,000. DRW Securities LLC acquired a new stake in shares of Oklo during the third quarter worth $404,000. Finally, Portland Investment Counsel Inc. acquired a new stake in shares of Oklo during the third quarter worth $6,493,000. Institutional investors and hedge funds own 85.03% of the company's stock.

Oklo Stock Performance

NYSE OKLO traded up $0.21 on Wednesday, reaching $20.34. The stock had a trading volume of 8,635,251 shares, compared to its average volume of 5,756,559. The business has a 50 day moving average price of $18.29 and a 200 day moving average price of $11.63. Oklo Inc. has a 1 year low of $5.35 and a 1 year high of $28.12.

Analyst Ratings Changes

A number of equities research analysts have recently issued reports on OKLO shares. B. Riley began coverage on Oklo in a research report on Thursday, September 19th. They set a "buy" rating and a $10.00 target price on the stock. Seaport Res Ptn raised Oklo to a "hold" rating in a research report on Friday, September 6th. Finally, Citigroup dropped their price target on Oklo from $11.00 to $10.00 and set a "neutral" rating on the stock in a research report on Tuesday, September 24th.

Get Our Latest Report on Oklo

About Oklo

(

Free Report)

Oklo Inc designs and develops fission power plants to provide reliable and commercial-scale energy to customers in the United States. It also provides used nuclear fuel recycling services. The company was founded in 2013 and is based in Santa Clara, California.

See Also

Before you consider Oklo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oklo wasn't on the list.

While Oklo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.