Atom Investors LP acquired a new position in Main Street Capital Co. (NYSE:MAIN - Free Report) during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund acquired 44,532 shares of the financial services provider's stock, valued at approximately $2,233,000. Atom Investors LP owned 0.05% of Main Street Capital as of its most recent filing with the Securities and Exchange Commission (SEC).

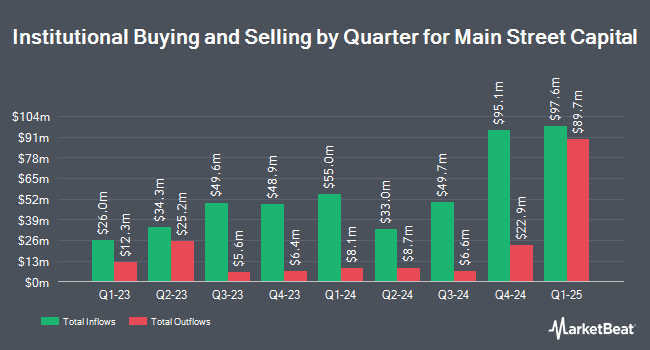

Several other large investors have also made changes to their positions in the business. Van ECK Associates Corp grew its position in Main Street Capital by 3.9% in the 3rd quarter. Van ECK Associates Corp now owns 1,195,476 shares of the financial services provider's stock worth $61,758,000 after purchasing an additional 45,381 shares during the last quarter. Burgundy Asset Management Ltd. increased its stake in Main Street Capital by 1.6% during the second quarter. Burgundy Asset Management Ltd. now owns 1,106,782 shares of the financial services provider's stock valued at $55,881,000 after acquiring an additional 17,623 shares during the period. Adell Harriman & Carpenter Inc. raised its holdings in Main Street Capital by 3.5% in the 3rd quarter. Adell Harriman & Carpenter Inc. now owns 419,255 shares of the financial services provider's stock valued at $21,021,000 after acquiring an additional 14,045 shares in the last quarter. Muzinich & Co. Inc. lifted its position in shares of Main Street Capital by 9.3% in the 3rd quarter. Muzinich & Co. Inc. now owns 212,384 shares of the financial services provider's stock worth $10,649,000 after acquiring an additional 18,059 shares during the period. Finally, Sumitomo Mitsui Trust Group Inc. grew its holdings in shares of Main Street Capital by 9.4% during the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 209,924 shares of the financial services provider's stock worth $10,526,000 after purchasing an additional 18,059 shares in the last quarter. Institutional investors and hedge funds own 20.31% of the company's stock.

Wall Street Analyst Weigh In

MAIN has been the topic of a number of recent research reports. Oppenheimer lifted their price target on shares of Main Street Capital from $43.00 to $44.00 and gave the stock a "market perform" rating in a research note on Tuesday, August 13th. Royal Bank of Canada restated an "outperform" rating and set a $52.00 price target on shares of Main Street Capital in a research report on Wednesday, August 14th. Finally, B. Riley boosted their price objective on Main Street Capital from $49.00 to $51.00 and gave the stock a "neutral" rating in a research note on Monday, November 11th. Four equities research analysts have rated the stock with a hold rating and one has given a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $48.80.

Get Our Latest Stock Analysis on Main Street Capital

Main Street Capital Stock Performance

MAIN remained flat at $55.35 during mid-day trading on Tuesday. The company's stock had a trading volume of 142,242 shares, compared to its average volume of 365,876. The company has a market cap of $4.88 billion, a PE ratio of 10.03 and a beta of 1.30. Main Street Capital Co. has a 52-week low of $41.31 and a 52-week high of $55.85. The company has a quick ratio of 0.08, a current ratio of 0.08 and a debt-to-equity ratio of 0.13. The stock has a 50 day moving average price of $51.89 and a two-hundred day moving average price of $50.47.

Main Street Capital Announces Dividend

The firm also recently declared a dividend, which will be paid on Friday, December 27th. Stockholders of record on Friday, December 20th will be given a dividend of $0.30 per share. The ex-dividend date is Friday, December 20th. Main Street Capital's dividend payout ratio is 53.26%.

About Main Street Capital

(

Free Report)

Main Street Capital Corporation is a business development company specializes in equity capital to lower middle market companies. The firm specializing in recapitalizations, management buyouts, refinancing, family estate planning, management buyouts, refinancing, industry consolidation, mature, later stage emerging growth.

Further Reading

Before you consider Main Street Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Main Street Capital wasn't on the list.

While Main Street Capital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.