Atom Investors LP lowered its position in shares of Allegro MicroSystems, Inc. (NASDAQ:ALGM - Free Report) by 61.7% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 47,115 shares of the company's stock after selling 75,871 shares during the period. Atom Investors LP's holdings in Allegro MicroSystems were worth $1,098,000 as of its most recent SEC filing.

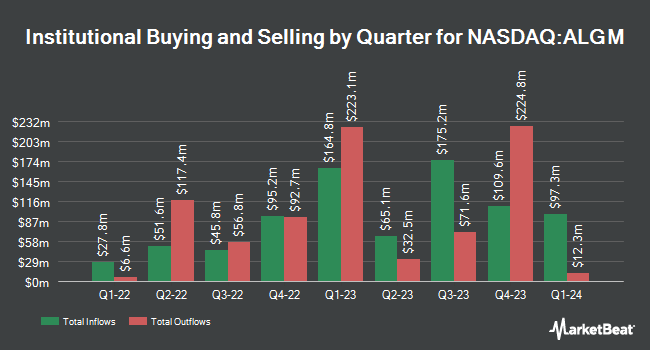

Other large investors have also recently made changes to their positions in the company. FMR LLC boosted its position in shares of Allegro MicroSystems by 43.3% in the 3rd quarter. FMR LLC now owns 28,253,811 shares of the company's stock worth $658,314,000 after purchasing an additional 8,534,089 shares in the last quarter. Principal Financial Group Inc. raised its holdings in Allegro MicroSystems by 14.1% during the third quarter. Principal Financial Group Inc. now owns 2,499,760 shares of the company's stock worth $58,244,000 after purchasing an additional 308,943 shares in the last quarter. The Manufacturers Life Insurance Company increased its stake in shares of Allegro MicroSystems by 15.3% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 2,148,478 shares of the company's stock worth $60,673,000 after purchasing an additional 285,747 shares in the last quarter. Westfield Capital Management Co. LP boosted its holdings in shares of Allegro MicroSystems by 54.6% in the 3rd quarter. Westfield Capital Management Co. LP now owns 2,014,481 shares of the company's stock valued at $46,937,000 after purchasing an additional 711,185 shares during the last quarter. Finally, Massachusetts Financial Services Co. MA lifted its holdings in Allegro MicroSystems by 47.6% in the 3rd quarter. Massachusetts Financial Services Co. MA now owns 1,453,004 shares of the company's stock worth $33,855,000 after buying an additional 468,707 shares in the last quarter. 56.45% of the stock is currently owned by institutional investors.

Allegro MicroSystems Stock Down 2.9 %

NASDAQ ALGM traded down $0.63 during trading on Wednesday, reaching $21.25. 2,257,715 shares of the company's stock were exchanged, compared to its average volume of 1,945,507. The stock has a market cap of $3.91 billion, a P/E ratio of -151.77 and a beta of 1.67. The company has a debt-to-equity ratio of 0.42, a quick ratio of 2.80 and a current ratio of 4.22. The company has a 50 day moving average price of $21.34 and a two-hundred day moving average price of $24.72. Allegro MicroSystems, Inc. has a 1 year low of $18.59 and a 1 year high of $33.26.

Allegro MicroSystems (NASDAQ:ALGM - Get Free Report) last released its earnings results on Thursday, October 31st. The company reported $0.08 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.06 by $0.02. Allegro MicroSystems had a positive return on equity of 8.48% and a negative net margin of 2.96%. The company had revenue of $187.39 million for the quarter, compared to analysts' expectations of $187.52 million. During the same quarter in the previous year, the firm posted $0.36 EPS. The firm's quarterly revenue was down 32.0% on a year-over-year basis.

Insider Transactions at Allegro MicroSystems

In related news, SVP Michael Doogue purchased 15,000 shares of the stock in a transaction that occurred on Monday, November 18th. The stock was purchased at an average cost of $19.00 per share, for a total transaction of $285,000.00. Following the acquisition, the senior vice president now owns 246,086 shares in the company, valued at approximately $4,675,634. This trade represents a 6.49 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 0.50% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts have issued reports on the stock. Morgan Stanley began coverage on shares of Allegro MicroSystems in a research report on Thursday, November 7th. They issued an "equal weight" rating and a $21.00 target price for the company. Needham & Company LLC cut their price objective on shares of Allegro MicroSystems from $33.00 to $30.00 and set a "buy" rating on the stock in a research report on Thursday, October 31st. Barclays decreased their price target on shares of Allegro MicroSystems from $32.00 to $25.00 and set an "overweight" rating on the stock in a research note on Friday, November 1st. Loop Capital assumed coverage on shares of Allegro MicroSystems in a report on Tuesday, November 12th. They issued a "buy" rating and a $30.00 price objective for the company. Finally, UBS Group assumed coverage on Allegro MicroSystems in a report on Tuesday, September 3rd. They issued a "buy" rating and a $33.00 target price on the stock. One research analyst has rated the stock with a hold rating and ten have given a buy rating to the company's stock. According to data from MarketBeat, Allegro MicroSystems presently has an average rating of "Moderate Buy" and a consensus target price of $30.09.

Read Our Latest Stock Report on Allegro MicroSystems

About Allegro MicroSystems

(

Free Report)

Allegro MicroSystems, Inc, together with its subsidiaries, designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy-efficient systems. Its products include magnetic sensor ICs, such as position, speed, and current sensor ICs; and power ICs comprising motor driver ICs, regulator and LED driver ICs, and isolated gate drivers.

See Also

Before you consider Allegro MicroSystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegro MicroSystems wasn't on the list.

While Allegro MicroSystems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.