Atom Investors LP decreased its stake in Tower Semiconductor Ltd. (NASDAQ:TSEM - Free Report) by 57.2% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 33,424 shares of the semiconductor company's stock after selling 44,646 shares during the period. Atom Investors LP's holdings in Tower Semiconductor were worth $1,479,000 at the end of the most recent quarter.

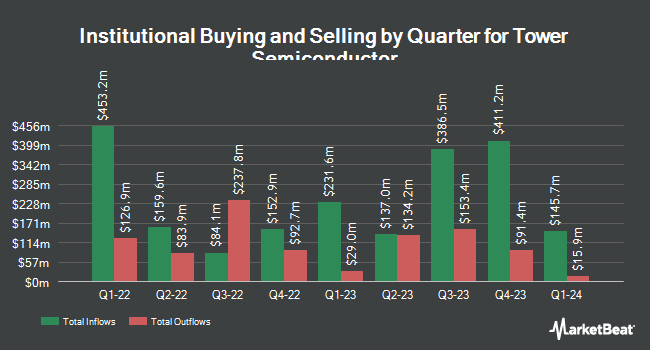

Other institutional investors also recently modified their holdings of the company. Summit Partners Public Asset Management LLC raised its stake in shares of Tower Semiconductor by 1,146.9% during the third quarter. Summit Partners Public Asset Management LLC now owns 1,496,315 shares of the semiconductor company's stock valued at $66,227,000 after acquiring an additional 1,376,315 shares during the last quarter. Y.D. More Investments Ltd boosted its holdings in Tower Semiconductor by 9,622.0% in the second quarter. Y.D. More Investments Ltd now owns 911,926 shares of the semiconductor company's stock valued at $35,952,000 after acquiring an additional 902,546 shares during the last quarter. Point72 Asset Management L.P. increased its position in Tower Semiconductor by 169.0% during the 2nd quarter. Point72 Asset Management L.P. now owns 1,022,121 shares of the semiconductor company's stock valued at $40,180,000 after purchasing an additional 642,121 shares during the period. Meitav Investment House Ltd. lifted its position in shares of Tower Semiconductor by 25.6% in the 2nd quarter. Meitav Investment House Ltd. now owns 2,431,817 shares of the semiconductor company's stock worth $95,686,000 after purchasing an additional 495,380 shares during the period. Finally, Scopia Capital Management LP bought a new stake in shares of Tower Semiconductor in the 3rd quarter valued at $13,926,000. 70.51% of the stock is currently owned by institutional investors and hedge funds.

Tower Semiconductor Stock Performance

NASDAQ TSEM traded up $0.71 during trading on Tuesday, hitting $48.58. 80,072 shares of the company's stock traded hands, compared to its average volume of 522,943. The company has a debt-to-equity ratio of 0.05, a quick ratio of 4.89 and a current ratio of 5.82. The stock has a market capitalization of $5.38 billion, a price-to-earnings ratio of 25.88 and a beta of 0.92. Tower Semiconductor Ltd. has a 12-month low of $27.15 and a 12-month high of $50.25. The business has a 50 day moving average of $44.94 and a 200-day moving average of $41.66.

Tower Semiconductor (NASDAQ:TSEM - Get Free Report) last announced its quarterly earnings results on Wednesday, November 13th. The semiconductor company reported $0.57 EPS for the quarter, beating analysts' consensus estimates of $0.45 by $0.12. Tower Semiconductor had a net margin of 14.75% and a return on equity of 8.22%. The company had revenue of $370.50 million for the quarter, compared to analysts' expectations of $370.30 million. During the same period in the prior year, the company posted $0.47 EPS. Tower Semiconductor's revenue was up 3.4% compared to the same quarter last year. As a group, equities research analysts anticipate that Tower Semiconductor Ltd. will post 1.77 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of brokerages recently weighed in on TSEM. Susquehanna lifted their target price on shares of Tower Semiconductor from $55.00 to $60.00 and gave the stock a "positive" rating in a research note on Thursday, November 14th. Craig Hallum raised their target price on Tower Semiconductor from $54.00 to $60.00 and gave the company a "buy" rating in a report on Thursday, November 14th. StockNews.com downgraded Tower Semiconductor from a "buy" rating to a "hold" rating in a report on Tuesday, November 12th. Finally, Benchmark restated a "buy" rating and set a $55.00 price objective on shares of Tower Semiconductor in a research note on Thursday, November 14th. One equities research analyst has rated the stock with a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat.com, Tower Semiconductor currently has a consensus rating of "Moderate Buy" and an average price target of $58.33.

View Our Latest Research Report on Tower Semiconductor

Tower Semiconductor Profile

(

Free Report)

Tower Semiconductor Ltd., an independent semiconductor foundry, focus on specialty process technologies to manufacture analog intensive mixed-signal semiconductor devices in Israel, the United States, Japan, Europe, and internationally. It provides various customizable process technologies, including SiGe, BiCMOS, mixed signal/CMOS, RF CMOS, CMOS image sensor, integrated power management, and MEMS.

Featured Articles

Before you consider Tower Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tower Semiconductor wasn't on the list.

While Tower Semiconductor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.