Atreides Management LP cut its position in shares of Grab Holdings Limited (NASDAQ:GRAB - Free Report) by 33.3% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 6,677,707 shares of the company's stock after selling 3,335,057 shares during the quarter. Atreides Management LP owned 0.17% of Grab worth $25,375,000 as of its most recent SEC filing.

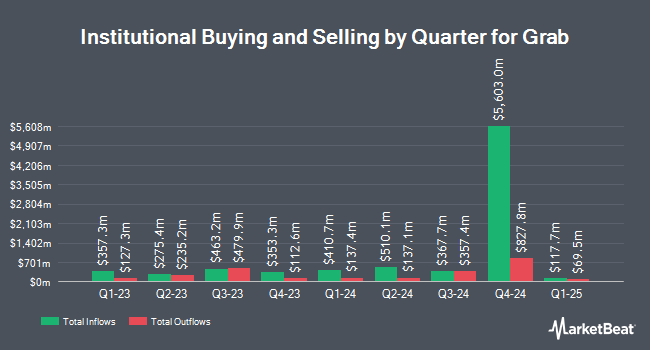

A number of other hedge funds and other institutional investors have also bought and sold shares of GRAB. Sequoia Financial Advisors LLC raised its holdings in shares of Grab by 8.1% in the second quarter. Sequoia Financial Advisors LLC now owns 40,185 shares of the company's stock valued at $143,000 after purchasing an additional 3,020 shares during the last quarter. Empowered Funds LLC lifted its position in Grab by 7.7% during the 3rd quarter. Empowered Funds LLC now owns 43,788 shares of the company's stock worth $166,000 after buying an additional 3,147 shares in the last quarter. Blue Trust Inc. grew its holdings in shares of Grab by 53.6% in the 3rd quarter. Blue Trust Inc. now owns 9,767 shares of the company's stock valued at $35,000 after acquiring an additional 3,408 shares in the last quarter. Dorsey & Whitney Trust CO LLC grew its holdings in shares of Grab by 37.0% in the 2nd quarter. Dorsey & Whitney Trust CO LLC now owns 14,061 shares of the company's stock valued at $50,000 after acquiring an additional 3,795 shares in the last quarter. Finally, Asset Management One Co. Ltd. increased its position in shares of Grab by 0.5% in the third quarter. Asset Management One Co. Ltd. now owns 776,458 shares of the company's stock valued at $2,951,000 after acquiring an additional 3,941 shares during the last quarter. Institutional investors and hedge funds own 55.52% of the company's stock.

Grab Stock Performance

NASDAQ:GRAB traded up $0.18 during mid-day trading on Monday, hitting $5.18. 26,465,222 shares of the stock were exchanged, compared to its average volume of 25,873,748. The company has a debt-to-equity ratio of 0.04, a quick ratio of 2.67 and a current ratio of 2.70. The firm's 50-day simple moving average is $4.25 and its 200 day simple moving average is $3.74. Grab Holdings Limited has a fifty-two week low of $2.90 and a fifty-two week high of $5.72. The stock has a market capitalization of $20.86 billion, a price-to-earnings ratio of -259.00 and a beta of 0.81.

Grab (NASDAQ:GRAB - Get Free Report) last released its quarterly earnings results on Monday, November 11th. The company reported $0.01 EPS for the quarter. The business had revenue of $716.00 million for the quarter, compared to the consensus estimate of $705.40 million. Grab had a negative net margin of 3.57% and a negative return on equity of 1.50%. During the same period in the prior year, the company posted ($0.02) earnings per share. As a group, equities analysts anticipate that Grab Holdings Limited will post -0.03 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of research analysts have weighed in on GRAB shares. Barclays raised their price target on Grab from $4.70 to $5.50 and gave the company an "overweight" rating in a research note on Wednesday, November 13th. Daiwa Capital Markets started coverage on shares of Grab in a report on Wednesday, October 23rd. They set an "outperform" rating and a $4.60 target price on the stock. Evercore ISI upped their target price on shares of Grab from $7.00 to $8.00 and gave the company an "outperform" rating in a report on Tuesday, November 12th. JPMorgan Chase & Co. lifted their price target on Grab from $5.00 to $5.70 and gave the stock an "overweight" rating in a report on Tuesday, November 12th. Finally, Benchmark restated a "buy" rating and issued a $6.00 price objective on shares of Grab in a research note on Tuesday, November 12th. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating and nine have assigned a buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $5.42.

Read Our Latest Stock Analysis on Grab

Grab Profile

(

Free Report)

Grab Holdings Limited engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. The company offers its Grab ecosystem, a single platform with superapps for driver- and merchant-partners and consumers, that allows access to mobility, delivery, digital financial services, and enterprise sector offerings.

See Also

Before you consider Grab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grab wasn't on the list.

While Grab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.