Atria Investments Inc trimmed its holdings in Autodesk, Inc. (NASDAQ:ADSK - Free Report) by 22.3% in the 3rd quarter, according to its most recent filing with the SEC. The institutional investor owned 37,703 shares of the software company's stock after selling 10,824 shares during the quarter. Atria Investments Inc's holdings in Autodesk were worth $10,386,000 at the end of the most recent reporting period.

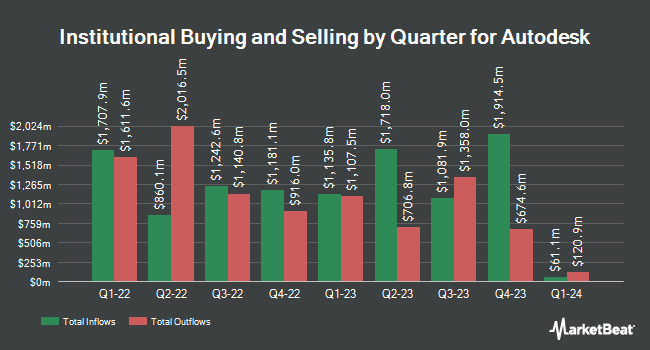

A number of other large investors also recently added to or reduced their stakes in ADSK. Price T Rowe Associates Inc. MD increased its stake in Autodesk by 263.6% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 6,294,746 shares of the software company's stock worth $1,639,279,000 after acquiring an additional 4,563,668 shares during the last quarter. Ninety One UK Ltd boosted its holdings in Autodesk by 28.0% during the 2nd quarter. Ninety One UK Ltd now owns 5,071,950 shares of the software company's stock valued at $1,255,054,000 after acquiring an additional 1,108,973 shares during the period. Van ECK Associates Corp boosted its holdings in Autodesk by 100.9% during the 2nd quarter. Van ECK Associates Corp now owns 1,642,973 shares of the software company's stock valued at $406,554,000 after acquiring an additional 825,165 shares during the period. Point72 Asset Management L.P. lifted its holdings in shares of Autodesk by 366.5% in the 2nd quarter. Point72 Asset Management L.P. now owns 843,040 shares of the software company's stock worth $208,610,000 after buying an additional 662,339 shares during the period. Finally, International Assets Investment Management LLC lifted its holdings in shares of Autodesk by 58,375.5% in the 3rd quarter. International Assets Investment Management LLC now owns 567,797 shares of the software company's stock worth $1,564,170,000 after buying an additional 566,826 shares during the period. 90.24% of the stock is owned by hedge funds and other institutional investors.

Autodesk Trading Up 2.7 %

NASDAQ ADSK traded up $8.33 on Monday, reaching $313.89. 1,549,364 shares of the company were exchanged, compared to its average volume of 1,576,916. The business's fifty day moving average price is $275.95 and its 200 day moving average price is $248.50. The stock has a market capitalization of $67.49 billion, a P/E ratio of 62.49, a price-to-earnings-growth ratio of 3.84 and a beta of 1.47. The company has a current ratio of 0.64, a quick ratio of 0.64 and a debt-to-equity ratio of 0.80. Autodesk, Inc. has a fifty-two week low of $195.32 and a fifty-two week high of $314.70.

Autodesk (NASDAQ:ADSK - Get Free Report) last released its quarterly earnings data on Thursday, August 29th. The software company reported $2.15 earnings per share for the quarter, topping analysts' consensus estimates of $2.00 by $0.15. The company had revenue of $1.51 billion for the quarter, compared to analyst estimates of $1.48 billion. Autodesk had a return on equity of 59.41% and a net margin of 18.21%. The firm's revenue for the quarter was up 11.9% compared to the same quarter last year. During the same quarter in the previous year, the company posted $1.12 earnings per share. Analysts forecast that Autodesk, Inc. will post 5.73 earnings per share for the current year.

Analysts Set New Price Targets

ADSK has been the subject of several research reports. Mizuho set a $260.00 target price on Autodesk in a report on Friday, October 18th. Royal Bank of Canada upped their target price on Autodesk from $290.00 to $313.00 and gave the company an "outperform" rating in a research report on Friday, August 30th. Stifel Nicolaus upped their target price on Autodesk from $290.00 to $320.00 and gave the company a "buy" rating in a research report on Friday, August 30th. Citigroup set a $325.00 target price on Autodesk and gave the company a "buy" rating in a research report on Friday, October 18th. Finally, Hsbc Global Res raised Autodesk to a "strong-buy" rating in a research report on Tuesday, September 3rd. Eight research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $292.95.

Check Out Our Latest Report on Autodesk

Insider Buying and Selling at Autodesk

In other Autodesk news, Director Mary T. Mcdowell sold 550 shares of Autodesk stock in a transaction on Tuesday, October 15th. The stock was sold at an average price of $285.31, for a total value of $156,920.50. Following the sale, the director now owns 30,799 shares in the company, valued at $8,787,262.69. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In other Autodesk news, Director Mary T. Mcdowell sold 550 shares of Autodesk stock in a transaction on Tuesday, October 15th. The stock was sold at an average price of $285.31, for a total value of $156,920.50. Following the sale, the director now owns 30,799 shares in the company, valued at $8,787,262.69. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CAO Stephen W. Hope sold 286 shares of the business's stock in a transaction on Monday, September 30th. The shares were sold at an average price of $274.84, for a total value of $78,604.24. Following the completion of the sale, the chief accounting officer now owns 4,879 shares in the company, valued at $1,340,944.36. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 19,280 shares of company stock worth $5,200,929 over the last quarter. 0.14% of the stock is currently owned by company insiders.

Autodesk Profile

(

Free Report)

Autodesk, Inc provides 3D design, engineering, and entertainment technology solutions worldwide. The company offers AutoCAD Civil 3D, a surveying, design, analysis, and documentation solution for civil engineering, including land development, transportation, and environmental projects; BuildingConnected, a SaaS preconstruction solution; AutoCAD, a software for professional design, drafting, detailing, and visualization; AutoCAD LT, a drafting and detailing software; computer-aided manufacturing (CAM) software for computer numeric control machining, inspection, and modelling for manufacturing; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Industry Collections tools for professionals in architecture, engineering and construction, product design and manufacturing, and media and entertainment collection industries.

Recommended Stories

Before you consider Autodesk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autodesk wasn't on the list.

While Autodesk currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report