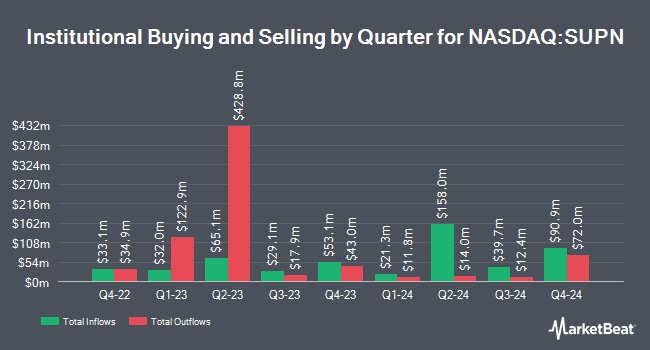

Atria Investments Inc bought a new stake in shares of Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 7,978 shares of the specialty pharmaceutical company's stock, valued at approximately $288,000.

Several other institutional investors also recently made changes to their positions in the stock. Principal Financial Group Inc. raised its stake in Supernus Pharmaceuticals by 5.4% during the 3rd quarter. Principal Financial Group Inc. now owns 285,411 shares of the specialty pharmaceutical company's stock valued at $8,899,000 after purchasing an additional 14,566 shares during the period. State of New Jersey Common Pension Fund D acquired a new position in Supernus Pharmaceuticals during the third quarter worth $1,774,000. Victory Capital Management Inc. increased its position in Supernus Pharmaceuticals by 1.1% during the third quarter. Victory Capital Management Inc. now owns 742,871 shares of the specialty pharmaceutical company's stock worth $23,163,000 after buying an additional 7,833 shares during the last quarter. Natixis Advisors LLC increased its position in Supernus Pharmaceuticals by 14.9% during the third quarter. Natixis Advisors LLC now owns 39,318 shares of the specialty pharmaceutical company's stock worth $1,226,000 after buying an additional 5,113 shares during the last quarter. Finally, Quest Partners LLC bought a new stake in Supernus Pharmaceuticals during the third quarter valued at about $241,000.

Insider Transactions at Supernus Pharmaceuticals

In other Supernus Pharmaceuticals news, SVP Jonathan Rubin sold 927 shares of the stock in a transaction that occurred on Friday, February 21st. The shares were sold at an average price of $39.15, for a total transaction of $36,292.05. Following the transaction, the senior vice president now owns 7,853 shares in the company, valued at $307,444.95. This represents a 10.56 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, VP Padmanabh P. Bhatt sold 9,477 shares of the stock in a transaction that occurred on Tuesday, February 4th. The stock was sold at an average price of $39.70, for a total transaction of $376,236.90. Following the sale, the vice president now owns 10,149 shares in the company, valued at $402,915.30. This represents a 48.29 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 11,104 shares of company stock worth $440,263 in the last three months. Insiders own 9.30% of the company's stock.

Supernus Pharmaceuticals Price Performance

Shares of Supernus Pharmaceuticals stock traded down $0.17 on Friday, hitting $32.15. 2,221,904 shares of the company's stock traded hands, compared to its average volume of 467,903. The firm's 50-day moving average price is $35.79 and its two-hundred day moving average price is $35.09. The stock has a market capitalization of $1.79 billion, a PE ratio of 30.05 and a beta of 0.83. Supernus Pharmaceuticals, Inc. has a one year low of $25.53 and a one year high of $40.28.

Wall Street Analysts Forecast Growth

Several research firms recently weighed in on SUPN. Cantor Fitzgerald reiterated a "neutral" rating and issued a $36.00 target price on shares of Supernus Pharmaceuticals in a research note on Wednesday, February 26th. StockNews.com upgraded shares of Supernus Pharmaceuticals from a "buy" rating to a "strong-buy" rating in a research note on Sunday, March 16th.

Read Our Latest Report on SUPN

About Supernus Pharmaceuticals

(

Free Report)

Supernus Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of products for the treatment of central nervous system (CNS) diseases in the United States. The company's commercial products are Trokendi XR, an extended release topiramate product indicated for the treatment of epilepsy, as well as for the prophylaxis of migraine headache; and Oxtellar XR, an extended release oxcarbazepine for the monotherapy treatment of partial onset seizures in adults and children between 6 to 17 years of age.

Featured Stories

Before you consider Supernus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Supernus Pharmaceuticals wasn't on the list.

While Supernus Pharmaceuticals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.