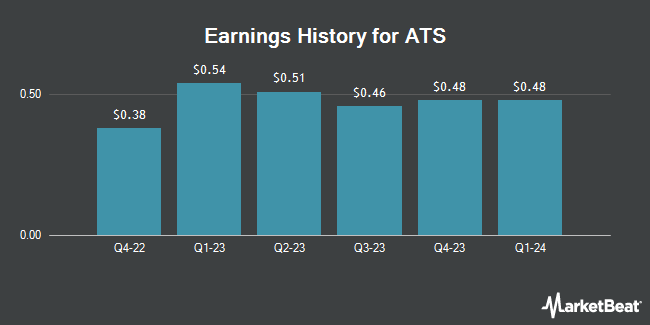

ATS (NYSE:ATS - Get Free Report) will likely be posting its quarterly earnings results before the market opens on Wednesday, February 5th. Analysts expect ATS to post earnings of $0.23 per share and revenue of $651.21 million for the quarter.

ATS Trading Down 0.6 %

ATS stock traded down $0.16 during midday trading on Friday, hitting $27.10. 190,575 shares of the stock were exchanged, compared to its average volume of 113,954. The stock has a market capitalization of $2.65 billion, a PE ratio of 28.23 and a beta of 1.16. The company has a fifty day simple moving average of $29.67 and a two-hundred day simple moving average of $29.13. The company has a quick ratio of 1.71, a current ratio of 2.08 and a debt-to-equity ratio of 1.00. ATS has a 52 week low of $24.82 and a 52 week high of $44.11.

ATS Company Profile

(

Get Free Report)

ATS Corporation, together with its subsidiaries, provides automation solutions worldwide. The company is also involved in planning, designing, building, commissioning, and servicing automated manufacturing and assembly systems, including automation products and test solutions. In addition, it offers pre-automation services comprising discovery and analysis, concept development, simulation, and total cost of ownership modelling; post automation services, including training, process optimization, preventative maintenance, emergency and on-call support, spare parts, retooling, retrofits, and equipment relocation; and contract manufacturing services, as well as after sales and services.

Featured Articles

Before you consider ATS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ATS wasn't on the list.

While ATS currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.