FMR LLC lessened its stake in Aura Biosciences, Inc. (NASDAQ:AURA - Free Report) by 56.1% in the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 101,217 shares of the company's stock after selling 129,234 shares during the quarter. FMR LLC owned approximately 0.20% of Aura Biosciences worth $902,000 at the end of the most recent reporting period.

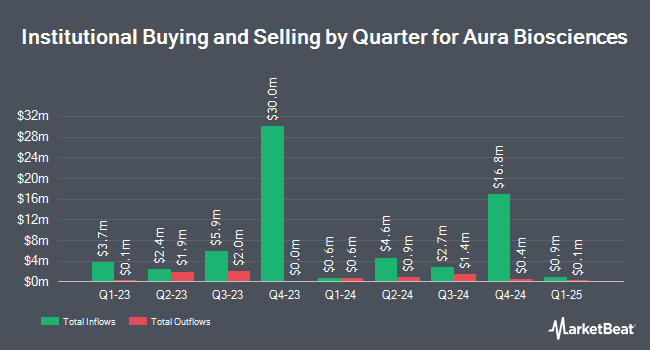

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. Levin Capital Strategies L.P. lifted its stake in shares of Aura Biosciences by 194.5% in the second quarter. Levin Capital Strategies L.P. now owns 327,466 shares of the company's stock worth $2,476,000 after buying an additional 216,266 shares in the last quarter. Dimensional Fund Advisors LP boosted its holdings in shares of Aura Biosciences by 20.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 250,375 shares of the company's stock worth $1,892,000 after purchasing an additional 41,711 shares during the last quarter. Long Focus Capital Management LLC grew its position in shares of Aura Biosciences by 113.4% in the second quarter. Long Focus Capital Management LLC now owns 1,057,188 shares of the company's stock valued at $7,992,000 after purchasing an additional 561,766 shares in the last quarter. Rhumbline Advisers increased its holdings in shares of Aura Biosciences by 39.6% in the second quarter. Rhumbline Advisers now owns 63,483 shares of the company's stock valued at $480,000 after purchasing an additional 18,011 shares during the last quarter. Finally, The Manufacturers Life Insurance Company lifted its position in Aura Biosciences by 14.6% during the second quarter. The Manufacturers Life Insurance Company now owns 64,452 shares of the company's stock worth $487,000 after buying an additional 8,194 shares in the last quarter. Hedge funds and other institutional investors own 96.75% of the company's stock.

Insider Buying and Selling at Aura Biosciences

In other Aura Biosciences news, CTO Mark Plavsic sold 7,383 shares of Aura Biosciences stock in a transaction that occurred on Wednesday, October 16th. The stock was sold at an average price of $9.85, for a total value of $72,722.55. Following the transaction, the chief technology officer now directly owns 121,132 shares in the company, valued at approximately $1,193,150.20. This trade represents a 5.74 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Janet Jill Hopkins sold 11,822 shares of the company's stock in a transaction that occurred on Monday, November 18th. The stock was sold at an average price of $9.36, for a total value of $110,653.92. Following the sale, the insider now owns 151,693 shares of the company's stock, valued at $1,419,846.48. This trade represents a 7.23 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 79,081 shares of company stock valued at $891,353. Insiders own 5.40% of the company's stock.

Analyst Upgrades and Downgrades

AURA has been the subject of a number of recent research reports. JMP Securities raised their target price on Aura Biosciences from $19.00 to $23.00 and gave the stock a "market outperform" rating in a research note on Friday, September 13th. HC Wainwright reiterated a "buy" rating and issued a $22.00 target price on shares of Aura Biosciences in a report on Thursday, November 14th. Cowen reaffirmed a "buy" rating on shares of Aura Biosciences in a research report on Friday, October 18th. Scotiabank increased their price target on Aura Biosciences from $20.00 to $23.00 and gave the stock a "sector outperform" rating in a report on Friday, October 18th. Finally, Evercore ISI raised shares of Aura Biosciences to a "strong-buy" rating in a research report on Monday, September 16th. Five equities research analysts have rated the stock with a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average price target of $23.00.

Get Our Latest Stock Report on AURA

Aura Biosciences Price Performance

Shares of AURA stock traded down $0.22 during trading on Tuesday, reaching $8.67. The company's stock had a trading volume of 176,186 shares, compared to its average volume of 180,305. Aura Biosciences, Inc. has a 1-year low of $6.63 and a 1-year high of $12.38. The stock's 50-day moving average price is $9.71 and its 200 day moving average price is $8.76. The company has a market capitalization of $433.08 million, a price-to-earnings ratio of -5.01 and a beta of 0.26.

Aura Biosciences (NASDAQ:AURA - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The company reported ($0.42) earnings per share for the quarter, topping the consensus estimate of ($0.44) by $0.02. On average, sell-side analysts anticipate that Aura Biosciences, Inc. will post -1.66 EPS for the current fiscal year.

About Aura Biosciences

(

Free Report)

Aura Biosciences, Inc, a clinical-stage biotechnology company, develops precision immunotherapies to treat a range of solid tumors. The company's proprietary platform enables the targeting of a range of solid tumors using virus-like particles conjugated with drugs or loaded with nucleic acids to create virus-like drug conjugates.

See Also

Before you consider Aura Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aura Biosciences wasn't on the list.

While Aura Biosciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.