Aurora Investment Counsel acquired a new stake in Euronet Worldwide, Inc. (NASDAQ:EEFT - Free Report) in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 13,171 shares of the business services provider's stock, valued at approximately $1,307,000.

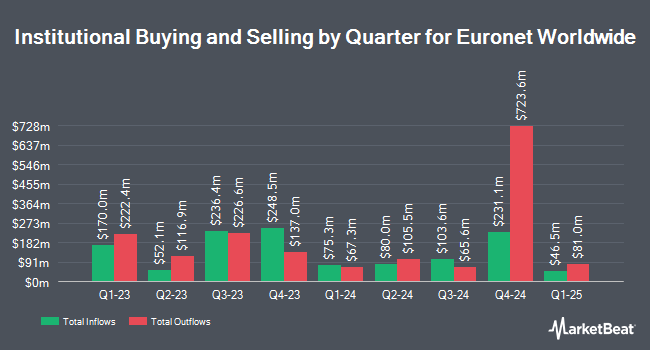

Other institutional investors and hedge funds have also made changes to their positions in the company. Ellsworth Advisors LLC purchased a new stake in shares of Euronet Worldwide in the second quarter valued at approximately $514,000. SG Capital Management LLC increased its position in shares of Euronet Worldwide by 106.8% in the first quarter. SG Capital Management LLC now owns 41,934 shares of the business services provider's stock valued at $4,610,000 after buying an additional 21,654 shares in the last quarter. Burgundy Asset Management Ltd. increased its position in shares of Euronet Worldwide by 1.4% during the second quarter. Burgundy Asset Management Ltd. now owns 767,293 shares of the business services provider's stock worth $79,415,000 after purchasing an additional 10,689 shares in the last quarter. Savant Capital LLC increased its position in shares of Euronet Worldwide by 199.3% during the second quarter. Savant Capital LLC now owns 8,928 shares of the business services provider's stock worth $924,000 after purchasing an additional 5,945 shares in the last quarter. Finally, Maverick Capital Ltd. increased its position in shares of Euronet Worldwide by 507.8% during the second quarter. Maverick Capital Ltd. now owns 14,916 shares of the business services provider's stock worth $1,544,000 after purchasing an additional 12,462 shares in the last quarter. 91.60% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling

In related news, CEO Juan Bianchi sold 4,000 shares of the stock in a transaction dated Thursday, September 5th. The stock was sold at an average price of $102.58, for a total transaction of $410,320.00. Following the transaction, the chief executive officer now owns 12,440 shares of the company's stock, valued at approximately $1,276,095.20. This represents a 24.33 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 10.50% of the stock is owned by corporate insiders.

Euronet Worldwide Stock Performance

Shares of Euronet Worldwide stock opened at $103.43 on Thursday. Euronet Worldwide, Inc. has a 52 week low of $85.89 and a 52 week high of $117.66. The business's fifty day simple moving average is $99.70 and its 200-day simple moving average is $103.86. The firm has a market cap of $4.54 billion, a PE ratio of 14.95 and a beta of 1.46. The company has a quick ratio of 1.26, a current ratio of 1.26 and a debt-to-equity ratio of 0.88.

Euronet Worldwide (NASDAQ:EEFT - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The business services provider reported $3.03 EPS for the quarter, beating the consensus estimate of $2.92 by $0.11. Euronet Worldwide had a return on equity of 26.86% and a net margin of 8.49%. The business had revenue of $1.11 billion for the quarter, compared to analyst estimates of $1.04 billion. During the same quarter in the prior year, the company posted $2.53 EPS. Equities analysts forecast that Euronet Worldwide, Inc. will post 7.87 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several analysts recently commented on the company. Citigroup cut Euronet Worldwide from a "buy" rating to a "neutral" rating and dropped their price target for the stock from $118.00 to $110.00 in a research report on Friday, October 18th. Monness Crespi & Hardt upgraded Euronet Worldwide from a "hold" rating to a "strong-buy" rating in a research report on Thursday, October 24th. Needham & Company LLC dropped their price target on Euronet Worldwide from $125.00 to $120.00 and set a "buy" rating for the company in a research report on Thursday, October 24th. DA Davidson reiterated a "buy" rating and set a $136.00 price target on shares of Euronet Worldwide in a research report on Tuesday, October 8th. Finally, StockNews.com raised Euronet Worldwide from a "hold" rating to a "buy" rating in a research note on Tuesday, November 12th. Three equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $125.38.

Check Out Our Latest Analysis on EEFT

Euronet Worldwide Profile

(

Free Report)

Euronet Worldwide, Inc provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide. It operates through three segments: Electronic Fund Transfer Processing, epay, and Money Transfer. The Electronic Fund Transfer Processing segment provides electronic payment solutions, including automated teller machine (ATM) cash withdrawal and deposit services, ATM network participation, outsourced ATM and point-of-sale (POS) management solutions, credit and debit and prepaid card outsourcing, card issuing, and merchant acquiring services.

Further Reading

Want to see what other hedge funds are holding EEFT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Euronet Worldwide, Inc. (NASDAQ:EEFT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Euronet Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Euronet Worldwide wasn't on the list.

While Euronet Worldwide currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.