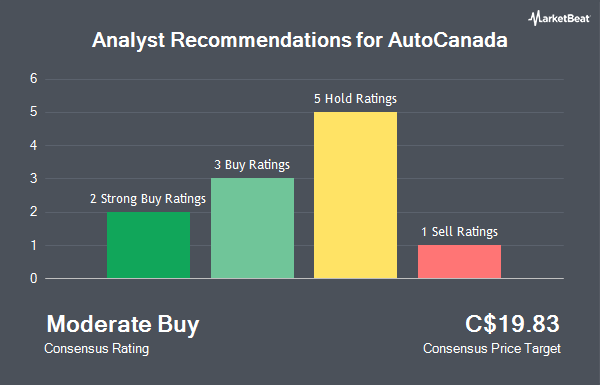

Shares of AutoCanada Inc. (TSE:ACQ - Get Free Report) have received a consensus recommendation of "Moderate Buy" from the eleven analysts that are covering the company, Marketbeat.com reports. One analyst has rated the stock with a sell recommendation, five have assigned a hold recommendation, three have assigned a buy recommendation and two have given a strong buy recommendation to the company. The average 12-month target price among brokerages that have issued ratings on the stock in the last year is C$19.83.

A number of research analysts recently weighed in on the stock. Canaccord Genuity Group raised their target price on shares of AutoCanada from C$17.00 to C$22.00 and gave the company a "strong-buy" rating in a research report on Thursday, March 20th. Acumen Capital raised AutoCanada from a "hold" rating to a "speculative buy" rating and upped their target price for the company from C$20.00 to C$22.50 in a research report on Friday, March 21st. CIBC reduced their price target on AutoCanada from C$17.00 to C$15.00 and set an "underperform" rating on the stock in a research report on Thursday, March 20th. Finally, ATB Capital boosted their target price on shares of AutoCanada from C$18.00 to C$18.50 and gave the company a "sector perform" rating in a research report on Thursday.

Get Our Latest Report on ACQ

AutoCanada Stock Performance

ACQ stock traded down C$0.51 during mid-day trading on Thursday, reaching C$16.12. 10,074 shares of the stock traded hands, compared to its average volume of 18,281. The company has a quick ratio of 0.25, a current ratio of 1.03 and a debt-to-equity ratio of 451.54. The business has a 50-day moving average of C$17.90 and a two-hundred day moving average of C$17.19. The firm has a market capitalization of C$375.14 million, a PE ratio of -7.44, a P/E/G ratio of 0.30 and a beta of 2.54. AutoCanada has a 52 week low of C$13.75 and a 52 week high of C$26.88.

AutoCanada Company Profile

(

Get Free ReportAutoCanada Inc, through its subsidiaries, operates franchised automobile dealerships and related business. The company offers a range of automotive products and services, including new and used vehicles, vehicle leasing, vehicle parts, vehicle maintenance and collision repair services, and extended service contracts; and vehicle protection, after-market products, and auction services.

See Also

Before you consider AutoCanada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AutoCanada wasn't on the list.

While AutoCanada currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.