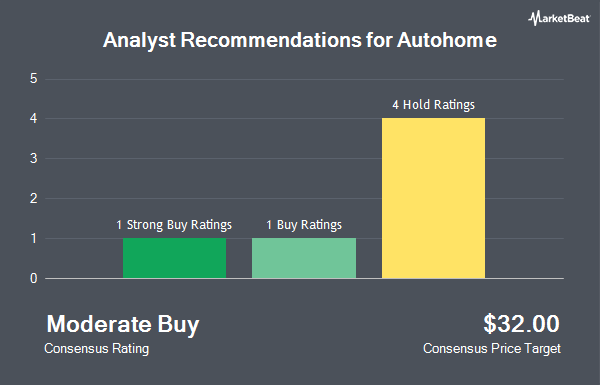

Shares of Autohome Inc. (NYSE:ATHM - Get Free Report) have been given an average rating of "Moderate Buy" by the six brokerages that are currently covering the firm, Marketbeat reports. Four equities research analysts have rated the stock with a hold rating, one has issued a buy rating and one has given a strong buy rating to the company. The average twelve-month target price among brokers that have updated their coverage on the stock in the last year is $32.00.

A number of research firms have recently weighed in on ATHM. The Goldman Sachs Group raised Autohome to a "hold" rating in a report on Wednesday, December 11th. StockNews.com cut shares of Autohome from a "buy" rating to a "hold" rating in a research note on Friday, February 28th. Finally, JPMorgan Chase & Co. upgraded Autohome from a "neutral" rating to an "overweight" rating and upped their target price for the company from $24.00 to $36.00 in a research report on Wednesday, March 12th.

Get Our Latest Report on Autohome

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the business. Robeco Institutional Asset Management B.V. boosted its holdings in shares of Autohome by 140.5% in the fourth quarter. Robeco Institutional Asset Management B.V. now owns 1,718,761 shares of the information services provider's stock worth $44,602,000 after acquiring an additional 1,004,043 shares during the period. Norges Bank bought a new position in Autohome in the 4th quarter worth about $12,195,000. Invesco Ltd. boosted its stake in Autohome by 7.0% in the 4th quarter. Invesco Ltd. now owns 6,388,268 shares of the information services provider's stock worth $165,776,000 after purchasing an additional 415,515 shares during the period. North of South Capital LLP grew its holdings in Autohome by 16.3% during the 4th quarter. North of South Capital LLP now owns 1,965,350 shares of the information services provider's stock valued at $51,001,000 after buying an additional 274,974 shares in the last quarter. Finally, Public Employees Retirement System of Ohio bought a new stake in shares of Autohome during the third quarter valued at about $6,663,000. 63.08% of the stock is currently owned by hedge funds and other institutional investors.

Autohome Price Performance

NYSE ATHM traded up $0.04 during trading on Friday, reaching $27.86. 287,453 shares of the company's stock were exchanged, compared to its average volume of 476,809. The business has a 50 day moving average price of $28.86 and a 200-day moving average price of $28.59. The stock has a market capitalization of $3.37 billion, a P/E ratio of 15.06 and a beta of 0.20. Autohome has a fifty-two week low of $21.89 and a fifty-two week high of $34.70.

Autohome (NYSE:ATHM - Get Free Report) last released its quarterly earnings data on Thursday, February 20th. The information services provider reported $0.50 EPS for the quarter, beating the consensus estimate of $0.49 by $0.01. The firm had revenue of $244.33 million for the quarter, compared to the consensus estimate of $243.26 million. Autohome had a net margin of 23.02% and a return on equity of 7.79%. On average, analysts forecast that Autohome will post 1.84 earnings per share for the current year.

About Autohome

(

Get Free ReportAutohome Inc operates as an online destination for automobile consumers in the People's Republic of China. The company delivers interactive content and tools to automobile consumers through its three websites, autohome.com.cn, che168.com, and ttpai.cn on PCs, mobile devices, mobile applications, and mini apps.

Featured Articles

Before you consider Autohome, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autohome wasn't on the list.

While Autohome currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.