Stephens Inc. AR cut its position in shares of AutoNation, Inc. (NYSE:AN - Free Report) by 63.9% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 12,531 shares of the company's stock after selling 22,166 shares during the quarter. Stephens Inc. AR's holdings in AutoNation were worth $2,128,000 at the end of the most recent reporting period.

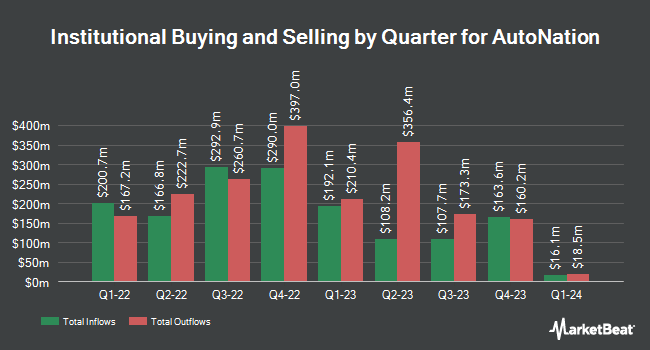

Several other large investors also recently modified their holdings of AN. Fortitude Family Office LLC increased its stake in AutoNation by 581.8% in the fourth quarter. Fortitude Family Office LLC now owns 150 shares of the company's stock valued at $25,000 after purchasing an additional 128 shares in the last quarter. Global X Japan Co. Ltd. increased its stake in AutoNation by 150.8% in the fourth quarter. Global X Japan Co. Ltd. now owns 158 shares of the company's stock valued at $27,000 after purchasing an additional 95 shares in the last quarter. Venturi Wealth Management LLC increased its stake in AutoNation by 403.6% in the third quarter. Venturi Wealth Management LLC now owns 282 shares of the company's stock valued at $50,000 after purchasing an additional 226 shares in the last quarter. GAMMA Investing LLC increased its stake in AutoNation by 54.0% in the third quarter. GAMMA Investing LLC now owns 311 shares of the company's stock valued at $56,000 after purchasing an additional 109 shares in the last quarter. Finally, NBC Securities Inc. increased its stake in AutoNation by 28.1% in the third quarter. NBC Securities Inc. now owns 802 shares of the company's stock valued at $143,000 after purchasing an additional 176 shares in the last quarter. 94.62% of the stock is currently owned by institutional investors and hedge funds.

AutoNation Stock Up 0.4 %

AutoNation stock traded up $0.75 during midday trading on Friday, hitting $192.74. 412,001 shares of the stock were exchanged, compared to its average volume of 387,925. The company has a quick ratio of 0.20, a current ratio of 0.80 and a debt-to-equity ratio of 1.58. The stock has a market capitalization of $7.64 billion, a price-to-earnings ratio of 11.12, a price-to-earnings-growth ratio of 3.71 and a beta of 1.25. AutoNation, Inc. has a 52-week low of $136.35 and a 52-week high of $198.50. The business's 50-day moving average price is $179.72 and its 200-day moving average price is $173.57.

AutoNation (NYSE:AN - Get Free Report) last released its earnings results on Tuesday, February 11th. The company reported $4.97 earnings per share for the quarter, beating analysts' consensus estimates of $4.26 by $0.71. AutoNation had a net margin of 2.74% and a return on equity of 32.01%. On average, research analysts expect that AutoNation, Inc. will post 16.74 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on AN. Guggenheim reaffirmed a "buy" rating on shares of AutoNation in a research note on Wednesday. Wells Fargo & Company lifted their price objective on shares of AutoNation from $170.00 to $194.00 and gave the company an "equal weight" rating in a report on Wednesday. StockNews.com upgraded shares of AutoNation from a "hold" rating to a "buy" rating in a report on Thursday. Stephens lifted their price objective on shares of AutoNation from $195.00 to $200.00 and gave the company an "equal weight" rating in a report on Wednesday. Finally, JPMorgan Chase & Co. reduced their price objective on shares of AutoNation from $190.00 to $180.00 and set a "neutral" rating for the company in a report on Tuesday, November 5th. Three investment analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat.com, AutoNation currently has an average rating of "Moderate Buy" and a consensus target price of $199.71.

Get Our Latest Research Report on AutoNation

About AutoNation

(

Free Report)

AutoNation, Inc, through its subsidiaries, operates as an automotive retailer in the United States. The company operates through three segments: Domestic, Import, and Premium Luxury. It offers a range of automotive products and services, including new and used vehicles; and parts and services, such as automotive repair and maintenance, and wholesale parts and collision services.

Featured Articles

Before you consider AutoNation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AutoNation wasn't on the list.

While AutoNation currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.