Avantax Advisory Services Inc. lifted its position in shares of GameStop Corp. (NYSE:GME - Free Report) by 91.4% during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 23,703 shares of the company's stock after purchasing an additional 11,322 shares during the quarter. Avantax Advisory Services Inc.'s holdings in GameStop were worth $743,000 as of its most recent filing with the Securities & Exchange Commission.

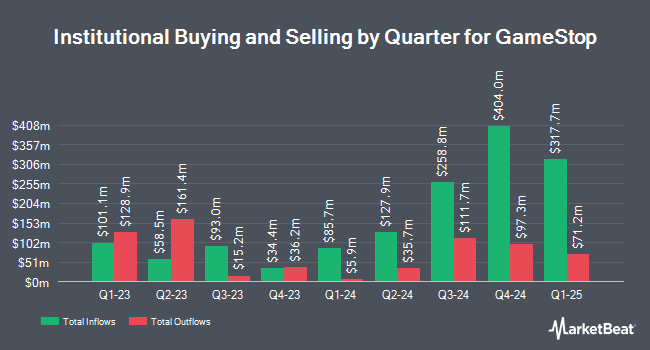

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. CIBC Asset Management Inc lifted its holdings in shares of GameStop by 5.7% during the fourth quarter. CIBC Asset Management Inc now owns 9,381 shares of the company's stock valued at $294,000 after purchasing an additional 502 shares during the last quarter. Christensen King & Associates Investment Services Inc. raised its stake in GameStop by 1.9% during the fourth quarter. Christensen King & Associates Investment Services Inc. now owns 27,397 shares of the company's stock valued at $853,000 after buying an additional 518 shares during the last quarter. Crossmark Global Holdings Inc. raised its stake in GameStop by 2.9% during the fourth quarter. Crossmark Global Holdings Inc. now owns 18,338 shares of the company's stock valued at $575,000 after buying an additional 523 shares during the last quarter. Securian Asset Management Inc. boosted its holdings in GameStop by 1.8% in the fourth quarter. Securian Asset Management Inc. now owns 30,717 shares of the company's stock worth $963,000 after acquiring an additional 557 shares in the last quarter. Finally, Fifth Third Bancorp grew its stake in shares of GameStop by 11.1% in the fourth quarter. Fifth Third Bancorp now owns 5,648 shares of the company's stock worth $177,000 after acquiring an additional 566 shares during the last quarter. 29.21% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In other GameStop news, insider Daniel William Moore sold 895 shares of the business's stock in a transaction on Friday, January 3rd. The shares were sold at an average price of $31.07, for a total transaction of $27,807.65. Following the completion of the sale, the insider now directly owns 31,385 shares in the company, valued at approximately $975,131.95. The trade was a 2.77 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, General Counsel Mark Haymond Robinson sold 1,577 shares of the firm's stock in a transaction on Friday, January 3rd. The stock was sold at an average price of $31.07, for a total value of $48,997.39. Following the completion of the transaction, the general counsel now owns 42,350 shares in the company, valued at approximately $1,315,814.50. This trade represents a 3.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 12.28% of the company's stock.

GameStop Stock Performance

Shares of GME traded down $0.24 on Tuesday, hitting $25.37. 8,491,373 shares of the stock traded hands, compared to its average volume of 19,395,874. The company has a market capitalization of $11.34 billion, a PE ratio of 140.95 and a beta of -0.29. GameStop Corp. has a one year low of $9.95 and a one year high of $64.83. The business has a 50 day simple moving average of $25.63 and a 200 day simple moving average of $25.66.

GameStop (NYSE:GME - Get Free Report) last posted its earnings results on Tuesday, March 25th. The company reported $0.30 EPS for the quarter, topping analysts' consensus estimates of $0.09 by $0.21. GameStop had a return on equity of 2.11% and a net margin of 1.45%. The business had revenue of $1.28 billion during the quarter, compared to analyst estimates of $1.48 billion. During the same quarter last year, the company earned $0.21 EPS. The company's quarterly revenue was down 28.5% compared to the same quarter last year. On average, equities analysts expect that GameStop Corp. will post 0.08 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Separately, Wedbush reiterated an "underperform" rating and issued a $10.00 price target on shares of GameStop in a research note on Monday.

View Our Latest Report on GME

About GameStop

(

Free Report)

GameStop Corp., a specialty retailer, provides games and entertainment products through its stores and ecommerce platforms in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, and virtual reality products; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads.

Featured Articles

Before you consider GameStop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GameStop wasn't on the list.

While GameStop currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.