Avantax Advisory Services Inc. increased its position in KKR & Co. Inc. (NYSE:KKR - Free Report) by 23.2% during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 23,626 shares of the asset manager's stock after acquiring an additional 4,447 shares during the period. Avantax Advisory Services Inc.'s holdings in KKR & Co. Inc. were worth $3,494,000 as of its most recent SEC filing.

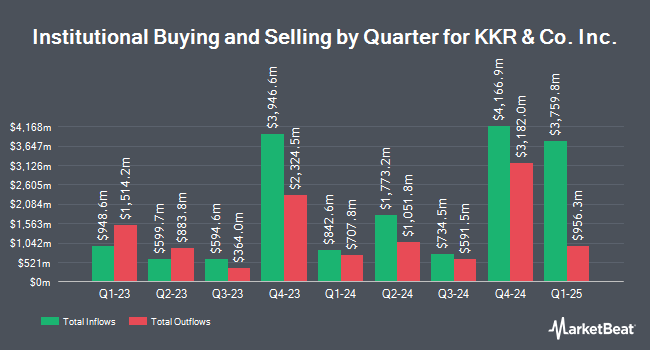

A number of other institutional investors and hedge funds have also modified their holdings of KKR. Proficio Capital Partners LLC grew its holdings in shares of KKR & Co. Inc. by 4,981.9% in the 4th quarter. Proficio Capital Partners LLC now owns 1,573,046 shares of the asset manager's stock worth $232,669,000 after acquiring an additional 1,542,092 shares during the period. Raymond James Financial Inc. acquired a new stake in shares of KKR & Co. Inc. in the 4th quarter worth approximately $218,918,000. Roberts Foundation acquired a new stake in shares of KKR & Co. Inc. in the 4th quarter worth approximately $147,910,000. Amundi grew its holdings in shares of KKR & Co. Inc. by 51.8% in the 4th quarter. Amundi now owns 2,136,126 shares of the asset manager's stock worth $316,659,000 after acquiring an additional 728,515 shares during the period. Finally, Allspring Global Investments Holdings LLC grew its holdings in shares of KKR & Co. Inc. by 92.5% in the 4th quarter. Allspring Global Investments Holdings LLC now owns 1,047,382 shares of the asset manager's stock worth $156,199,000 after acquiring an additional 503,365 shares during the period. Institutional investors and hedge funds own 76.26% of the company's stock.

KKR & Co. Inc. Trading Up 4.5 %

Shares of KKR opened at $113.54 on Friday. The company has a current ratio of 0.07, a quick ratio of 0.07 and a debt-to-equity ratio of 0.82. The firm has a market capitalization of $100.85 billion, a P/E ratio of 34.10, a price-to-earnings-growth ratio of 1.00 and a beta of 1.72. The stock's fifty day simple moving average is $142.16 and its 200 day simple moving average is $141.68. KKR & Co. Inc. has a twelve month low of $91.92 and a twelve month high of $170.40.

KKR & Co. Inc. Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, February 28th. Investors of record on Friday, February 14th were given a $0.175 dividend. This represents a $0.70 annualized dividend and a dividend yield of 0.62%. The ex-dividend date was Friday, February 14th. KKR & Co. Inc.'s dividend payout ratio (DPR) is currently 21.02%.

Insider Buying and Selling

In related news, major shareholder Genetic Disorder L.P. Kkr sold 6,000,000 shares of the stock in a transaction on Wednesday, March 5th. The stock was sold at an average price of $32.96, for a total value of $197,760,000.00. Following the transaction, the insider now directly owns 19,260,971 shares of the company's stock, valued at approximately $634,841,604.16. This trade represents a 23.75 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Corporate insiders own 39.34% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently weighed in on KKR shares. Morgan Stanley lowered their price target on KKR & Co. Inc. from $157.00 to $156.00 and set an "equal weight" rating on the stock in a report on Thursday, February 6th. Oppenheimer increased their target price on KKR & Co. Inc. from $153.00 to $175.00 and gave the company an "outperform" rating in a report on Thursday, December 12th. The Goldman Sachs Group increased their target price on KKR & Co. Inc. from $160.00 to $177.00 and gave the company a "buy" rating in a report on Tuesday, November 19th. Barclays lowered their target price on KKR & Co. Inc. from $185.00 to $181.00 and set an "overweight" rating on the stock in a report on Wednesday, February 5th. Finally, Keefe, Bruyette & Woods lowered their target price on KKR & Co. Inc. from $170.00 to $168.00 and set an "outperform" rating on the stock in a report on Monday, January 13th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating, eleven have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $161.43.

Get Our Latest Analysis on KKR

KKR & Co. Inc. Company Profile

(

Free Report)

KKR & Co, Inc operates as an investment firm. It offers alternative asset management as well as capital markets and insurance solutions. The firm's business segments include Asset Management and Insurance Business. The Asset Management segment engages in providing private equity, real assets, credit and liquid strategies, capital markets, and principal activities.

Featured Articles

Want to see what other hedge funds are holding KKR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for KKR & Co. Inc. (NYSE:KKR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider KKR & Co. Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KKR & Co. Inc. wasn't on the list.

While KKR & Co. Inc. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.