Avanza Fonder AB purchased a new position in shares of Brookfield Co. (NYSE:BN - Free Report) during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 83,961 shares of the company's stock, valued at approximately $4,824,000.

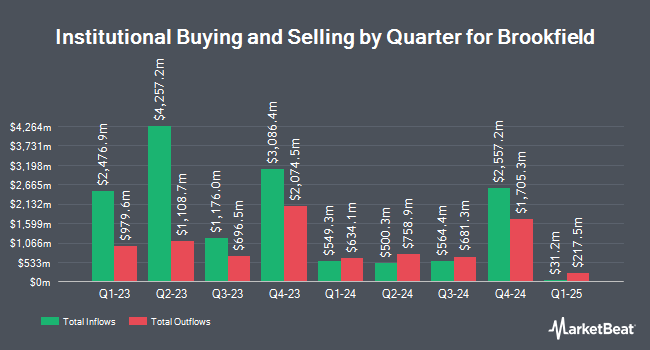

Other hedge funds have also recently added to or reduced their stakes in the company. American Century Companies Inc. grew its holdings in shares of Brookfield by 11.1% during the 2nd quarter. American Century Companies Inc. now owns 63,788 shares of the company's stock valued at $2,653,000 after purchasing an additional 6,389 shares during the last quarter. Mercer Global Advisors Inc. ADV grew its stake in shares of Brookfield by 21.6% during the second quarter. Mercer Global Advisors Inc. ADV now owns 29,577 shares of the company's stock worth $1,229,000 after buying an additional 5,248 shares during the last quarter. Vanguard Personalized Indexing Management LLC increased its holdings in shares of Brookfield by 20.5% during the second quarter. Vanguard Personalized Indexing Management LLC now owns 37,599 shares of the company's stock worth $1,562,000 after buying an additional 6,394 shares in the last quarter. Hsbc Holdings PLC grew its position in Brookfield by 124.1% during the 2nd quarter. Hsbc Holdings PLC now owns 1,262,139 shares of the company's stock worth $52,246,000 after acquiring an additional 698,810 shares during the last quarter. Finally, Bristol Gate Capital Partners Inc. increased its holdings in Brookfield by 12.6% in the 2nd quarter. Bristol Gate Capital Partners Inc. now owns 26,343 shares of the company's stock worth $1,095,000 after purchasing an additional 2,958 shares in the last quarter. Institutional investors own 61.60% of the company's stock.

Brookfield Trading Up 1.0 %

Shares of BN traded up $0.58 during trading hours on Friday, hitting $58.16. 1,406,514 shares of the stock were exchanged, compared to its average volume of 1,766,969. The firm has a market capitalization of $87.73 billion, a P/E ratio of 123.75 and a beta of 1.56. The company has a debt-to-equity ratio of 1.40, a current ratio of 1.17 and a quick ratio of 1.03. Brookfield Co. has a fifty-two week low of $38.18 and a fifty-two week high of $62.44. The business has a 50-day moving average of $58.13 and a 200-day moving average of $52.50.

Brookfield Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, December 31st. Stockholders of record on Monday, December 16th were given a $0.08 dividend. This represents a $0.32 annualized dividend and a dividend yield of 0.55%. The ex-dividend date was Monday, December 16th. Brookfield's dividend payout ratio (DPR) is presently 68.09%.

Wall Street Analyst Weigh In

Several analysts have recently weighed in on BN shares. Scotiabank boosted their price target on Brookfield from $65.00 to $69.00 and gave the stock a "sector outperform" rating in a report on Friday, November 15th. BMO Capital Markets reaffirmed an "outperform" rating and set a $62.00 price target (up previously from $50.00) on shares of Brookfield in a research note on Friday, November 15th. Two equities research analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $55.31.

View Our Latest Analysis on BN

Brookfield Profile

(

Free Report)

Brookfield Corporation is an alternative asset manager and REIT/Real Estate Investment Manager firm focuses on real estate, renewable power, infrastructure and venture capital and private equity assets. It manages a range of public and private investment products and services for institutional and retail clients.

Further Reading

Before you consider Brookfield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield wasn't on the list.

While Brookfield currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.