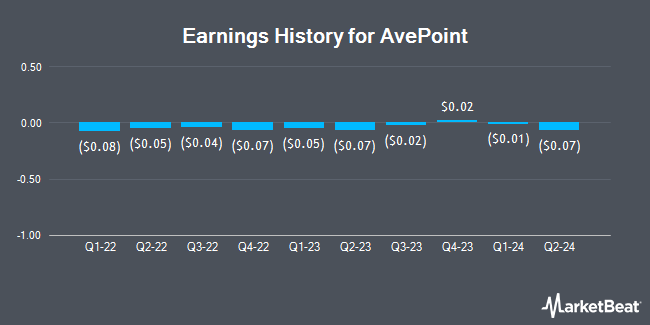

AvePoint (NASDAQ:AVPT - Get Free Report) announced its earnings results on Thursday. The company reported ($0.09) EPS for the quarter, missing the consensus estimate of $0.05 by ($0.14), Zacks reports. The firm had revenue of $89.18 million for the quarter, compared to the consensus estimate of $88.06 million. AvePoint had a negative return on equity of 3.16% and a negative net margin of 2.36%. AvePoint updated its FY 2025 guidance to EPS and its Q1 2025 guidance to EPS.

AvePoint Trading Up 0.6 %

NASDAQ:AVPT traded up $0.09 on Monday, hitting $15.03. 2,880,154 shares of the company's stock traded hands, compared to its average volume of 1,406,190. The firm has a 50-day moving average price of $17.80 and a 200-day moving average price of $15.18. AvePoint has a 1 year low of $7.08 and a 1 year high of $19.90. The company has a market cap of $2.81 billion, a PE ratio of -300.54 and a beta of 1.02.

Analyst Ratings Changes

Several research firms have recently weighed in on AVPT. Citigroup raised their price objective on shares of AvePoint from $17.00 to $18.00 and gave the company a "neutral" rating in a research report on Friday, January 17th. The Goldman Sachs Group lifted their target price on AvePoint from $7.50 to $15.00 and gave the stock a "neutral" rating in a report on Tuesday, November 12th.

View Our Latest Stock Report on AvePoint

AvePoint Company Profile

(

Get Free Report)

AvePoint, Inc provides cloud-native data management software platform in North America, Europe, Middle East, Africa, and Asia Pacific. It also offers software-as-a-service solutions and productivity applications. The company offers modularity and cloud services architecture to address critical challenges and the management of data to organizations that leverage third-party cloud vendors, including Microsoft, Salesforce, Google, AWS, Box, DropBox, and others; license and support; and maintenance services.

Featured Articles

Before you consider AvePoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AvePoint wasn't on the list.

While AvePoint currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.