Aviance Capital Partners LLC bought a new position in shares of Spotify Technology S.A. (NYSE:SPOT - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm bought 7,000 shares of the company's stock, valued at approximately $2,580,000.

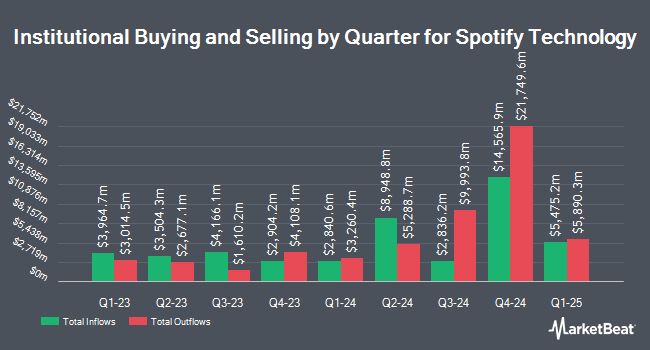

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. WCM Investment Management LLC boosted its stake in shares of Spotify Technology by 18.5% in the 3rd quarter. WCM Investment Management LLC now owns 3,873,625 shares of the company's stock worth $1,430,142,000 after buying an additional 605,755 shares during the last quarter. Bamco Inc. NY grew its holdings in shares of Spotify Technology by 28.3% during the 1st quarter. Bamco Inc. NY now owns 864,584 shares of the company's stock valued at $228,164,000 after purchasing an additional 190,931 shares during the last quarter. Swedbank AB lifted its position in Spotify Technology by 13.2% in the second quarter. Swedbank AB now owns 852,526 shares of the company's stock valued at $267,514,000 after purchasing an additional 99,730 shares during the last quarter. Perpetual Ltd raised its position in Spotify Technology by 24.3% during the 3rd quarter. Perpetual Ltd now owns 759,681 shares of the company's stock valued at $279,965,000 after purchasing an additional 148,431 shares during the last quarter. Finally, D1 Capital Partners L.P. grew its holdings in shares of Spotify Technology by 5.6% during the 2nd quarter. D1 Capital Partners L.P. now owns 680,061 shares of the company's stock worth $213,396,000 after acquiring an additional 36,000 shares during the period. 84.09% of the stock is owned by institutional investors and hedge funds.

Spotify Technology Trading Up 2.1 %

Shares of SPOT traded up $9.54 during mid-day trading on Tuesday, reaching $463.90. The company had a trading volume of 2,797,657 shares, compared to its average volume of 1,944,430. Spotify Technology S.A. has a fifty-two week low of $175.00 and a fifty-two week high of $489.69. The stock has a market cap of $92.34 billion, a price-to-earnings ratio of 123.42 and a beta of 1.56. The firm has a fifty day simple moving average of $380.76 and a 200-day simple moving average of $339.74.

Spotify Technology (NYSE:SPOT - Get Free Report) last issued its earnings results on Tuesday, November 12th. The company reported $1.45 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.75 by ($0.30). Spotify Technology had a return on equity of 19.07% and a net margin of 4.66%. The firm had revenue of $3.99 billion for the quarter, compared to analysts' expectations of $4.03 billion. During the same quarter in the previous year, the firm posted $0.36 EPS. The firm's revenue for the quarter was up 18.8% compared to the same quarter last year. As a group, equities analysts predict that Spotify Technology S.A. will post 6.09 EPS for the current fiscal year.

Analysts Set New Price Targets

Several brokerages have recently weighed in on SPOT. TD Cowen lifted their price target on shares of Spotify Technology from $356.00 to $416.00 and gave the stock a "hold" rating in a research note on Wednesday, November 13th. Barclays increased their price objective on shares of Spotify Technology from $385.00 to $475.00 and gave the company an "overweight" rating in a report on Wednesday, November 13th. Guggenheim lifted their price objective on shares of Spotify Technology from $400.00 to $420.00 and gave the stock a "buy" rating in a research note on Wednesday, July 24th. Wells Fargo & Company lifted their target price on Spotify Technology from $470.00 to $520.00 and gave the stock an "overweight" rating in a report on Wednesday, November 13th. Finally, Pivotal Research upped their target price on Spotify Technology from $510.00 to $565.00 and gave the company a "buy" rating in a research note on Wednesday, November 13th. One investment analyst has rated the stock with a sell rating, five have assigned a hold rating and twenty-three have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $421.69.

Check Out Our Latest Stock Analysis on SPOT

Spotify Technology Profile

(

Free Report)

Spotify Technology SA, together with its subsidiaries, provides audio streaming subscription services worldwide. It operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers.

Featured Articles

Before you consider Spotify Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spotify Technology wasn't on the list.

While Spotify Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.