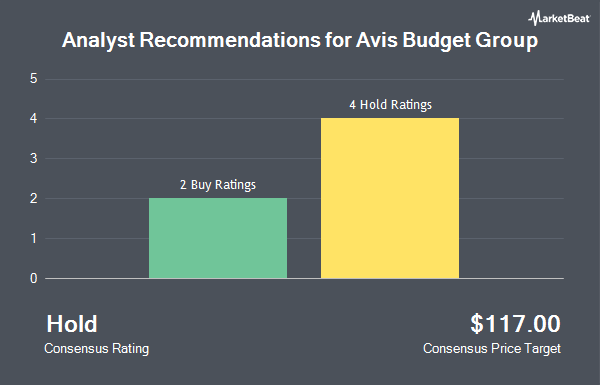

Avis Budget Group, Inc. (NASDAQ:CAR - Get Free Report) has been given an average rating of "Moderate Buy" by the eight brokerages that are currently covering the firm, Marketbeat.com reports. Four equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average 1-year price target among brokerages that have updated their coverage on the stock in the last year is $133.13.

A number of research analysts have issued reports on CAR shares. StockNews.com raised Avis Budget Group from a "sell" rating to a "hold" rating in a research note on Monday, November 4th. The Goldman Sachs Group decreased their target price on Avis Budget Group from $105.00 to $90.00 and set a "neutral" rating for the company in a research note on Friday, October 11th. Northcoast Research cut Avis Budget Group from a "buy" rating to a "neutral" rating in a research note on Monday, November 18th. Susquehanna decreased their target price on Avis Budget Group from $120.00 to $95.00 and set a "neutral" rating for the company in a research note on Friday, August 9th. Finally, Deutsche Bank Aktiengesellschaft decreased their target price on Avis Budget Group from $145.00 to $143.00 and set a "buy" rating for the company in a research note on Tuesday, November 5th.

Read Our Latest Report on Avis Budget Group

Avis Budget Group Price Performance

Shares of NASDAQ CAR traded up $0.23 during midday trading on Friday, hitting $109.07. The stock had a trading volume of 227,208 shares, compared to its average volume of 717,044. The company's 50-day simple moving average is $91.02 and its 200 day simple moving average is $95.67. The firm has a market cap of $3.83 billion, a P/E ratio of 9.96 and a beta of 2.14. Avis Budget Group has a fifty-two week low of $65.73 and a fifty-two week high of $204.77.

Avis Budget Group (NASDAQ:CAR - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The business services provider reported $6.65 earnings per share (EPS) for the quarter, missing the consensus estimate of $8.55 by ($1.90). Avis Budget Group had a negative return on equity of 101.41% and a net margin of 3.34%. The company had revenue of $3.48 billion during the quarter, compared to the consensus estimate of $3.53 billion. During the same quarter in the prior year, the business earned $16.78 earnings per share. The firm's revenue for the quarter was down 2.4% on a year-over-year basis. Equities analysts expect that Avis Budget Group will post 3.59 EPS for the current fiscal year.

Hedge Funds Weigh In On Avis Budget Group

Large investors have recently made changes to their positions in the company. International Assets Investment Management LLC grew its position in Avis Budget Group by 19,203.5% during the third quarter. International Assets Investment Management LLC now owns 481,044 shares of the business services provider's stock worth $421,350,000 after buying an additional 478,552 shares in the last quarter. Rubric Capital Management LP grew its position in Avis Budget Group by 220.9% during the second quarter. Rubric Capital Management LP now owns 690,273 shares of the business services provider's stock worth $72,147,000 after buying an additional 475,181 shares in the last quarter. Assenagon Asset Management S.A. acquired a new stake in Avis Budget Group during the second quarter worth approximately $19,978,000. FMR LLC grew its position in Avis Budget Group by 4.0% during the third quarter. FMR LLC now owns 3,354,546 shares of the business services provider's stock worth $293,825,000 after buying an additional 129,805 shares in the last quarter. Finally, Toronto Dominion Bank acquired a new stake in shares of Avis Budget Group in the 2nd quarter valued at $10,452,000. Institutional investors own 96.35% of the company's stock.

About Avis Budget Group

(

Get Free ReportAvis Budget Group, Inc, together with its subsidiaries, provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia. It operates the Avis brand, that offers vehicle rental and other mobility solutions to the premium commercial and leisure segments of the travel industry; and the Zipcar brand, a car sharing network, as well as the Budget brand, a supplier of vehicle rental and other mobility solutions focused primarily on more value-conscious customers comprising Budget car rental, and Budget Truck, a local, and one-way truck and cargo van rental businesses with a fleet of approximately 19,000 vehicles, which are rented through a network of dealer-operated and company-operated locations that serve the light commercial and consumer sectors in the continental United States.

See Also

Before you consider Avis Budget Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avis Budget Group wasn't on the list.

While Avis Budget Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.