Aviso Wealth Management increased its stake in MicroStrategy Incorporated (NASDAQ:MSTR - Free Report) by 897.7% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 13,000 shares of the software maker's stock after acquiring an additional 11,697 shares during the quarter. MicroStrategy comprises 1.2% of Aviso Wealth Management's holdings, making the stock its 18th largest holding. Aviso Wealth Management's holdings in MicroStrategy were worth $2,192,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

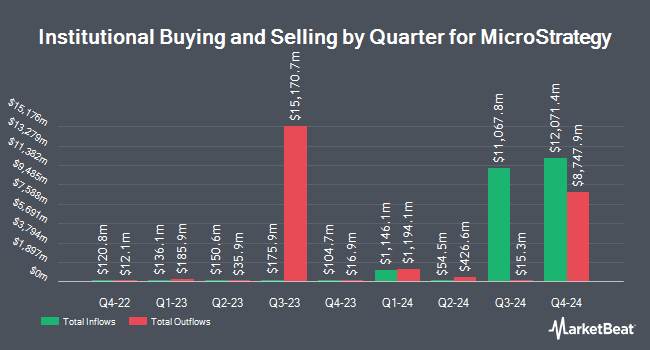

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Allspring Global Investments Holdings LLC purchased a new stake in MicroStrategy in the first quarter worth $58,000. Sei Investments Co. increased its stake in MicroStrategy by 36.3% in the 1st quarter. Sei Investments Co. now owns 575 shares of the software maker's stock worth $980,000 after purchasing an additional 153 shares during the period. Vanguard Group Inc. increased its position in MicroStrategy by 34.8% during the 1st quarter. Vanguard Group Inc. now owns 1,553,048 shares of the software maker's stock valued at $2,647,263,000 after purchasing an additional 401,071 shares during the period. Edgestream Partners L.P. bought a new position in MicroStrategy during the 1st quarter valued at approximately $309,000. Finally, Ameritas Investment Partners Inc. lifted its stake in MicroStrategy by 19.8% during the 1st quarter. Ameritas Investment Partners Inc. now owns 1,482 shares of the software maker's stock valued at $2,526,000 after acquiring an additional 245 shares during the period. 72.03% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

MSTR has been the subject of several recent analyst reports. Sanford C. Bernstein dropped their price target on MicroStrategy from $2,890.00 to $290.00 and set an "outperform" rating for the company in a research note on Wednesday, October 9th. TD Cowen boosted their price target on shares of MicroStrategy from $200.00 to $300.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Cantor Fitzgerald started coverage on MicroStrategy in a report on Wednesday, August 21st. They issued an "overweight" rating and a $194.00 target price on the stock. Barclays increased their target price on MicroStrategy from $225.00 to $275.00 and gave the company an "overweight" rating in a research report on Monday, November 4th. Finally, BTIG Research boosted their target price on shares of MicroStrategy from $180.00 to $240.00 and gave the stock a "buy" rating in a report on Monday, October 21st. One investment analyst has rated the stock with a sell rating and eight have assigned a buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $271.13.

Get Our Latest Stock Analysis on MicroStrategy

Insider Buying and Selling

In other news, CFO Andrew Kang sold 5,700 shares of MicroStrategy stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $257.15, for a total value of $1,465,755.00. Following the sale, the chief financial officer now directly owns 12,080 shares in the company, valued at $3,106,372. This trade represents a 32.06 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CAO Jeanine Montgomery sold 56,250 shares of the business's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $257.41, for a total transaction of $14,479,312.50. Following the transaction, the chief accounting officer now owns 5,670 shares in the company, valued at approximately $1,459,514.70. The trade was a 90.84 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 134,954 shares of company stock valued at $30,553,037. Company insiders own 13.18% of the company's stock.

MicroStrategy Stock Up 9.0 %

MSTR stock traded up $30.54 during mid-day trading on Monday, hitting $371.19. 23,215,701 shares of the company were exchanged, compared to its average volume of 17,197,896. The company has a current ratio of 0.65, a quick ratio of 0.65 and a debt-to-equity ratio of 1.12. The firm has a fifty day simple moving average of $204.83 and a 200 day simple moving average of $166.15. The company has a market capitalization of $75.22 billion, a PE ratio of -174.21 and a beta of 3.05. MicroStrategy Incorporated has a twelve month low of $43.87 and a twelve month high of $383.40.

MicroStrategy (NASDAQ:MSTR - Get Free Report) last released its earnings results on Wednesday, October 30th. The software maker reported ($1.56) earnings per share for the quarter, missing the consensus estimate of ($0.12) by ($1.44). MicroStrategy had a negative net margin of 87.05% and a negative return on equity of 17.31%. The business had revenue of $116.07 million for the quarter, compared to analysts' expectations of $121.45 million. During the same period last year, the firm earned ($8.98) EPS. The company's revenue was down 10.3% compared to the same quarter last year.

MicroStrategy Company Profile

(

Free Report)

MicroStrategy Incorporated provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally. It offers MicroStrategy ONE, which provides non-technical users with the ability to directly access novel and actionable insights for decision-making; and MicroStrategy Cloud for Government service, which offers always-on threat monitoring that meets the rigorous technical and regulatory needs of governments and financial institutions.

See Also

Before you consider MicroStrategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MicroStrategy wasn't on the list.

While MicroStrategy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.