Aviva PLC lifted its holdings in shares of Eversource Energy (NYSE:ES - Free Report) by 16.3% during the fourth quarter, according to its most recent disclosure with the SEC. The fund owned 704,623 shares of the utilities provider's stock after acquiring an additional 98,722 shares during the period. Aviva PLC owned approximately 0.19% of Eversource Energy worth $40,466,000 at the end of the most recent quarter.

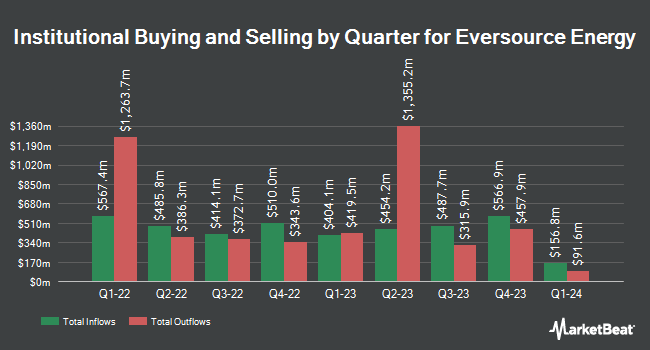

Several other hedge funds and other institutional investors have also recently modified their holdings of ES. Wellington Management Group LLP increased its position in shares of Eversource Energy by 38.6% in the 4th quarter. Wellington Management Group LLP now owns 16,470,356 shares of the utilities provider's stock valued at $945,893,000 after acquiring an additional 4,585,232 shares during the period. Norges Bank acquired a new stake in shares of Eversource Energy during the fourth quarter worth about $188,838,000. Amundi boosted its position in Eversource Energy by 32.2% in the fourth quarter. Amundi now owns 6,482,546 shares of the utilities provider's stock valued at $367,691,000 after buying an additional 1,579,818 shares during the last quarter. Vanguard Group Inc. increased its holdings in Eversource Energy by 3.2% in the 4th quarter. Vanguard Group Inc. now owns 44,609,716 shares of the utilities provider's stock worth $2,561,936,000 after buying an additional 1,387,072 shares during the period. Finally, Magellan Asset Management Ltd raised its position in Eversource Energy by 15.9% during the 4th quarter. Magellan Asset Management Ltd now owns 6,474,477 shares of the utilities provider's stock worth $371,829,000 after buying an additional 890,514 shares during the last quarter. 79.99% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at Eversource Energy

In other news, insider Frederica M. Williams sold 3,092 shares of Eversource Energy stock in a transaction that occurred on Wednesday, February 19th. The shares were sold at an average price of $62.26, for a total transaction of $192,507.92. Following the sale, the insider now owns 22,671 shares of the company's stock, valued at approximately $1,411,496.46. The trade was a 12.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, VP Jay S. Buth sold 980 shares of the stock in a transaction that occurred on Friday, February 21st. The stock was sold at an average price of $62.99, for a total value of $61,730.20. Following the completion of the transaction, the vice president now owns 24,374 shares of the company's stock, valued at $1,535,318.26. The trade was a 3.87 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.41% of the stock is owned by company insiders.

Eversource Energy Price Performance

ES stock traded up $0.09 during midday trading on Friday, reaching $55.78. The stock had a trading volume of 722,130 shares, compared to its average volume of 2,313,105. Eversource Energy has a 52-week low of $52.28 and a 52-week high of $69.01. The company has a current ratio of 0.76, a quick ratio of 0.76 and a debt-to-equity ratio of 1.71. The company's fifty day simple moving average is $60.45 and its 200 day simple moving average is $60.91. The company has a market cap of $20.48 billion, a price-to-earnings ratio of 24.12, a price-to-earnings-growth ratio of 2.35 and a beta of 0.58.

Eversource Energy (NYSE:ES - Get Free Report) last posted its quarterly earnings results on Tuesday, February 11th. The utilities provider reported $1.01 earnings per share for the quarter, topping analysts' consensus estimates of $1.00 by $0.01. Eversource Energy had a net margin of 6.82% and a return on equity of 10.99%. As a group, sell-side analysts predict that Eversource Energy will post 4.75 earnings per share for the current fiscal year.

Eversource Energy Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, March 31st. Shareholders of record on Tuesday, March 4th were paid a dividend of $0.7525 per share. The ex-dividend date was Tuesday, March 4th. This represents a $3.01 dividend on an annualized basis and a yield of 5.40%. This is a positive change from Eversource Energy's previous quarterly dividend of $0.72. Eversource Energy's payout ratio is 130.30%.

Wall Street Analysts Forecast Growth

ES has been the topic of several recent research reports. Guggenheim reaffirmed a "buy" rating on shares of Eversource Energy in a report on Monday, February 10th. Barclays dropped their target price on Eversource Energy from $72.00 to $69.00 and set an "equal weight" rating on the stock in a report on Wednesday, January 22nd. StockNews.com downgraded Eversource Energy from a "hold" rating to a "sell" rating in a report on Sunday, April 6th. Scotiabank cut their target price on shares of Eversource Energy from $56.00 to $55.00 and set a "sector underperform" rating for the company in a report on Thursday, February 13th. Finally, Wells Fargo & Company lowered their price target on shares of Eversource Energy from $79.00 to $75.00 and set an "overweight" rating on the stock in a report on Thursday, February 13th. Four research analysts have rated the stock with a sell rating, four have assigned a hold rating and three have given a buy rating to the stock. According to MarketBeat, the stock has an average rating of "Hold" and a consensus price target of $65.78.

Get Our Latest Research Report on Eversource Energy

About Eversource Energy

(

Free Report)

Eversource Energy, a public utility holding company, engages in the energy delivery business. The company operates through Electric Distribution, Electric Transmission, Natural Gas Distribution, and Water Distribution segments. It is involved in the transmission and distribution of electricity; solar power facilities; and distribution of natural gas.

Read More

Before you consider Eversource Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eversource Energy wasn't on the list.

While Eversource Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report