Aviva PLC raised its position in Coca-Cola Europacific Partners PLC (NASDAQ:CCEP - Free Report) by 4.0% in the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 276,790 shares of the company's stock after acquiring an additional 10,720 shares during the period. Aviva PLC owned approximately 0.06% of Coca-Cola Europacific Partners worth $21,260,000 as of its most recent filing with the Securities & Exchange Commission.

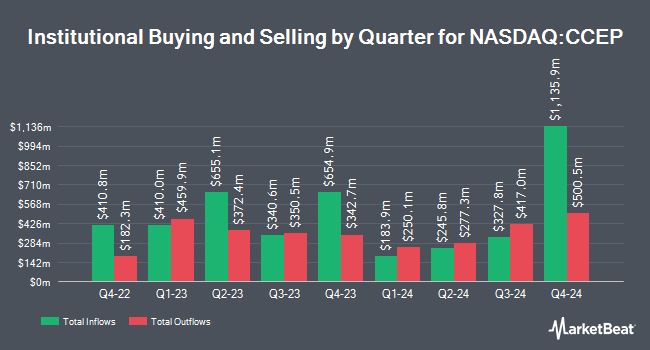

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. SBI Securities Co. Ltd. purchased a new stake in Coca-Cola Europacific Partners during the 4th quarter worth approximately $27,000. MassMutual Private Wealth & Trust FSB increased its holdings in Coca-Cola Europacific Partners by 85.3% in the fourth quarter. MassMutual Private Wealth & Trust FSB now owns 428 shares of the company's stock valued at $33,000 after buying an additional 197 shares in the last quarter. Summit Securities Group LLC purchased a new position in shares of Coca-Cola Europacific Partners in the 4th quarter valued at about $34,000. Whipplewood Advisors LLC purchased a new stake in shares of Coca-Cola Europacific Partners in the fourth quarter valued at approximately $52,000. Finally, Blue Trust Inc. increased its holdings in Coca-Cola Europacific Partners by 16.2% in the 4th quarter. Blue Trust Inc. now owns 1,189 shares of the company's stock worth $94,000 after acquiring an additional 166 shares in the last quarter. 31.35% of the stock is currently owned by hedge funds and other institutional investors.

Coca-Cola Europacific Partners Stock Up 1.9 %

NASDAQ CCEP traded up $1.61 during trading hours on Friday, hitting $86.60. 2,756,288 shares of the company were exchanged, compared to its average volume of 1,688,807. The company has a 50 day moving average of $84.58 and a two-hundred day moving average of $79.73. The company has a quick ratio of 0.63, a current ratio of 0.81 and a debt-to-equity ratio of 1.11. The firm has a market cap of $39.92 billion, a price-to-earnings ratio of 17.82, a PEG ratio of 4.89 and a beta of 0.73. Coca-Cola Europacific Partners PLC has a 52-week low of $65.94 and a 52-week high of $91.29.

Wall Street Analyst Weigh In

Several research firms recently commented on CCEP. Evercore ISI increased their price objective on Coca-Cola Europacific Partners from $82.00 to $90.00 and gave the company an "outperform" rating in a research note on Tuesday, February 18th. Kepler Capital Markets lowered shares of Coca-Cola Europacific Partners from a "hold" rating to a "reduce" rating in a research report on Tuesday, February 25th. Finally, Barclays boosted their price objective on shares of Coca-Cola Europacific Partners from $99.00 to $100.00 and gave the company an "overweight" rating in a report on Friday. One equities research analyst has rated the stock with a sell rating, four have given a hold rating, six have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $87.13.

View Our Latest Analysis on Coca-Cola Europacific Partners

Coca-Cola Europacific Partners Profile

(

Free Report)

Coca-Cola Europacific Partners PLC, together with its subsidiaries, produces, distributes, and sells a range of non-alcoholic ready to drink beverages. It offers flavours, mixers, and energy drinks; soft drinks, waters, enhanced water, and isotonic drinks; and ready-to-drink tea and coffee, juices, and other drinks.

Featured Articles

Before you consider Coca-Cola Europacific Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola Europacific Partners wasn't on the list.

While Coca-Cola Europacific Partners currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.