Primecap Management Co. CA lowered its position in Axcelis Technologies, Inc. (NASDAQ:ACLS - Free Report) by 1.6% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 974,436 shares of the semiconductor company's stock after selling 15,360 shares during the period. Primecap Management Co. CA owned 2.99% of Axcelis Technologies worth $102,170,000 as of its most recent SEC filing.

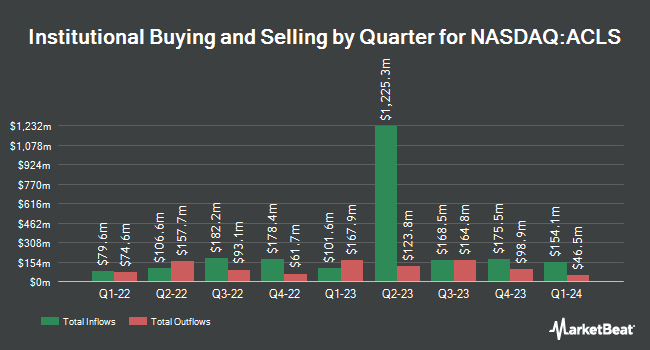

A number of other hedge funds have also recently added to or reduced their stakes in ACLS. Boston Trust Walden Corp bought a new position in shares of Axcelis Technologies in the 3rd quarter worth $53,099,000. Reinhart Partners LLC. grew its holdings in shares of Axcelis Technologies by 64.1% during the third quarter. Reinhart Partners LLC. now owns 687,608 shares of the semiconductor company's stock valued at $72,096,000 after buying an additional 268,560 shares during the last quarter. Vanguard Group Inc. increased its position in shares of Axcelis Technologies by 6.5% during the first quarter. Vanguard Group Inc. now owns 4,304,516 shares of the semiconductor company's stock worth $480,040,000 after acquiring an additional 263,604 shares in the last quarter. Granite Investment Partners LLC acquired a new stake in shares of Axcelis Technologies in the 2nd quarter worth about $27,801,000. Finally, Boston Partners acquired a new stake in shares of Axcelis Technologies in the 1st quarter worth about $20,819,000. Institutional investors and hedge funds own 89.98% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have issued reports on the company. Benchmark downgraded Axcelis Technologies from a "buy" rating to a "hold" rating in a research note on Friday, November 8th. Needham & Company LLC restated a "hold" rating on shares of Axcelis Technologies in a research note on Friday, November 8th. Finally, B. Riley cut their price objective on shares of Axcelis Technologies from $190.00 to $165.00 and set a "buy" rating on the stock in a report on Friday, August 2nd. Three equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company. According to MarketBeat.com, Axcelis Technologies currently has an average rating of "Moderate Buy" and a consensus price target of $167.33.

Get Our Latest Stock Report on Axcelis Technologies

Axcelis Technologies Stock Performance

NASDAQ:ACLS traded up $1.79 during trading on Friday, reaching $75.07. The company's stock had a trading volume of 546,645 shares, compared to its average volume of 639,091. Axcelis Technologies, Inc. has a 12 month low of $69.35 and a 12 month high of $158.61. The firm has a market cap of $2.44 billion, a price-to-earnings ratio of 10.83, a price-to-earnings-growth ratio of 2.19 and a beta of 1.60. The firm has a 50 day moving average of $92.56 and a 200-day moving average of $111.47. The company has a debt-to-equity ratio of 0.04, a quick ratio of 3.29 and a current ratio of 4.45.

Axcelis Technologies Profile

(

Free Report)

Axcelis Technologies, Inc designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and Asia Pacific. The company offers high energy, high current, and medium current implanters for various application requirements.

Read More

Before you consider Axcelis Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axcelis Technologies wasn't on the list.

While Axcelis Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.