Axim Planning & Wealth reduced its position in EHang Holdings Limited (NASDAQ:EH - Free Report) by 1.9% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 4,604,908 shares of the company's stock after selling 88,912 shares during the period. EHang comprises approximately 73.3% of Axim Planning & Wealth's holdings, making the stock its largest position. Axim Planning & Wealth owned approximately 7.25% of EHang worth $65,113,000 at the end of the most recent quarter.

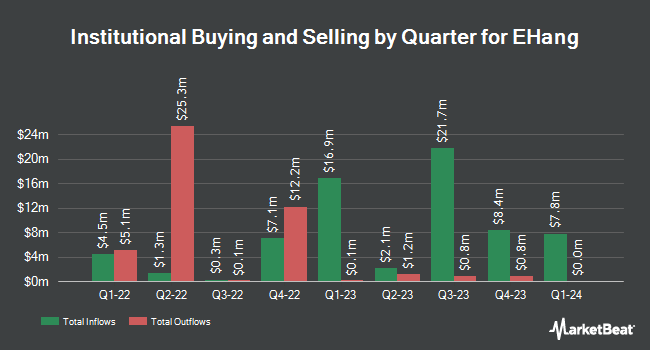

Other hedge funds also recently added to or reduced their stakes in the company. Baader Bank Aktiengesellschaft bought a new stake in EHang in the 2nd quarter worth approximately $883,000. XTX Topco Ltd bought a new stake in EHang in the 2nd quarter worth approximately $383,000. SteelPeak Wealth LLC grew its position in EHang by 70.7% in the 3rd quarter. SteelPeak Wealth LLC now owns 67,110 shares of the company's stock worth $949,000 after purchasing an additional 27,805 shares during the period. Russell Investments Group Ltd. bought a new stake in EHang in the 1st quarter worth approximately $484,000. Finally, Vanguard Group Inc. grew its position in shares of EHang by 0.5% during the 1st quarter. Vanguard Group Inc. now owns 1,563,754 shares of the company's stock valued at $32,166,000 after acquiring an additional 8,228 shares during the period. 94.03% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

EH has been the subject of a number of recent research reports. China Renaissance initiated coverage on shares of EHang in a research report on Tuesday, September 24th. They set a "buy" rating for the company. UBS Group initiated coverage on shares of EHang in a research report on Wednesday, August 28th. They set a "buy" rating and a $22.00 price objective for the company.

Get Our Latest Stock Analysis on EHang

EHang Price Performance

EHang stock traded down $0.80 during mid-day trading on Thursday, hitting $16.58. The stock had a trading volume of 1,722,050 shares, compared to its average volume of 1,329,094. The firm has a market capitalization of $1.05 billion, a P/E ratio of -28.59 and a beta of 0.99. The company has a current ratio of 2.12, a quick ratio of 1.99 and a debt-to-equity ratio of 0.02. The firm's 50 day moving average is $15.32 and its 200 day moving average is $14.96. EHang Holdings Limited has a one year low of $9.51 and a one year high of $22.98.

EHang (NASDAQ:EH - Get Free Report) last issued its earnings results on Thursday, August 22nd. The company reported ($0.14) earnings per share for the quarter. The firm had revenue of $14.04 million during the quarter. EHang had a negative return on equity of 84.09% and a negative net margin of 110.21%. During the same period in the prior year, the company earned ($0.18) earnings per share. On average, sell-side analysts forecast that EHang Holdings Limited will post -0.41 earnings per share for the current fiscal year.

About EHang

(

Free Report)

EHang Holdings Limited operates as an autonomous aerial vehicle (AAV) technology platform company in the People's Republic of China, East Asia, West Asia, Europe, and internationally. It designs, develops, manufactures, sells, and operates AAVs, as well as their supporting systems and infrastructure for various industries and applications, including passenger transportation, logistics, smart city management, and aerial media solutions.

Featured Articles

Before you consider EHang, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EHang wasn't on the list.

While EHang currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.