WCM Investment Management LLC decreased its position in shares of Axon Enterprise, Inc. (NASDAQ:AXON - Free Report) by 20.6% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 6,011 shares of the biotechnology company's stock after selling 1,555 shares during the period. WCM Investment Management LLC's holdings in Axon Enterprise were worth $2,376,000 as of its most recent filing with the Securities and Exchange Commission.

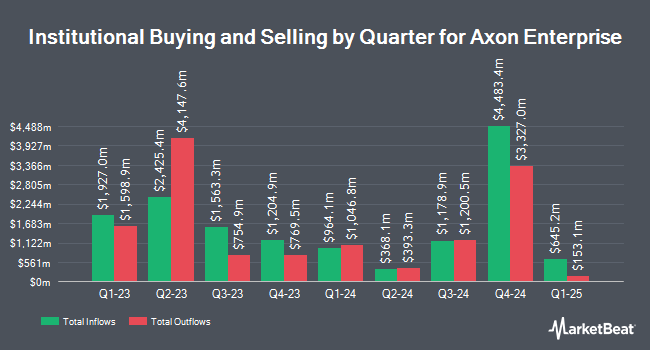

A number of other large investors also recently modified their holdings of AXON. Vanguard Group Inc. raised its holdings in shares of Axon Enterprise by 2.7% during the first quarter. Vanguard Group Inc. now owns 8,143,306 shares of the biotechnology company's stock valued at $2,547,878,000 after purchasing an additional 212,401 shares during the period. 1832 Asset Management L.P. grew its holdings in Axon Enterprise by 44.0% during the second quarter. 1832 Asset Management L.P. now owns 375,700 shares of the biotechnology company's stock valued at $110,546,000 after purchasing an additional 114,800 shares during the period. Allspring Global Investments Holdings LLC raised its position in shares of Axon Enterprise by 13.9% in the second quarter. Allspring Global Investments Holdings LLC now owns 368,732 shares of the biotechnology company's stock valued at $108,496,000 after purchasing an additional 45,049 shares during the period. Thrivent Financial for Lutherans grew its holdings in Axon Enterprise by 1.6% during the 2nd quarter. Thrivent Financial for Lutherans now owns 270,430 shares of the biotechnology company's stock valued at $79,571,000 after buying an additional 4,365 shares in the last quarter. Finally, Federated Hermes Inc. boosted its stake in Axon Enterprise by 14.5% during the second quarter. Federated Hermes Inc. now owns 234,185 shares of the biotechnology company's stock valued at $68,907,000 after buying an additional 29,680 shares during the period. 79.08% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several analysts have weighed in on the company. Robert W. Baird boosted their price objective on Axon Enterprise from $440.00 to $460.00 and gave the company an "outperform" rating in a research report on Monday, November 4th. Craig Hallum increased their price objective on shares of Axon Enterprise from $370.00 to $376.00 and gave the stock a "buy" rating in a research note on Wednesday, August 7th. Barclays upped their price objective on Axon Enterprise from $381.00 to $387.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 7th. Northland Securities raised their price target on Axon Enterprise from $365.00 to $550.00 and gave the company an "outperform" rating in a report on Monday. Finally, Bank of America initiated coverage on Axon Enterprise in a research note on Wednesday, July 17th. They issued a "buy" rating and a $380.00 target price on the stock. Two research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $427.83.

Check Out Our Latest Report on Axon Enterprise

Axon Enterprise Price Performance

Axon Enterprise stock traded down $20.96 on Tuesday, reaching $595.18. The company's stock had a trading volume of 1,389,890 shares, compared to its average volume of 548,091. The company has a debt-to-equity ratio of 0.35, a quick ratio of 2.52 and a current ratio of 2.88. The business's fifty day moving average price is $419.18 and its 200 day moving average price is $349.77. Axon Enterprise, Inc. has a twelve month low of $216.73 and a twelve month high of $624.84. The company has a market cap of $44.98 billion, a price-to-earnings ratio of 159.21, a PEG ratio of 15.15 and a beta of 0.94.

Insider Buying and Selling

In other Axon Enterprise news, CEO Patrick W. Smith sold 80,300 shares of the stock in a transaction dated Friday, August 23rd. The stock was sold at an average price of $371.78, for a total value of $29,853,934.00. Following the transaction, the chief executive officer now owns 3,015,366 shares of the company's stock, valued at approximately $1,121,052,771.48. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. In related news, CEO Patrick W. Smith sold 75,000 shares of Axon Enterprise stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $356.53, for a total transaction of $26,739,750.00. Following the completion of the transaction, the chief executive officer now owns 2,970,366 shares in the company, valued at approximately $1,059,024,589.98. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CEO Patrick W. Smith sold 80,300 shares of the company's stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $371.78, for a total value of $29,853,934.00. Following the completion of the transaction, the chief executive officer now directly owns 3,015,366 shares in the company, valued at approximately $1,121,052,771.48. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 369,172 shares of company stock valued at $136,270,842 over the last ninety days. Insiders own 6.10% of the company's stock.

About Axon Enterprise

(

Free Report)

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

Featured Stories

Before you consider Axon Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axon Enterprise wasn't on the list.

While Axon Enterprise currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report