AXQ Capital LP grew its holdings in HF Sinclair Co. (NYSE:DINO - Free Report) by 75.1% during the fourth quarter, according to the company in its most recent filing with the SEC. The fund owned 21,593 shares of the company's stock after acquiring an additional 9,264 shares during the quarter. AXQ Capital LP's holdings in HF Sinclair were worth $757,000 at the end of the most recent reporting period.

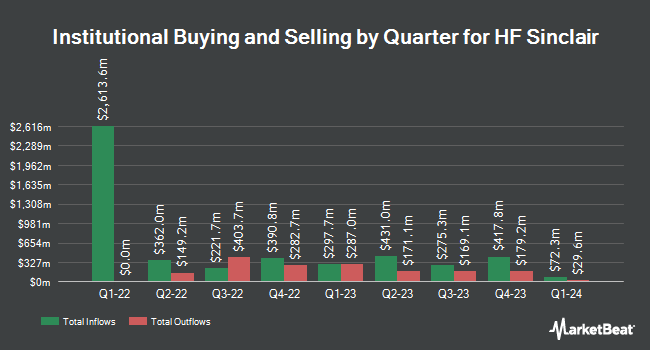

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Sugar Maple Asset Management LLC acquired a new position in HF Sinclair in the fourth quarter valued at $27,000. Lee Danner & Bass Inc. purchased a new position in HF Sinclair in the 4th quarter valued at approximately $32,000. EverSource Wealth Advisors LLC grew its stake in HF Sinclair by 53.9% in the 4th quarter. EverSource Wealth Advisors LLC now owns 934 shares of the company's stock valued at $33,000 after acquiring an additional 327 shares during the last quarter. MassMutual Private Wealth & Trust FSB raised its position in shares of HF Sinclair by 68.0% during the 4th quarter. MassMutual Private Wealth & Trust FSB now owns 1,378 shares of the company's stock worth $48,000 after purchasing an additional 558 shares during the last quarter. Finally, Millburn Ridgefield Corp acquired a new position in shares of HF Sinclair in the third quarter worth $50,000. 88.29% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at HF Sinclair

In other HF Sinclair news, Director Franklin Myers acquired 5,000 shares of the firm's stock in a transaction that occurred on Wednesday, February 26th. The stock was purchased at an average cost of $35.66 per share, for a total transaction of $178,300.00. Following the completion of the acquisition, the director now owns 154,065 shares of the company's stock, valued at approximately $5,493,957.90. This trade represents a 3.35 % increase in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Company insiders own 0.28% of the company's stock.

HF Sinclair Trading Up 1.0 %

Shares of HF Sinclair stock traded up $0.35 on Wednesday, reaching $33.53. 2,347,895 shares of the company were exchanged, compared to its average volume of 2,203,208. HF Sinclair Co. has a fifty-two week low of $29.85 and a fifty-two week high of $64.16. The firm has a market capitalization of $6.32 billion, a price-to-earnings ratio of 40.88 and a beta of 1.13. The company has a current ratio of 1.81, a quick ratio of 0.90 and a debt-to-equity ratio of 0.24. The stock has a fifty day moving average price of $35.17 and a 200-day moving average price of $38.95.

HF Sinclair (NYSE:DINO - Get Free Report) last posted its quarterly earnings data on Thursday, February 20th. The company reported ($1.02) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.91) by ($0.11). HF Sinclair had a return on equity of 1.98% and a net margin of 0.62%. The company had revenue of $6.50 billion for the quarter, compared to analyst estimates of $6.56 billion. On average, analysts expect that HF Sinclair Co. will post 2.39 EPS for the current year.

HF Sinclair Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, March 20th. Stockholders of record on Thursday, March 6th were issued a dividend of $0.50 per share. The ex-dividend date was Thursday, March 6th. This represents a $2.00 dividend on an annualized basis and a dividend yield of 5.97%. HF Sinclair's dividend payout ratio is 243.90%.

Wall Street Analysts Forecast Growth

DINO has been the topic of a number of research analyst reports. Barclays reduced their target price on HF Sinclair from $37.00 to $35.00 and set an "equal weight" rating on the stock in a report on Friday, March 14th. Wells Fargo & Company increased their price target on HF Sinclair from $42.00 to $44.00 and gave the company an "equal weight" rating in a report on Friday, March 21st. Mizuho decreased their price objective on shares of HF Sinclair from $50.00 to $45.00 and set a "neutral" rating for the company in a report on Monday, December 16th. Morgan Stanley cut their target price on HF Sinclair from $51.00 to $50.00 and set an "overweight" rating on the stock in a research note on Friday, March 14th. Finally, Piper Sandler set a $46.00 price target on HF Sinclair in a research report on Friday, March 7th. Seven research analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat.com, HF Sinclair presently has an average rating of "Hold" and a consensus target price of $47.00.

View Our Latest Report on DINO

About HF Sinclair

(

Free Report)

HF Sinclair Corporation operates as an independent energy company. The company produces and markets gasoline, diesel fuel, jet fuel, renewable diesel, specialty lubricant products, specialty chemicals, specialty and modified asphalt, and others. It owns and operates refineries located in Kansas, Oklahoma, New Mexico, Utah, Washington, and Wyoming; and markets its refined products principally in the Southwest United States and Rocky Mountains, Pacific Northwest, and in other neighboring Plains states.

See Also

Before you consider HF Sinclair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HF Sinclair wasn't on the list.

While HF Sinclair currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.