Axsome Therapeutics (NASDAQ:AXSM - Get Free Report) had its target price raised by investment analysts at Robert W. Baird from $112.00 to $116.00 in a report released on Wednesday,Benzinga reports. The brokerage presently has an "outperform" rating on the stock. Robert W. Baird's price objective suggests a potential upside of 18.07% from the company's current price.

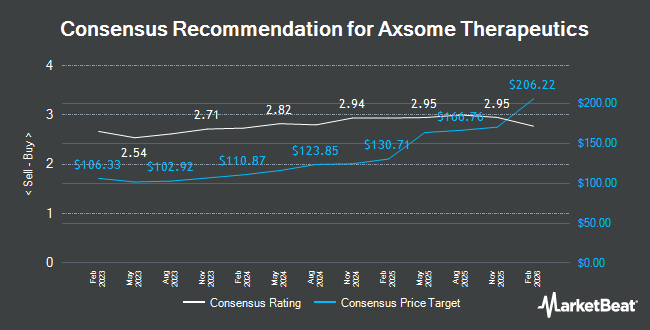

Other research analysts have also recently issued research reports about the company. StockNews.com cut Axsome Therapeutics from a "hold" rating to a "sell" rating in a research report on Tuesday. Cantor Fitzgerald restated an "overweight" rating and issued a $107.00 price target on shares of Axsome Therapeutics in a research note on Monday, September 16th. Needham & Company LLC restated a "buy" rating and issued a $130.00 price target on shares of Axsome Therapeutics in a research note on Tuesday. Wells Fargo & Company started coverage on shares of Axsome Therapeutics in a research note on Tuesday, September 3rd. They issued an "overweight" rating and a $140.00 price objective for the company. Finally, Bank of America raised shares of Axsome Therapeutics from a "neutral" rating to a "buy" rating and upped their price objective for the company from $95.00 to $106.00 in a report on Tuesday, August 6th. One investment analyst has rated the stock with a sell rating and fourteen have issued a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $124.93.

Get Our Latest Report on Axsome Therapeutics

Axsome Therapeutics Trading Down 1.2 %

Axsome Therapeutics stock traded down $1.24 during mid-day trading on Wednesday, hitting $98.25. 870,034 shares of the company's stock traded hands, compared to its average volume of 619,304. The firm has a 50 day simple moving average of $90.55 and a two-hundred day simple moving average of $83.95. Axsome Therapeutics has a fifty-two week low of $56.66 and a fifty-two week high of $105.00. The company has a current ratio of 2.44, a quick ratio of 2.40 and a debt-to-equity ratio of 1.97.

Axsome Therapeutics (NASDAQ:AXSM - Get Free Report) last posted its earnings results on Tuesday, November 12th. The company reported ($1.34) earnings per share for the quarter, topping analysts' consensus estimates of ($1.38) by $0.04. Axsome Therapeutics had a negative return on equity of 158.36% and a negative net margin of 91.87%. The company had revenue of $104.76 million during the quarter, compared to the consensus estimate of $98.71 million. During the same quarter last year, the firm earned ($1.32) earnings per share. On average, analysts anticipate that Axsome Therapeutics will post -5.12 earnings per share for the current year.

Insiders Place Their Bets

In other Axsome Therapeutics news, Director Mark E. Saad sold 11,016 shares of the firm's stock in a transaction dated Wednesday, September 11th. The stock was sold at an average price of $91.31, for a total value of $1,005,870.96. Following the transaction, the director now directly owns 10,002 shares of the company's stock, valued at approximately $913,282.62. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Insiders own 22.40% of the company's stock.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in AXSM. Janney Montgomery Scott LLC lifted its position in shares of Axsome Therapeutics by 9.5% during the 1st quarter. Janney Montgomery Scott LLC now owns 5,780 shares of the company's stock valued at $461,000 after buying an additional 500 shares in the last quarter. SG Americas Securities LLC raised its stake in Axsome Therapeutics by 605.5% during the 1st quarter. SG Americas Securities LLC now owns 15,104 shares of the company's stock valued at $1,205,000 after purchasing an additional 12,963 shares during the period. Sei Investments Co. raised its stake in Axsome Therapeutics by 8.2% during the 1st quarter. Sei Investments Co. now owns 35,654 shares of the company's stock valued at $2,845,000 after purchasing an additional 2,697 shares during the period. Russell Investments Group Ltd. raised its stake in Axsome Therapeutics by 5,550.0% during the 1st quarter. Russell Investments Group Ltd. now owns 791 shares of the company's stock valued at $63,000 after purchasing an additional 777 shares during the period. Finally, ProShare Advisors LLC raised its stake in Axsome Therapeutics by 9.0% during the 1st quarter. ProShare Advisors LLC now owns 9,724 shares of the company's stock valued at $776,000 after purchasing an additional 800 shares during the period. 81.49% of the stock is owned by hedge funds and other institutional investors.

Axsome Therapeutics Company Profile

(

Get Free Report)

Axsome Therapeutics, Inc, a biopharmaceutical company, engages in the development of novel therapies for central nervous system (CNS) disorders in the United States. The company's commercial product portfolio includes Auvelity (dextromethorphan-bupropion), a N-methyl-D-aspartate receptor antagonist with multimodal activity indicated for the treatment of major depressive disorder; and Sunosi (solriamfetol), a medication indicated to the treatment of excessive daytime sleepiness in patients with narcolepsy or obstructive sleep apnea.

Featured Articles

Before you consider Axsome Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axsome Therapeutics wasn't on the list.

While Axsome Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.