Azora Capital LP lifted its holdings in WisdomTree, Inc. (NYSE:WT - Free Report) by 12.1% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 10,609,577 shares of the company's stock after purchasing an additional 1,142,151 shares during the quarter. WisdomTree accounts for approximately 5.7% of Azora Capital LP's holdings, making the stock its 3rd largest position. Azora Capital LP owned approximately 7.26% of WisdomTree worth $105,990,000 as of its most recent SEC filing.

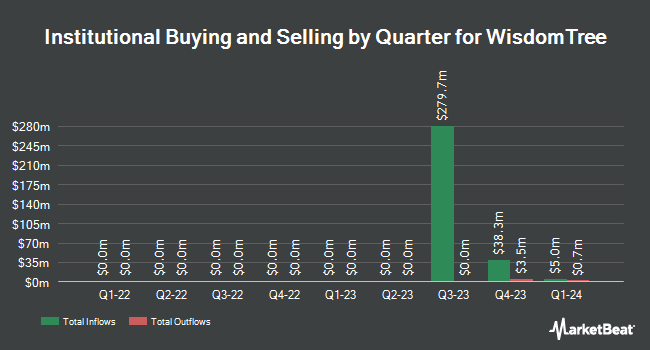

Several other institutional investors and hedge funds also recently modified their holdings of WT. FMR LLC boosted its stake in WisdomTree by 390.7% during the third quarter. FMR LLC now owns 2,859,073 shares of the company's stock valued at $28,562,000 after buying an additional 2,276,452 shares in the last quarter. Victory Capital Management Inc. boosted its stake in WisdomTree by 92.5% during the second quarter. Victory Capital Management Inc. now owns 1,922,414 shares of the company's stock valued at $19,051,000 after buying an additional 923,994 shares in the last quarter. Kornitzer Capital Management Inc. KS acquired a new position in shares of WisdomTree in the 2nd quarter valued at $5,748,000. Acadian Asset Management LLC acquired a new position in shares of WisdomTree in the 2nd quarter valued at $4,258,000. Finally, Marshall Wace LLP boosted its position in shares of WisdomTree by 82.3% in the 2nd quarter. Marshall Wace LLP now owns 772,543 shares of the company's stock valued at $7,656,000 after purchasing an additional 348,850 shares during the period. Institutional investors own 78.64% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts recently issued reports on WT shares. UBS Group increased their price objective on WisdomTree from $12.00 to $14.00 and gave the stock a "buy" rating in a research note on Tuesday, October 22nd. Northcoast Research lowered WisdomTree from a "strong-buy" rating to a "hold" rating in a report on Sunday, September 15th. Three investment analysts have rated the stock with a hold rating and four have given a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $12.25.

Get Our Latest Report on WisdomTree

Insider Activity

In other news, insider Peter M. Ziemba sold 100,000 shares of the company's stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $11.43, for a total value of $1,143,000.00. Following the transaction, the insider now owns 948,386 shares of the company's stock, valued at approximately $10,840,051.98. This represents a 9.54 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Jonathan L. Steinberg bought 67,869 shares of the firm's stock in a transaction dated Friday, November 8th. The stock was purchased at an average cost of $10.84 per share, for a total transaction of $735,699.96. Following the transaction, the chief executive officer now directly owns 9,240,707 shares of the company's stock, valued at $100,169,263.88. The trade was a 0.74 % increase in their position. The disclosure for this purchase can be found here. Corporate insiders own 7.80% of the company's stock.

WisdomTree Trading Down 2.2 %

NYSE:WT traded down $0.26 on Monday, reaching $11.69. The company's stock had a trading volume of 1,756,429 shares, compared to its average volume of 1,316,749. WisdomTree, Inc. has a 1-year low of $6.24 and a 1-year high of $12.45. The company has a debt-to-equity ratio of 1.36, a quick ratio of 2.16 and a current ratio of 2.88. The firm has a market cap of $1.71 billion, a PE ratio of 41.00 and a beta of 1.43. The business's 50-day moving average price is $10.66 and its two-hundred day moving average price is $10.25.

WisdomTree Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Wednesday, November 20th. Stockholders of record on Wednesday, November 6th were issued a $0.03 dividend. The ex-dividend date of this dividend was Wednesday, November 6th. This represents a $0.12 dividend on an annualized basis and a dividend yield of 1.03%. WisdomTree's dividend payout ratio (DPR) is 41.38%.

WisdomTree Company Profile

(

Free Report)

WisdomTree, Inc, through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager. It offers ETFs in equities, currency, fixed income, and alternatives asset classes. The company also licenses its indexes to third parties for proprietary products, as well as offers a platform to promote the use of WisdomTree ETFs in 401(k) plans.

Read More

Before you consider WisdomTree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WisdomTree wasn't on the list.

While WisdomTree currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.