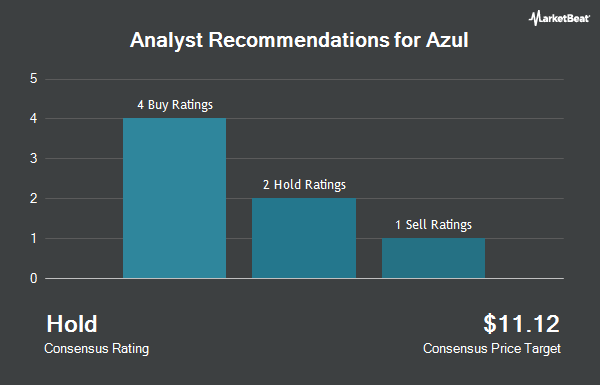

Azul S.A. (NYSE:AZUL - Get Free Report) has been assigned a consensus rating of "Hold" from the ten ratings firms that are currently covering the stock, MarketBeat Ratings reports. One investment analyst has rated the stock with a sell recommendation, seven have given a hold recommendation and two have given a buy recommendation to the company. The average 12 month target price among analysts that have updated their coverage on the stock in the last year is $6.59.

A number of research analysts have recently issued reports on the company. HSBC downgraded Azul from a "buy" rating to a "hold" rating and set a $2.70 price target on the stock. in a report on Thursday, September 5th. The Goldman Sachs Group downgraded shares of Azul from a "buy" rating to a "neutral" rating and reduced their target price for the stock from $6.70 to $4.00 in a report on Monday, September 23rd. Deutsche Bank Aktiengesellschaft lowered their price target on shares of Azul from $8.00 to $6.00 and set a "buy" rating on the stock in a report on Tuesday, August 13th. Hsbc Global Res upgraded shares of Azul to a "hold" rating in a research note on Thursday, September 5th. Finally, Seaport Res Ptn downgraded shares of Azul from a "strong-buy" rating to a "hold" rating in a research note on Thursday, October 10th.

Read Our Latest Stock Report on Azul

Azul Stock Down 6.4 %

AZUL stock traded down $0.15 during trading on Friday, hitting $2.21. 2,343,826 shares of the company's stock traded hands, compared to its average volume of 1,500,672. The firm has a market capitalization of $931.67 million, a P/E ratio of -0.31 and a beta of 1.92. Azul has a 1 year low of $2.02 and a 1 year high of $10.62. The business has a fifty day simple moving average of $2.86 and a two-hundred day simple moving average of $3.70.

Institutional Investors Weigh In On Azul

A number of large investors have recently made changes to their positions in AZUL. Coronation Fund Managers Ltd. lifted its holdings in shares of Azul by 9.5% during the second quarter. Coronation Fund Managers Ltd. now owns 27,341 shares of the company's stock worth $109,000 after purchasing an additional 2,380 shares during the period. Signaturefd LLC lifted its stake in Azul by 35.9% during the 2nd quarter. Signaturefd LLC now owns 10,649 shares of the company's stock valued at $43,000 after acquiring an additional 2,812 shares during the period. Inspire Advisors LLC boosted its holdings in shares of Azul by 20.1% in the 2nd quarter. Inspire Advisors LLC now owns 22,463 shares of the company's stock valued at $90,000 after acquiring an additional 3,764 shares during the last quarter. Marshall Wace LLP increased its stake in shares of Azul by 2,466.5% in the second quarter. Marshall Wace LLP now owns 598,670 shares of the company's stock worth $2,395,000 after acquiring an additional 575,344 shares during the period. Finally, Long Focus Capital Management LLC raised its holdings in shares of Azul by 106.3% during the second quarter. Long Focus Capital Management LLC now owns 4,454,000 shares of the company's stock worth $17,816,000 after purchasing an additional 2,295,000 shares during the last quarter. 0.82% of the stock is owned by hedge funds and other institutional investors.

About Azul

(

Get Free ReportAzul SA, together with its subsidiaries, provides air transportation services in Brazil and internationally. As of December 31, 2023, the company operated approximately 1,000 daily departures to 160 destinations through a network of 300 non-stop routes with an operating fleet of 183 aircraft and a passenger contractual fleet of 189 aircraft.

Featured Articles

Before you consider Azul, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Azul wasn't on the list.

While Azul currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.