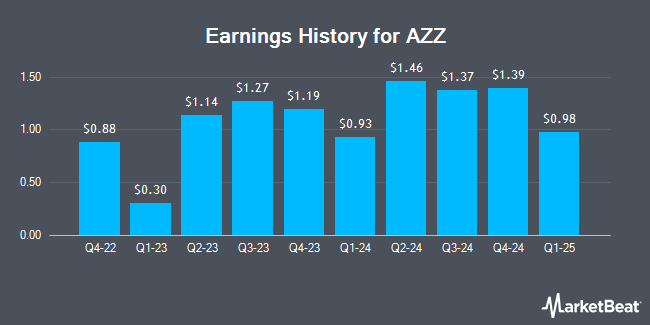

AZZ (NYSE:AZZ - Get Free Report) is projected to post its quarterly earnings results after the market closes on Monday, April 21st. Analysts expect AZZ to post earnings of $0.95 per share and revenue of $367.78 million for the quarter. Persons interested in listening to the company's earnings conference call can do so using this link.

AZZ Price Performance

NYSE:AZZ traded up $0.61 during trading hours on Wednesday, hitting $82.59. 281,822 shares of the stock were exchanged, compared to its average volume of 250,630. The firm's fifty day moving average price is $88.51 and its 200 day moving average price is $86.34. AZZ has a 52-week low of $69.59 and a 52-week high of $99.49. The company has a market cap of $2.47 billion, a P/E ratio of 55.80, a P/E/G ratio of 1.32 and a beta of 1.22. The company has a current ratio of 1.77, a quick ratio of 1.26 and a debt-to-equity ratio of 0.85.

AZZ Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Thursday, May 15th. Stockholders of record on Thursday, April 24th will be paid a $0.17 dividend. This represents a $0.68 dividend on an annualized basis and a dividend yield of 0.82%. The ex-dividend date of this dividend is Thursday, April 24th. AZZ's dividend payout ratio is presently 45.95%.

Wall Street Analysts Forecast Growth

A number of research analysts have weighed in on AZZ shares. Roth Mkm assumed coverage on AZZ in a report on Tuesday, February 11th. They issued a "buy" rating and a $108.00 price objective on the stock. B. Riley raised their price target on shares of AZZ from $99.00 to $111.00 and gave the stock a "buy" rating in a research note on Tuesday, February 11th. Roth Capital raised shares of AZZ to a "strong-buy" rating in a research note on Tuesday, February 11th. Sidoti upgraded shares of AZZ from a "neutral" rating to a "buy" rating and set a $101.00 price objective for the company in a report on Wednesday, April 9th. Finally, Noble Financial restated an "outperform" rating on shares of AZZ in a report on Thursday, March 6th. Four equities research analysts have rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, AZZ presently has a consensus rating of "Moderate Buy" and an average price target of $100.71.

Read Our Latest Stock Analysis on AZZ

About AZZ

(

Get Free Report)

AZZ Inc provides hot-dip galvanizing and coil coating solutions in North America. It offers metal finishing solutions for corrosion protection, including hot-dip galvanizing, spin galvanizing, powder coating, anodizing, and plating to steel fabrication and other industries, as well as to fabricators or manufacturers that provide services to the transmission and distribution, bridge and highway, petrochemical, and general industrial markets; and original equipment manufacturers.

See Also

Before you consider AZZ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AZZ wasn't on the list.

While AZZ currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.