Sidoti upgraded shares of AZZ (NYSE:AZZ - Free Report) from a neutral rating to a buy rating in a research note published on Wednesday morning, Marketbeat reports. Sidoti currently has $101.00 price objective on the industrial products company's stock.

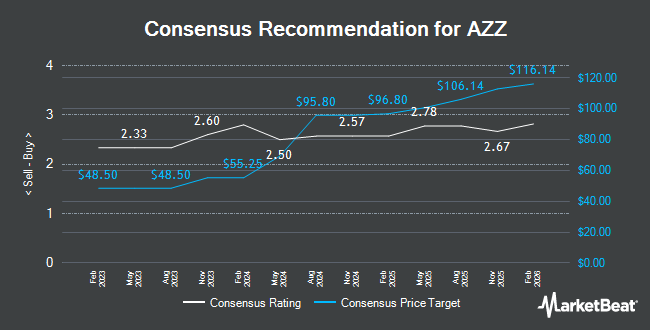

AZZ has been the topic of several other reports. Roth Mkm began coverage on shares of AZZ in a report on Tuesday, February 11th. They set a "buy" rating and a $108.00 price objective on the stock. Roth Capital raised AZZ to a "strong-buy" rating in a research report on Tuesday, February 11th. B. Riley raised their price objective on AZZ from $99.00 to $111.00 and gave the stock a "buy" rating in a report on Tuesday, February 11th. Finally, Noble Financial reiterated an "outperform" rating on shares of AZZ in a report on Thursday, March 6th. Four investment analysts have rated the stock with a hold rating, six have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $100.71.

Check Out Our Latest Stock Report on AZZ

AZZ Price Performance

NYSE:AZZ traded up $0.55 during trading hours on Wednesday, reaching $82.35. 49,753 shares of the company traded hands, compared to its average volume of 250,084. AZZ has a 1-year low of $69.59 and a 1-year high of $99.49. The stock has a market cap of $2.46 billion, a P/E ratio of 55.64, a P/E/G ratio of 1.32 and a beta of 1.22. The firm's 50-day moving average is $88.97 and its 200-day moving average is $86.36. The company has a debt-to-equity ratio of 0.85, a current ratio of 1.77 and a quick ratio of 1.26.

AZZ Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Thursday, May 15th. Investors of record on Thursday, April 24th will be given a $0.17 dividend. The ex-dividend date of this dividend is Thursday, April 24th. This represents a $0.68 annualized dividend and a dividend yield of 0.83%. AZZ's dividend payout ratio (DPR) is presently 45.95%.

Institutional Trading of AZZ

Several institutional investors have recently made changes to their positions in AZZ. Farther Finance Advisors LLC raised its stake in AZZ by 32.4% during the 4th quarter. Farther Finance Advisors LLC now owns 515 shares of the industrial products company's stock valued at $42,000 after purchasing an additional 126 shares during the last quarter. US Bancorp DE raised its position in shares of AZZ by 39.0% during the fourth quarter. US Bancorp DE now owns 463 shares of the industrial products company's stock valued at $38,000 after buying an additional 130 shares during the last quarter. Parkside Financial Bank & Trust lifted its stake in shares of AZZ by 4.1% in the fourth quarter. Parkside Financial Bank & Trust now owns 3,658 shares of the industrial products company's stock valued at $300,000 after buying an additional 143 shares during the period. State of New Jersey Common Pension Fund D grew its position in AZZ by 0.6% during the fourth quarter. State of New Jersey Common Pension Fund D now owns 24,151 shares of the industrial products company's stock worth $1,978,000 after buying an additional 154 shares in the last quarter. Finally, Summit Investment Advisors Inc. increased its stake in AZZ by 7.2% during the fourth quarter. Summit Investment Advisors Inc. now owns 3,072 shares of the industrial products company's stock valued at $252,000 after acquiring an additional 205 shares during the period. 90.93% of the stock is currently owned by institutional investors and hedge funds.

About AZZ

(

Get Free Report)

AZZ Inc provides hot-dip galvanizing and coil coating solutions in North America. It offers metal finishing solutions for corrosion protection, including hot-dip galvanizing, spin galvanizing, powder coating, anodizing, and plating to steel fabrication and other industries, as well as to fabricators or manufacturers that provide services to the transmission and distribution, bridge and highway, petrochemical, and general industrial markets; and original equipment manufacturers.

Featured Articles

Before you consider AZZ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AZZ wasn't on the list.

While AZZ currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.