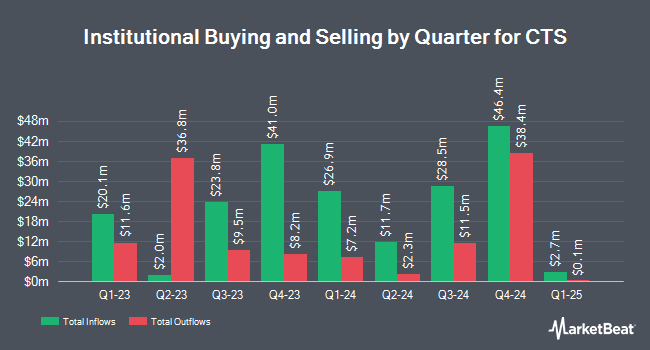

B. Metzler seel. Sohn & Co. Holding AG acquired a new stake in CTS Co. (NYSE:CTS - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm acquired 39,056 shares of the electronics maker's stock, valued at approximately $1,890,000. B. Metzler seel. Sohn & Co. Holding AG owned about 0.13% of CTS as of its most recent SEC filing.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Innealta Capital LLC bought a new stake in shares of CTS during the 2nd quarter worth about $27,000. GAMMA Investing LLC lifted its stake in CTS by 132.5% in the third quarter. GAMMA Investing LLC now owns 586 shares of the electronics maker's stock valued at $28,000 after acquiring an additional 334 shares during the last quarter. Canada Pension Plan Investment Board acquired a new stake in CTS in the second quarter valued at approximately $41,000. Quest Partners LLC acquired a new stake in CTS in the third quarter valued at approximately $92,000. Finally, Hantz Financial Services Inc. acquired a new stake in CTS in the second quarter valued at approximately $157,000. 96.87% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of research firms have issued reports on CTS. StockNews.com cut shares of CTS from a "buy" rating to a "hold" rating in a research note on Thursday, November 7th. Scotiabank cut shares of CTS from a "strong-buy" rating to a "hold" rating in a research note on Friday, October 25th.

Read Our Latest Report on CTS

CTS Stock Performance

Shares of CTS stock traded up $1.14 on Friday, reaching $54.32. The stock had a trading volume of 175,437 shares, compared to its average volume of 149,874. The business's 50-day moving average price is $50.07 and its two-hundred day moving average price is $50.09. The company has a debt-to-equity ratio of 0.19, a quick ratio of 1.91 and a current ratio of 2.46. CTS Co. has a fifty-two week low of $38.49 and a fifty-two week high of $59.68. The stock has a market cap of $1.64 billion, a P/E ratio of 27.56 and a beta of 0.58.

CTS (NYSE:CTS - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The electronics maker reported $0.63 earnings per share for the quarter, topping analysts' consensus estimates of $0.57 by $0.06. CTS had a net margin of 11.66% and a return on equity of 12.39%. The business had revenue of $132.42 million during the quarter. During the same quarter in the previous year, the firm posted $0.54 earnings per share. On average, sell-side analysts forecast that CTS Co. will post 2.15 EPS for the current year.

CTS Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, January 31st. Investors of record on Friday, December 27th will be given a dividend of $0.04 per share. This represents a $0.16 dividend on an annualized basis and a yield of 0.29%. The ex-dividend date of this dividend is Friday, December 27th. CTS's dividend payout ratio (DPR) is currently 8.25%.

About CTS

(

Free Report)

CTS Corporation manufactures and sells sensors, actuators, and connectivity components in North America, Europe, and Asia. The company provides encoders, rotary position sensors, slide potentiometers, industrial and commercial rotary potentiometers. It also provides non-contacting, and contacting pedals; and eBrake pedals.

Featured Articles

Before you consider CTS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CTS wasn't on the list.

While CTS currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.