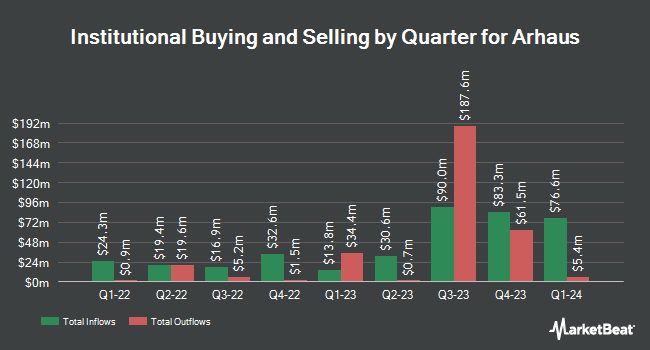

B. Metzler seel. Sohn & Co. Holding AG bought a new position in shares of Arhaus, Inc. (NASDAQ:ARHS - Free Report) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 106,953 shares of the company's stock, valued at approximately $1,317,000. B. Metzler seel. Sohn & Co. Holding AG owned 0.08% of Arhaus as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds also recently added to or reduced their stakes in ARHS. Vanguard Group Inc. increased its stake in Arhaus by 11.8% in the first quarter. Vanguard Group Inc. now owns 4,387,126 shares of the company's stock valued at $67,518,000 after purchasing an additional 463,749 shares during the last quarter. Price T Rowe Associates Inc. MD acquired a new stake in shares of Arhaus during the first quarter worth $8,326,000. Silvercrest Asset Management Group LLC acquired a new stake in shares of Arhaus during the first quarter worth $8,301,000. Bayesian Capital Management LP acquired a new stake in shares of Arhaus during the first quarter worth $290,000. Finally, Janus Henderson Group PLC lifted its holdings in shares of Arhaus by 188.1% during the first quarter. Janus Henderson Group PLC now owns 44,774 shares of the company's stock worth $688,000 after purchasing an additional 29,231 shares during the period. 27.88% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts recently weighed in on the company. Bank of America downgraded Arhaus from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $15.00 to $11.00 in a report on Thursday, November 7th. Robert W. Baird reduced their target price on Arhaus from $18.00 to $14.00 and set an "outperform" rating for the company in a report on Friday, August 9th. Telsey Advisory Group raised Arhaus from a "market perform" rating to an "outperform" rating and raised their target price for the company from $11.00 to $12.00 in a report on Thursday, November 14th. Stifel Nicolaus reduced their target price on Arhaus from $16.00 to $13.00 and set a "buy" rating for the company in a report on Monday, November 4th. Finally, Barclays reduced their target price on Arhaus from $15.00 to $13.00 and set an "overweight" rating for the company in a report on Friday, November 8th. Four research analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $12.90.

Get Our Latest Stock Analysis on ARHS

Arhaus Price Performance

Shares of ARHS stock traded up $0.13 during mid-day trading on Friday, reaching $9.75. The stock had a trading volume of 1,031,479 shares, compared to its average volume of 1,664,117. Arhaus, Inc. has a 12-month low of $8.30 and a 12-month high of $19.81. The company has a market cap of $1.37 billion, a P/E ratio of 17.41, a price-to-earnings-growth ratio of 12.62 and a beta of 2.58. The business has a 50-day simple moving average of $10.30 and a 200 day simple moving average of $13.51. The company has a current ratio of 1.23, a quick ratio of 0.52 and a debt-to-equity ratio of 0.17.

Arhaus (NASDAQ:ARHS - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The company reported $0.07 earnings per share for the quarter, missing analysts' consensus estimates of $0.08 by ($0.01). The firm had revenue of $319.13 million during the quarter, compared to analysts' expectations of $328.94 million. Arhaus had a net margin of 6.18% and a return on equity of 24.92%. The company's quarterly revenue was down 2.2% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.14 EPS. On average, sell-side analysts anticipate that Arhaus, Inc. will post 0.42 earnings per share for the current year.

Arhaus Profile

(

Free Report)

Arhaus, Inc operates as a lifestyle brand and premium retailer in the home furnishings market in the United States. It provides merchandise assortments across various categories, including furniture, lighting, textiles, décor, and outdoor. The company's furniture products comprise bedroom, dining room, living room, and home office furnishings, which includes sofas, dining tables and chairs, accent chairs, console and coffee tables, beds, headboards, dressers, desks, bookcases, modular storage, and other items; and outdoor products, such as outdoor dining tables, chairs, chaises and other furniture, lighting, textiles, décor, umbrellas, and fire pits.

Featured Stories

Before you consider Arhaus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arhaus wasn't on the list.

While Arhaus currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.