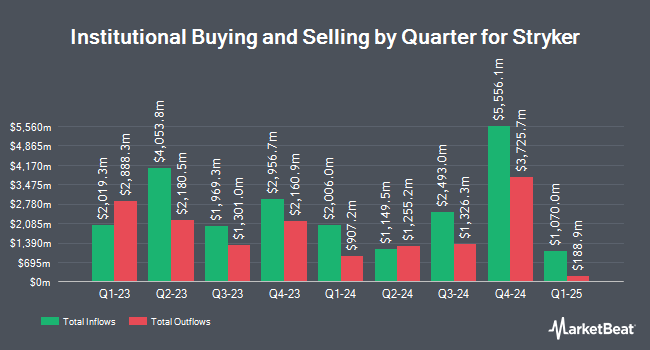

B. Metzler seel. Sohn & Co. Holding AG purchased a new stake in Stryker Co. (NYSE:SYK - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 89,611 shares of the medical technology company's stock, valued at approximately $32,373,000.

A number of other hedge funds also recently modified their holdings of SYK. International Assets Investment Management LLC boosted its stake in Stryker by 66,967.5% during the third quarter. International Assets Investment Management LLC now owns 853,769 shares of the medical technology company's stock worth $308,433,000 after buying an additional 852,496 shares in the last quarter. 1832 Asset Management L.P. increased its stake in Stryker by 146.9% in the first quarter. 1832 Asset Management L.P. now owns 878,669 shares of the medical technology company's stock valued at $314,449,000 after acquiring an additional 522,817 shares during the period. American Century Companies Inc. raised its position in Stryker by 287.6% in the second quarter. American Century Companies Inc. now owns 505,608 shares of the medical technology company's stock worth $172,033,000 after purchasing an additional 375,166 shares in the last quarter. Canada Pension Plan Investment Board lifted its stake in Stryker by 49.8% during the second quarter. Canada Pension Plan Investment Board now owns 686,416 shares of the medical technology company's stock worth $233,553,000 after purchasing an additional 228,139 shares during the period. Finally, Sofinnova Investments Inc. acquired a new stake in Stryker during the second quarter valued at approximately $65,697,000. Institutional investors own 77.09% of the company's stock.

Insider Buying and Selling

In other news, VP M Kathryn Fink sold 2,121 shares of the firm's stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $370.00, for a total transaction of $784,770.00. Following the completion of the sale, the vice president now owns 10,042 shares in the company, valued at approximately $3,715,540. This trade represents a 17.44 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, CEO Kevin Lobo sold 57,313 shares of the company's stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $368.70, for a total transaction of $21,131,303.10. Following the completion of the transaction, the chief executive officer now owns 100,027 shares in the company, valued at approximately $36,879,954.90. This trade represents a 36.43 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 67,381 shares of company stock worth $24,825,275. Company insiders own 5.50% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts recently commented on SYK shares. JPMorgan Chase & Co. raised their target price on Stryker from $375.00 to $420.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 30th. Wells Fargo & Company boosted their target price on shares of Stryker from $381.00 to $405.00 and gave the company an "overweight" rating in a research note on Wednesday, October 30th. Canaccord Genuity Group lifted their price target on shares of Stryker from $360.00 to $400.00 and gave the company a "buy" rating in a report on Wednesday, October 30th. Royal Bank of Canada raised their price objective on shares of Stryker from $386.00 to $400.00 and gave the stock an "outperform" rating in a report on Wednesday, October 30th. Finally, Piper Sandler restated an "overweight" rating and set a $420.00 price target (up from $380.00) on shares of Stryker in a research report on Wednesday, October 30th. Four analysts have rated the stock with a hold rating and seventeen have issued a buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $393.65.

Get Our Latest Research Report on Stryker

Stryker Trading Down 0.2 %

Stryker stock traded down $0.72 during midday trading on Tuesday, hitting $388.68. 1,524,142 shares of the stock were exchanged, compared to its average volume of 1,271,352. Stryker Co. has a 52 week low of $285.79 and a 52 week high of $398.20. The company has a quick ratio of 1.22, a current ratio of 1.91 and a debt-to-equity ratio of 0.66. The stock has a market capitalization of $148.17 billion, a PE ratio of 41.74, a P/E/G ratio of 2.94 and a beta of 0.91. The company has a fifty day simple moving average of $364.61 and a two-hundred day simple moving average of $347.98.

Stryker (NYSE:SYK - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The medical technology company reported $2.87 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.77 by $0.10. Stryker had a net margin of 16.34% and a return on equity of 23.07%. The firm had revenue of $5.49 billion for the quarter, compared to analyst estimates of $5.37 billion. During the same period in the prior year, the firm posted $2.46 earnings per share. The company's quarterly revenue was up 11.9% compared to the same quarter last year. Equities research analysts anticipate that Stryker Co. will post 12.06 EPS for the current fiscal year.

About Stryker

(

Free Report)

Stryker Corporation operates as a medical technology company. The company operates through two segments, MedSurg and Neurotechnology, and Orthopaedics and Spine. The Orthopaedics and Spine segment provides implants for use in total joint replacements, such as hip, knee and shoulder, and trauma and extremities surgeries.

Read More

Before you consider Stryker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stryker wasn't on the list.

While Stryker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.