B. Metzler seel. Sohn & Co. Holding AG bought a new position in EOG Resources, Inc. (NYSE:EOG - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor bought 33,306 shares of the energy exploration company's stock, valued at approximately $4,094,000.

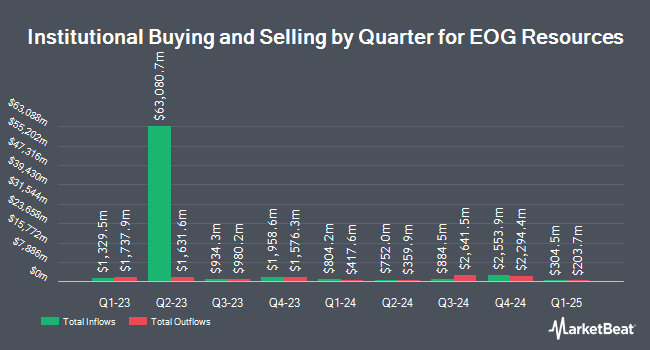

A number of other institutional investors have also bought and sold shares of EOG. Healthcare of Ontario Pension Plan Trust Fund purchased a new stake in shares of EOG Resources in the second quarter worth about $106,990,000. Legal & General Group Plc boosted its position in shares of EOG Resources by 9.1% during the 2nd quarter. Legal & General Group Plc now owns 4,840,705 shares of the energy exploration company's stock valued at $609,300,000 after acquiring an additional 403,676 shares during the last quarter. National Bank of Canada FI grew its holdings in shares of EOG Resources by 237.9% in the second quarter. National Bank of Canada FI now owns 487,920 shares of the energy exploration company's stock valued at $61,741,000 after purchasing an additional 343,527 shares in the last quarter. Canada Pension Plan Investment Board increased its position in EOG Resources by 67.3% in the first quarter. Canada Pension Plan Investment Board now owns 843,682 shares of the energy exploration company's stock worth $107,856,000 after purchasing an additional 339,480 shares during the last quarter. Finally, Victory Capital Management Inc. grew its stake in shares of EOG Resources by 42.8% in the 3rd quarter. Victory Capital Management Inc. now owns 1,113,429 shares of the energy exploration company's stock worth $136,874,000 after buying an additional 333,947 shares in the last quarter. Hedge funds and other institutional investors own 89.91% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages have recently commented on EOG. Royal Bank of Canada reiterated a "sector perform" rating and issued a $145.00 target price on shares of EOG Resources in a report on Monday, October 14th. Scotiabank reduced their price objective on EOG Resources from $150.00 to $140.00 and set a "sector perform" rating on the stock in a report on Thursday, October 10th. StockNews.com downgraded shares of EOG Resources from a "buy" rating to a "hold" rating in a research note on Saturday, November 16th. KeyCorp cut their target price on EOG Resources from $157.00 to $150.00 and set an "overweight" rating on the stock in a research note on Wednesday, October 16th. Finally, UBS Group cut their price objective on shares of EOG Resources from $167.00 to $154.00 and set a "buy" rating on the stock in a research report on Wednesday, September 18th. Fifteen investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, EOG Resources currently has a consensus rating of "Hold" and an average target price of $142.30.

Read Our Latest Analysis on EOG

EOG Resources Stock Up 0.8 %

EOG stock opened at $136.23 on Thursday. The firm's fifty day simple moving average is $127.27 and its 200-day simple moving average is $126.10. The company has a market capitalization of $76.62 billion, a P/E ratio of 10.97, a price-to-earnings-growth ratio of 3.58 and a beta of 1.28. EOG Resources, Inc. has a 12 month low of $108.94 and a 12 month high of $139.67. The company has a debt-to-equity ratio of 0.13, a current ratio of 2.31 and a quick ratio of 2.07.

EOG Resources Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, January 31st. Investors of record on Friday, January 17th will be given a dividend of $0.975 per share. This is a boost from EOG Resources's previous quarterly dividend of $0.91. This represents a $3.90 annualized dividend and a yield of 2.86%. The ex-dividend date of this dividend is Friday, January 17th. EOG Resources's dividend payout ratio (DPR) is currently 29.31%.

EOG Resources declared that its board has authorized a share repurchase program on Thursday, November 7th that allows the company to buyback $5.00 billion in outstanding shares. This buyback authorization allows the energy exploration company to repurchase up to 7% of its stock through open market purchases. Stock buyback programs are typically a sign that the company's management believes its stock is undervalued.

Insider Activity at EOG Resources

In related news, Director Janet F. Clark sold 568 shares of the company's stock in a transaction dated Tuesday, November 19th. The shares were sold at an average price of $135.33, for a total transaction of $76,867.44. Following the completion of the transaction, the director now owns 43,532 shares in the company, valued at $5,891,185.56. This represents a 1.29 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, EVP Michael P. Donaldson sold 11,037 shares of EOG Resources stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $129.50, for a total value of $1,429,291.50. Following the completion of the sale, the executive vice president now owns 74,250 shares in the company, valued at approximately $9,615,375. The trade was a 12.94 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 0.30% of the company's stock.

EOG Resources Company Profile

(

Free Report)

EOG Resources, Inc, together with its subsidiaries, explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas primarily in producing basins in the United States, the Republic of Trinidad and Tobago and internationally. The company was formerly known as Enron Oil & Gas Company.

Further Reading

Before you consider EOG Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EOG Resources wasn't on the list.

While EOG Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.