B. Metzler seel. Sohn & Co. Holding AG purchased a new position in shares of Halliburton (NYSE:HAL - Free Report) in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor purchased 215,252 shares of the oilfield services company's stock, valued at approximately $6,253,000.

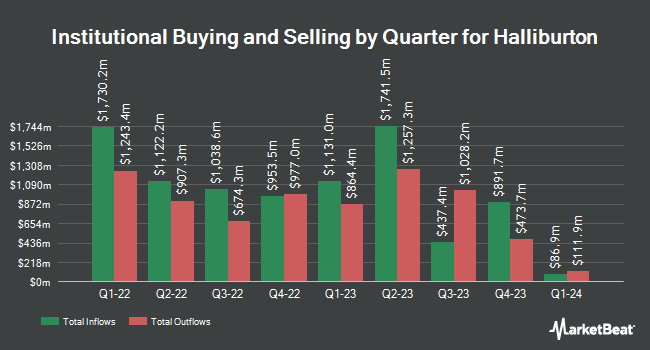

Other large investors have also recently bought and sold shares of the company. Banque Cantonale Vaudoise boosted its holdings in shares of Halliburton by 171.7% in the 3rd quarter. Banque Cantonale Vaudoise now owns 30,852 shares of the oilfield services company's stock valued at $896,000 after buying an additional 19,496 shares during the last quarter. Caprock Group LLC boosted its holdings in shares of Halliburton by 7.6% in the 3rd quarter. Caprock Group LLC now owns 67,765 shares of the oilfield services company's stock valued at $1,969,000 after buying an additional 4,807 shares during the last quarter. Pathstone Holdings LLC boosted its holdings in shares of Halliburton by 6.7% in the 3rd quarter. Pathstone Holdings LLC now owns 144,675 shares of the oilfield services company's stock valued at $4,203,000 after buying an additional 9,118 shares during the last quarter. Meeder Advisory Services Inc. boosted its holdings in shares of Halliburton by 8.2% in the 3rd quarter. Meeder Advisory Services Inc. now owns 24,504 shares of the oilfield services company's stock valued at $712,000 after buying an additional 1,848 shares during the last quarter. Finally, Quest Partners LLC boosted its holdings in shares of Halliburton by 2,418.9% in the 3rd quarter. Quest Partners LLC now owns 78,387 shares of the oilfield services company's stock valued at $2,277,000 after buying an additional 75,275 shares during the last quarter. Institutional investors and hedge funds own 85.23% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts recently weighed in on the company. Dbs Bank assumed coverage on Halliburton in a research note on Wednesday, September 18th. They issued a "buy" rating and a $45.00 price target on the stock. Raymond James dropped their price target on Halliburton from $41.00 to $37.00 and set a "strong-buy" rating on the stock in a research note on Friday, November 8th. Barclays dropped their price target on Halliburton from $47.00 to $43.00 and set an "overweight" rating on the stock in a research note on Friday, November 8th. Morgan Stanley dropped their price target on Halliburton from $35.00 to $34.00 and set an "overweight" rating on the stock in a research note on Monday. Finally, Bank of America dropped their price target on Halliburton from $40.00 to $38.00 and set a "buy" rating on the stock in a research note on Monday, October 14th. Four equities research analysts have rated the stock with a hold rating, sixteen have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, Halliburton has an average rating of "Moderate Buy" and a consensus target price of $40.74.

View Our Latest Research Report on HAL

Halliburton Stock Up 2.3 %

Shares of NYSE HAL traded up $0.71 during midday trading on Wednesday, hitting $31.18. 9,522,688 shares of the stock traded hands, compared to its average volume of 8,100,993. The company has a market cap of $27.39 billion, a PE ratio of 10.86, a P/E/G ratio of 3.64 and a beta of 1.89. Halliburton has a one year low of $27.26 and a one year high of $41.56. The business has a 50 day moving average price of $29.29 and a two-hundred day moving average price of $32.07. The company has a debt-to-equity ratio of 0.74, a quick ratio of 1.62 and a current ratio of 2.21.

Halliburton (NYSE:HAL - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The oilfield services company reported $0.73 EPS for the quarter, missing the consensus estimate of $0.75 by ($0.02). The firm had revenue of $5.70 billion for the quarter, compared to the consensus estimate of $5.83 billion. Halliburton had a net margin of 11.04% and a return on equity of 28.33%. The company's revenue was down 1.8% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $0.79 EPS. On average, equities analysts predict that Halliburton will post 3.02 EPS for the current year.

Halliburton Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, December 26th. Investors of record on Wednesday, December 4th will be given a dividend of $0.17 per share. The ex-dividend date of this dividend is Wednesday, December 4th. This represents a $0.68 annualized dividend and a dividend yield of 2.18%. Halliburton's payout ratio is 23.69%.

About Halliburton

(

Free Report)

Halliburton Company provides products and services to the energy industry worldwide. It operates through two segments, Completion and Production, and Drilling and Evaluation. The Completion and Production segment offers production enhancement services that include stimulation and sand control services; cementing services, such as well bonding and casing, and casing equipment; and completion tools that offer downhole solutions and services, including well completion products and services, intelligent well completions, and service tools, as well as liner hanger, sand control, and multilateral systems.

Further Reading

Before you consider Halliburton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Halliburton wasn't on the list.

While Halliburton currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.