B. Metzler seel. Sohn & Co. Holding AG acquired a new position in shares of Rockwell Automation, Inc. (NYSE:ROK - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 18,497 shares of the industrial products company's stock, valued at approximately $4,966,000.

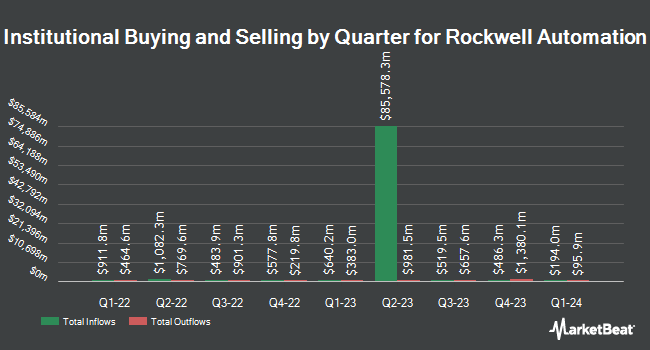

A number of other large investors also recently added to or reduced their stakes in the business. Price T Rowe Associates Inc. MD grew its holdings in Rockwell Automation by 951.4% during the first quarter. Price T Rowe Associates Inc. MD now owns 5,532,949 shares of the industrial products company's stock valued at $1,611,915,000 after purchasing an additional 5,006,706 shares during the period. Lazard Asset Management LLC increased its position in shares of Rockwell Automation by 32.0% in the 1st quarter. Lazard Asset Management LLC now owns 1,510,019 shares of the industrial products company's stock valued at $439,912,000 after buying an additional 365,795 shares in the last quarter. Accredited Investors Inc. raised its stake in Rockwell Automation by 162,058.5% during the 3rd quarter. Accredited Investors Inc. now owns 1,185,379 shares of the industrial products company's stock worth $318,227,000 after buying an additional 1,184,648 shares during the period. Sumitomo Mitsui Trust Group Inc. raised its stake in Rockwell Automation by 4.4% during the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 986,849 shares of the industrial products company's stock worth $264,929,000 after buying an additional 41,605 shares during the period. Finally, International Assets Investment Management LLC grew its stake in Rockwell Automation by 29,591.7% in the third quarter. International Assets Investment Management LLC now owns 936,178 shares of the industrial products company's stock valued at $251,326,000 after acquiring an additional 933,025 shares during the period. 75.75% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on ROK. Robert W. Baird lifted their price objective on Rockwell Automation from $280.00 to $290.00 and gave the company an "outperform" rating in a report on Friday, November 8th. TD Cowen lowered their target price on Rockwell Automation from $220.00 to $215.00 and set a "sell" rating for the company in a report on Thursday, August 8th. UBS Group began coverage on Rockwell Automation in a report on Wednesday, November 13th. They issued a "neutral" rating and a $313.00 price target on the stock. JPMorgan Chase & Co. cut their target price on Rockwell Automation from $245.00 to $227.00 and set an "underweight" rating on the stock in a research note on Monday, August 12th. Finally, Bank of America raised their target price on shares of Rockwell Automation from $270.00 to $285.00 and gave the company a "neutral" rating in a research report on Thursday, October 17th. Three research analysts have rated the stock with a sell rating, six have given a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $286.13.

Get Our Latest Stock Analysis on ROK

Rockwell Automation Price Performance

ROK stock traded up $1.94 during midday trading on Wednesday, reaching $280.08. The company had a trading volume of 980,705 shares, compared to its average volume of 884,965. Rockwell Automation, Inc. has a 1-year low of $242.81 and a 1-year high of $312.76. The stock has a 50 day moving average price of $270.42 and a 200-day moving average price of $267.03. The company has a debt-to-equity ratio of 0.70, a current ratio of 1.08 and a quick ratio of 0.72. The company has a market capitalization of $31.62 billion, a price-to-earnings ratio of 33.83, a price-to-earnings-growth ratio of 2.95 and a beta of 1.36.

Rockwell Automation (NYSE:ROK - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The industrial products company reported $2.47 earnings per share for the quarter, topping analysts' consensus estimates of $2.40 by $0.07. The company had revenue of $2.04 billion during the quarter, compared to the consensus estimate of $2.06 billion. Rockwell Automation had a net margin of 11.53% and a return on equity of 30.42%. The firm's quarterly revenue was down 20.6% on a year-over-year basis. During the same quarter in the prior year, the firm posted $3.64 EPS. Equities research analysts expect that Rockwell Automation, Inc. will post 9.54 earnings per share for the current year.

Rockwell Automation Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Monday, November 18th will be paid a dividend of $1.31 per share. This is an increase from Rockwell Automation's previous quarterly dividend of $1.25. The ex-dividend date of this dividend is Monday, November 18th. This represents a $5.24 annualized dividend and a yield of 1.87%. Rockwell Automation's payout ratio is presently 60.39%.

Rockwell Automation announced that its Board of Directors has approved a stock repurchase plan on Thursday, September 5th that allows the company to buyback $1.00 billion in outstanding shares. This buyback authorization allows the industrial products company to reacquire up to 3.4% of its stock through open market purchases. Stock buyback plans are often an indication that the company's board of directors believes its shares are undervalued.

Insider Transactions at Rockwell Automation

In other Rockwell Automation news, SVP Veena M. Lakkundi sold 579 shares of the stock in a transaction that occurred on Monday, November 4th. The shares were sold at an average price of $266.86, for a total transaction of $154,511.94. Following the completion of the sale, the senior vice president now owns 4,576 shares of the company's stock, valued at approximately $1,221,151.36. This represents a 11.23 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, VP John M. Miller sold 467 shares of Rockwell Automation stock in a transaction on Monday, November 18th. The stock was sold at an average price of $284.07, for a total transaction of $132,660.69. Following the transaction, the vice president now directly owns 4,800 shares of the company's stock, valued at $1,363,536. This represents a 8.87 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 0.68% of the company's stock.

About Rockwell Automation

(

Free Report)

Rockwell Automation, Inc provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates through three segments, Intelligent Devices, Software & Control, and Lifecycle Services. Its solutions include hardware and software products and services.

Featured Stories

Before you consider Rockwell Automation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rockwell Automation wasn't on the list.

While Rockwell Automation currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report