B. Metzler seel. Sohn & Co. Holding AG acquired a new position in shares of Hamilton Lane Incorporated (NASDAQ:HLNE - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 25,696 shares of the company's stock, valued at approximately $4,327,000.

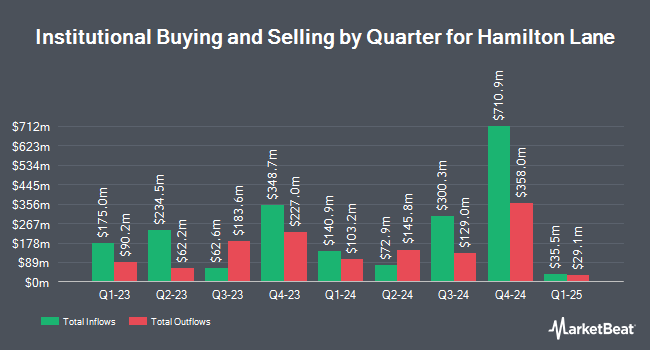

Several other hedge funds have also added to or reduced their stakes in HLNE. Vanguard Group Inc. lifted its position in shares of Hamilton Lane by 8.3% during the 1st quarter. Vanguard Group Inc. now owns 3,678,617 shares of the company's stock valued at $414,801,000 after buying an additional 283,190 shares during the last quarter. Van Berkom & Associates Inc. boosted its holdings in shares of Hamilton Lane by 2.0% in the second quarter. Van Berkom & Associates Inc. now owns 892,812 shares of the company's stock worth $110,334,000 after acquiring an additional 17,272 shares during the period. Copeland Capital Management LLC grew its holdings in Hamilton Lane by 0.8% during the 3rd quarter. Copeland Capital Management LLC now owns 863,397 shares of the company's stock valued at $145,388,000 after buying an additional 7,106 shares in the last quarter. Fred Alger Management LLC increased its position in shares of Hamilton Lane by 10.5% during the second quarter. Fred Alger Management LLC now owns 687,521 shares of the company's stock valued at $84,964,000 after buying an additional 65,151 shares during the period. Finally, Dimensional Fund Advisors LP lifted its holdings in shares of Hamilton Lane by 6.8% in the second quarter. Dimensional Fund Advisors LP now owns 590,270 shares of the company's stock worth $72,943,000 after buying an additional 37,680 shares in the last quarter. Institutional investors own 97.40% of the company's stock.

Analyst Upgrades and Downgrades

HLNE has been the topic of a number of analyst reports. Morgan Stanley upped their target price on shares of Hamilton Lane from $182.00 to $190.00 and gave the stock an "equal weight" rating in a report on Monday, November 11th. Wells Fargo & Company lifted their price objective on Hamilton Lane from $156.00 to $170.00 and gave the company an "equal weight" rating in a research note on Wednesday, October 9th. UBS Group upped their target price on Hamilton Lane from $150.00 to $185.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 22nd. Keefe, Bruyette & Woods upped their price objective on shares of Hamilton Lane from $181.00 to $215.00 and gave the stock a "market perform" rating in a research report on Thursday, November 7th. Finally, JPMorgan Chase & Co. lifted their price objective on shares of Hamilton Lane from $134.00 to $175.00 and gave the stock a "neutral" rating in a report on Thursday, November 7th. Seven analysts have rated the stock with a hold rating, Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average target price of $180.33.

Check Out Our Latest Analysis on Hamilton Lane

Hamilton Lane Price Performance

Shares of Hamilton Lane stock opened at $194.48 on Thursday. The business's 50 day simple moving average is $176.46 and its two-hundred day simple moving average is $147.28. Hamilton Lane Incorporated has a one year low of $93.05 and a one year high of $203.72. The company has a debt-to-equity ratio of 0.24, a current ratio of 3.37 and a quick ratio of 3.37. The stock has a market capitalization of $10.78 billion, a P/E ratio of 42.19 and a beta of 1.18.

Hamilton Lane (NASDAQ:HLNE - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported $1.07 EPS for the quarter, beating analysts' consensus estimates of $1.06 by $0.01. The business had revenue of $150.00 million during the quarter, compared to analyst estimates of $151.55 million. Hamilton Lane had a return on equity of 35.59% and a net margin of 28.03%. Hamilton Lane's quarterly revenue was up 18.2% compared to the same quarter last year. During the same quarter in the prior year, the company posted $0.89 EPS. Analysts forecast that Hamilton Lane Incorporated will post 4.87 EPS for the current year.

Hamilton Lane Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, January 7th. Investors of record on Monday, December 16th will be given a dividend of $0.49 per share. This represents a $1.96 annualized dividend and a dividend yield of 1.01%. The ex-dividend date is Monday, December 16th. Hamilton Lane's dividend payout ratio is currently 42.52%.

Hamilton Lane Profile

(

Free Report)

Hamilton Lane Incorporated is a private equity firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies. It prefers to invest in energy, industrials, consumer discretionary, health care, real estate, information technology, utilities, and consumer services.

Featured Stories

Before you consider Hamilton Lane, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hamilton Lane wasn't on the list.

While Hamilton Lane currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.