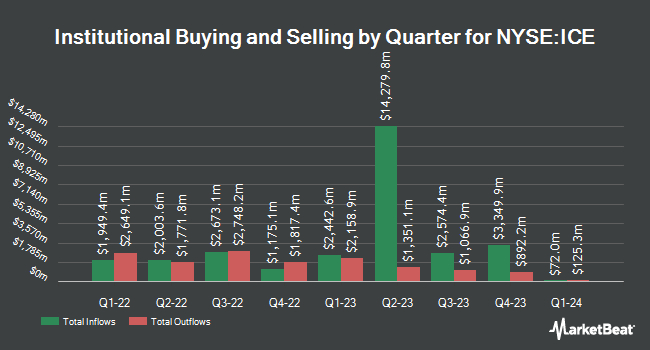

B. Metzler seel. Sohn & Co. Holding AG purchased a new stake in Intercontinental Exchange, Inc. (NYSE:ICE - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm purchased 120,012 shares of the financial services provider's stock, valued at approximately $19,279,000.

Several other hedge funds have also recently bought and sold shares of the business. Assenagon Asset Management S.A. raised its stake in shares of Intercontinental Exchange by 819.7% during the second quarter. Assenagon Asset Management S.A. now owns 137,074 shares of the financial services provider's stock valued at $18,764,000 after purchasing an additional 122,169 shares during the period. UniSuper Management Pty Ltd boosted its holdings in Intercontinental Exchange by 200.2% in the first quarter. UniSuper Management Pty Ltd now owns 14,459 shares of the financial services provider's stock worth $1,987,000 after purchasing an additional 9,642 shares during the period. BDF Gestion acquired a new position in Intercontinental Exchange in the second quarter worth $2,849,000. LRI Investments LLC acquired a new position in Intercontinental Exchange in the first quarter worth $137,000. Finally, Burke & Herbert Bank & Trust Co. acquired a new position in Intercontinental Exchange in the second quarter worth $1,366,000. Hedge funds and other institutional investors own 89.30% of the company's stock.

Intercontinental Exchange Price Performance

Intercontinental Exchange stock traded up $0.24 during midday trading on Tuesday, hitting $157.93. The company's stock had a trading volume of 2,847,512 shares, compared to its average volume of 2,577,285. The company has a quick ratio of 1.00, a current ratio of 1.00 and a debt-to-equity ratio of 0.68. The stock's 50-day moving average price is $160.89 and its 200-day moving average price is $150.44. Intercontinental Exchange, Inc. has a 12 month low of $110.64 and a 12 month high of $167.99. The company has a market capitalization of $90.68 billion, a PE ratio of 37.37, a price-to-earnings-growth ratio of 2.57 and a beta of 1.08.

Intercontinental Exchange (NYSE:ICE - Get Free Report) last issued its quarterly earnings results on Thursday, October 31st. The financial services provider reported $1.55 EPS for the quarter, hitting the consensus estimate of $1.55. Intercontinental Exchange had a net margin of 21.31% and a return on equity of 12.75%. The firm had revenue of $2.35 billion for the quarter, compared to analysts' expectations of $2.35 billion. During the same period in the previous year, the business earned $1.46 earnings per share. Intercontinental Exchange's revenue for the quarter was up 17.3% compared to the same quarter last year. Analysts anticipate that Intercontinental Exchange, Inc. will post 6.07 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of equities analysts have commented on the stock. StockNews.com raised shares of Intercontinental Exchange from a "sell" rating to a "hold" rating in a report on Tuesday, November 12th. Barclays reduced their price target on shares of Intercontinental Exchange from $179.00 to $173.00 and set an "overweight" rating for the company in a report on Friday, November 1st. Deutsche Bank Aktiengesellschaft boosted their price target on shares of Intercontinental Exchange from $160.00 to $163.00 and gave the company a "hold" rating in a report on Monday, November 11th. TD Cowen started coverage on shares of Intercontinental Exchange in a report on Thursday, September 26th. They set a "buy" rating and a $182.00 price target for the company. Finally, Keefe, Bruyette & Woods reissued an "outperform" rating and set a $168.00 price target on shares of Intercontinental Exchange in a report on Tuesday, August 6th. Three equities research analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the stock. According to data from MarketBeat, Intercontinental Exchange presently has a consensus rating of "Moderate Buy" and a consensus price target of $174.13.

View Our Latest Research Report on Intercontinental Exchange

Insiders Place Their Bets

In other Intercontinental Exchange news, Director Martha A. Tirinnanzi sold 509 shares of the business's stock in a transaction dated Friday, August 23rd. The stock was sold at an average price of $158.98, for a total transaction of $80,920.82. Following the sale, the director now owns 3,958 shares in the company, valued at approximately $629,242.84. The trade was a 11.39 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, General Counsel Andrew J. Surdykowski sold 2,048 shares of the business's stock in a transaction dated Thursday, September 26th. The stock was sold at an average price of $159.57, for a total value of $326,799.36. Following the sale, the general counsel now owns 44,865 shares in the company, valued at approximately $7,159,108.05. The trade was a 4.37 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 7,489 shares of company stock worth $1,202,259. 1.10% of the stock is owned by corporate insiders.

Intercontinental Exchange Profile

(

Free Report)

Intercontinental Exchange, Inc, together with its subsidiaries, engages in the provision of market infrastructure, data services, and technology solutions for financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, Singapore, India, Abu Dhabi, Israel, and Canada.

Further Reading

Before you consider Intercontinental Exchange, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intercontinental Exchange wasn't on the list.

While Intercontinental Exchange currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.