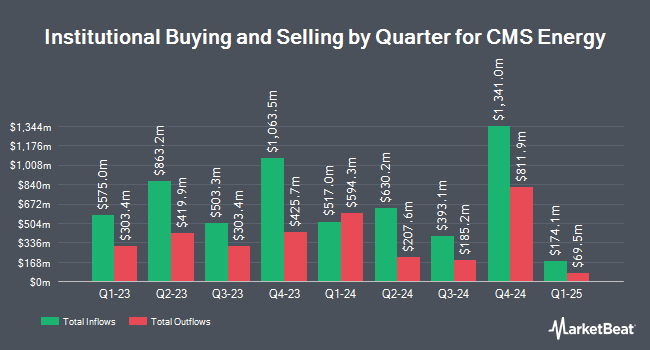

B. Metzler seel. Sohn & Co. Holding AG bought a new stake in CMS Energy Co. (NYSE:CMS - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 109,537 shares of the utilities provider's stock, valued at approximately $7,736,000.

Other institutional investors have also recently added to or reduced their stakes in the company. Covestor Ltd lifted its stake in CMS Energy by 206.1% in the third quarter. Covestor Ltd now owns 701 shares of the utilities provider's stock valued at $50,000 after acquiring an additional 472 shares during the last quarter. TruNorth Capital Management LLC lifted its stake in shares of CMS Energy by 431.3% in the second quarter. TruNorth Capital Management LLC now owns 712 shares of the utilities provider's stock worth $42,000 after buying an additional 578 shares during the last quarter. Innealta Capital LLC acquired a new stake in shares of CMS Energy in the second quarter worth $43,000. Values First Advisors Inc. acquired a new stake in shares of CMS Energy in the third quarter worth $56,000. Finally, Voisard Asset Management Group Inc. lifted its stake in shares of CMS Energy by 25.7% in the third quarter. Voisard Asset Management Group Inc. now owns 798 shares of the utilities provider's stock worth $56,000 after buying an additional 163 shares during the last quarter. 93.57% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of brokerages have recently weighed in on CMS. BMO Capital Markets reduced their price objective on shares of CMS Energy from $77.00 to $76.00 and set an "outperform" rating for the company in a research note on Friday, November 1st. Evercore ISI upgraded shares of CMS Energy to a "hold" rating in a research note on Friday, July 26th. Bank of America boosted their target price on shares of CMS Energy from $69.00 to $73.00 and gave the stock a "buy" rating in a research report on Thursday, August 29th. KeyCorp boosted their target price on shares of CMS Energy from $73.00 to $76.00 and gave the stock an "overweight" rating in a research report on Monday, September 30th. Finally, Wells Fargo & Company boosted their target price on shares of CMS Energy from $70.00 to $77.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 16th. One research analyst has rated the stock with a sell rating, six have issued a hold rating and ten have issued a buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $70.29.

Get Our Latest Report on CMS Energy

Insider Buying and Selling at CMS Energy

In other news, SVP Brandon J. Hofmeister sold 2,000 shares of the business's stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $68.17, for a total value of $136,340.00. Following the sale, the senior vice president now directly owns 64,771 shares in the company, valued at $4,415,439.07. The trade was a 3.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Insiders own 0.53% of the company's stock.

CMS Energy Price Performance

NYSE CMS traded down $0.05 on Wednesday, hitting $68.52. 1,957,792 shares of the company were exchanged, compared to its average volume of 2,279,453. The firm has a 50 day moving average of $69.73 and a two-hundred day moving average of $65.40. The company has a market cap of $20.47 billion, a P/E ratio of 19.58, a P/E/G ratio of 2.72 and a beta of 0.41. The company has a current ratio of 1.23, a quick ratio of 0.83 and a debt-to-equity ratio of 1.86. CMS Energy Co. has a 1-year low of $55.10 and a 1-year high of $72.40.

CMS Energy (NYSE:CMS - Get Free Report) last released its earnings results on Thursday, October 31st. The utilities provider reported $0.84 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.78 by $0.06. CMS Energy had a net margin of 14.01% and a return on equity of 12.81%. The company had revenue of $1.74 billion for the quarter, compared to the consensus estimate of $1.88 billion. During the same period in the prior year, the company posted $0.61 EPS. The company's revenue was up 4.2% compared to the same quarter last year. On average, equities analysts predict that CMS Energy Co. will post 3.33 EPS for the current year.

CMS Energy Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, November 27th. Shareholders of record on Wednesday, November 13th will be issued a dividend of $0.515 per share. The ex-dividend date is Wednesday, November 13th. This is a positive change from CMS Energy's previous quarterly dividend of $0.51. This represents a $2.06 annualized dividend and a yield of 3.01%. CMS Energy's payout ratio is currently 58.86%.

CMS Energy Profile

(

Free Report)

CMS Energy Corporation operates as an energy company primarily in Michigan. The company operates through three segments: Electric Utility; Gas Utility; and Enterprises. The Electric Utility segment is involved in the generation, purchase, transmission, distribution, and sale of electricity. This segment generates electricity through coal, wind, gas, renewable energy, oil, and nuclear sources.

Further Reading

Before you consider CMS Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CMS Energy wasn't on the list.

While CMS Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.