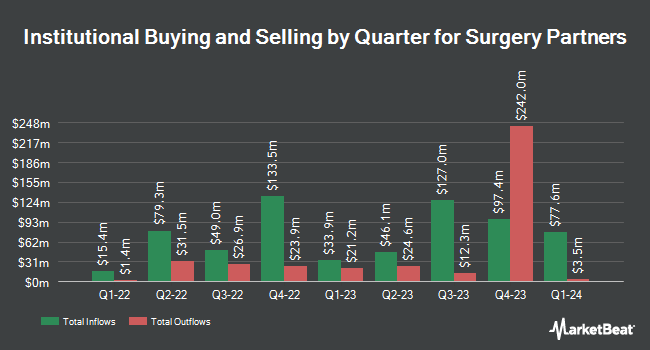

B. Metzler seel. Sohn & Co. Holding AG purchased a new stake in Surgery Partners, Inc. (NASDAQ:SGRY - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The fund purchased 66,028 shares of the company's stock, valued at approximately $2,129,000. B. Metzler seel. Sohn & Co. Holding AG owned approximately 0.05% of Surgery Partners as of its most recent SEC filing.

Other institutional investors and hedge funds have also recently modified their holdings of the company. Quarry LP increased its stake in shares of Surgery Partners by 133.1% in the 2nd quarter. Quarry LP now owns 3,082 shares of the company's stock valued at $73,000 after purchasing an additional 1,760 shares in the last quarter. KBC Group NV increased its stake in shares of Surgery Partners by 31.8% in the 3rd quarter. KBC Group NV now owns 2,385 shares of the company's stock valued at $77,000 after purchasing an additional 576 shares in the last quarter. DekaBank Deutsche Girozentrale increased its stake in shares of Surgery Partners by 102.0% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 2,723 shares of the company's stock valued at $80,000 after purchasing an additional 1,375 shares in the last quarter. Creative Planning purchased a new position in shares of Surgery Partners in the 3rd quarter valued at about $258,000. Finally, Versor Investments LP purchased a new position in shares of Surgery Partners in the 3rd quarter valued at about $271,000.

Wall Street Analyst Weigh In

Several brokerages recently weighed in on SGRY. Citigroup cut their price target on Surgery Partners from $38.00 to $36.00 and set a "buy" rating for the company in a research note on Wednesday, August 7th. UBS Group assumed coverage on Surgery Partners in a research note on Monday, October 14th. They set a "buy" rating and a $38.00 price objective for the company. Royal Bank of Canada cut their price objective on Surgery Partners from $49.00 to $35.00 and set an "outperform" rating for the company in a research note on Wednesday. StockNews.com lowered Surgery Partners from a "hold" rating to a "sell" rating in a research note on Wednesday, August 7th. Finally, Macquarie reiterated an "outperform" rating and set a $34.00 price objective on shares of Surgery Partners in a research note on Tuesday. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating and six have issued a buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $38.71.

Get Our Latest Report on SGRY

Surgery Partners Price Performance

Shares of Surgery Partners stock traded down $0.34 on Friday, hitting $23.01. 853,899 shares of the company were exchanged, compared to its average volume of 970,094. The stock has a market capitalization of $2.92 billion, a price-to-earnings ratio of -48.67, a price-to-earnings-growth ratio of 16.71 and a beta of 2.76. The company has a 50-day moving average price of $30.02 and a 200 day moving average price of $28.37. Surgery Partners, Inc. has a 1-year low of $21.36 and a 1-year high of $36.92. The company has a quick ratio of 1.66, a current ratio of 1.80 and a debt-to-equity ratio of 0.99.

Surgery Partners (NASDAQ:SGRY - Get Free Report) last issued its earnings results on Tuesday, November 12th. The company reported $0.19 earnings per share for the quarter, missing the consensus estimate of $0.25 by ($0.06). The company had revenue of $770.40 million for the quarter, compared to analyst estimates of $768.99 million. Surgery Partners had a positive return on equity of 2.85% and a negative net margin of 2.03%. The company's revenue for the quarter was up 14.3% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.15 earnings per share. As a group, sell-side analysts predict that Surgery Partners, Inc. will post 0.83 earnings per share for the current fiscal year.

About Surgery Partners

(

Free Report)

Surgery Partners, Inc, together with its subsidiaries, owns and operates a network of surgical facilities and ancillary services in the United States. The company provides ambulatory surgery centers and surgical hospitals that offer non-emergency surgical procedures in various specialties, including orthopedics and pain management, ophthalmology, gastroenterology, and general surgery.

Featured Stories

Before you consider Surgery Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Surgery Partners wasn't on the list.

While Surgery Partners currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.